Crypto Market Weakens: Bitcoin Holds Line, Ethereum Struggles at $4K

16.10.2025 9:15 1 min. read Alexander Zdravkov

The global crypto market has come under renewed selling pressure, shedding about $60 billion in the past day to settle around $3.75 trillion.

The drop highlights growing investor caution as broader economic uncertainties weigh on sentiment.

If the decline continues, total market capitalization could slide toward $3.67 trillion or even $3.58 trillion, particularly if outflows from volatile altcoins intensify. Still, a shift in confidence could spark a rebound, with potential recovery targets near $3.81 trillion and $3.89 trillion.

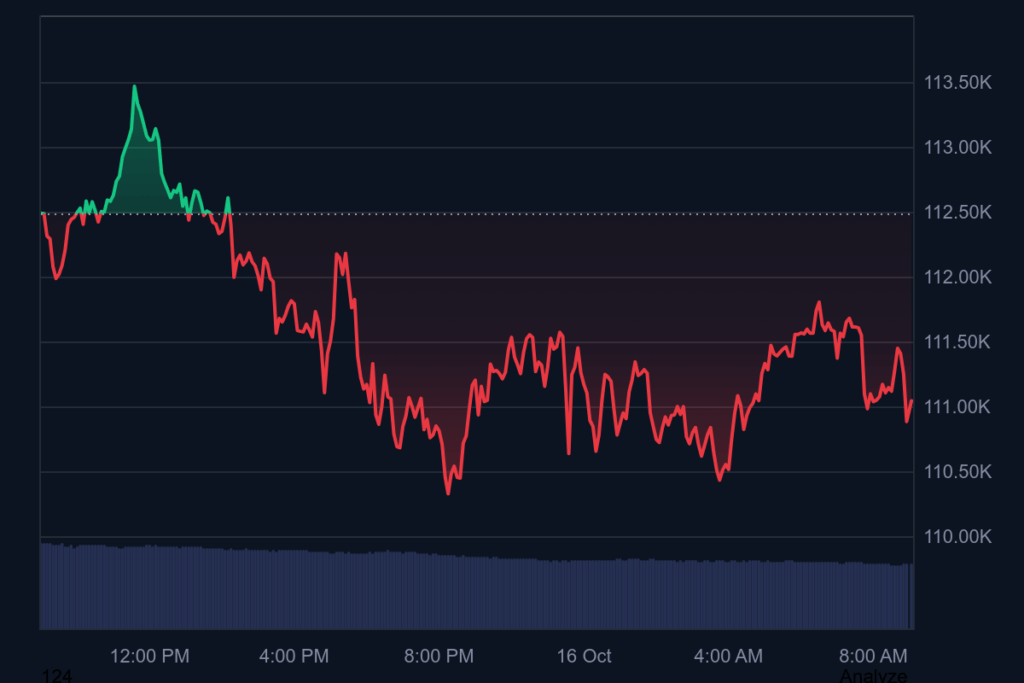

Bitcoin remains relatively steady around $111,000, staying above the psychologically important $110,000 level – a zone that has repeatedly attracted buying interest in previous downturns.

However, technical signals remain weak. The Relative Strength Index points to persistent bearish momentum, implying sellers still dominate. If pressure continues, Bitcoin could fall below $110,000, possibly testing $108,000. On the other hand, a rebound from current levels could lift the asset above $112,500 and pave the way for a push toward $115,000.

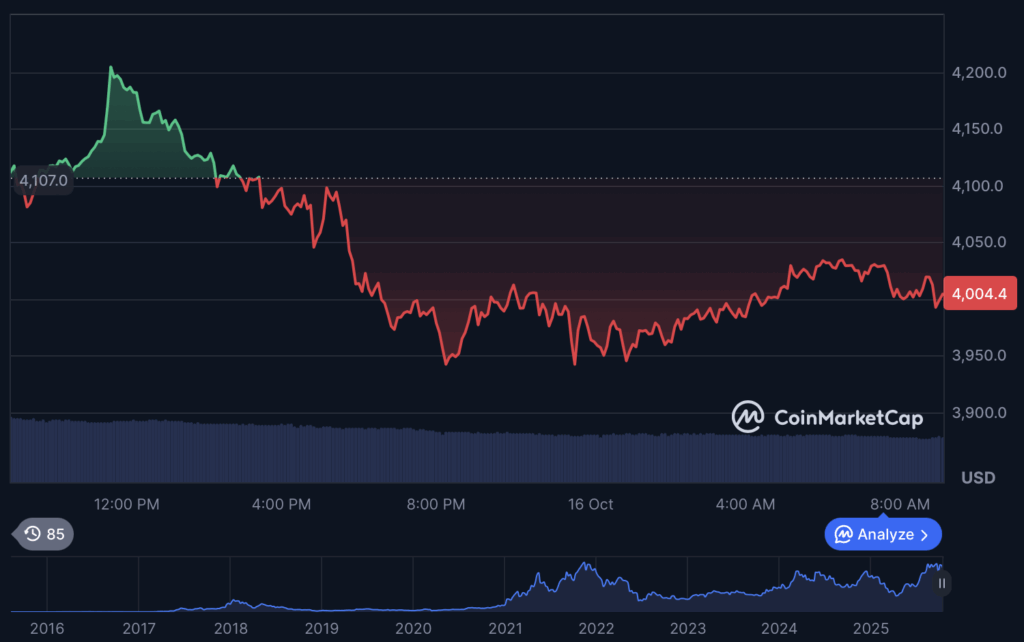

Ethereum is attempting to hold the $4,000 threshold after falling more than 2% over the past 24 hours. The decline reflects broader market weakness, though maintaining this level could be key to preventing deeper losses across major altcoins.

-

1

Forced Liquidations, Not Fear, Drove XRP’s Wild Drop – Accumulation Follows

11.10.2025 21:00 2 min. read -

2

Too Much Risk, Too Little Liquidity: Why the Market Collapse Was Inevitable

14.10.2025 10:00 2 min. read -

3

VanEck Files Delaware Trust For Staked Ethereum ETF Linked To Lido

04.10.2025 13:00 2 min. read -

4

Memecoins: Culture, Casinos, and Power Laws (Galaxy Report)

02.10.2025 14:30 3 min. read -

5

BNB Breaks Past $1,112 As Treasury Buys And Upgrades Boost Confidence

03.10.2025 12:38 2 min. read

Diverging Views Shake Bitcoin Market Ahead of Potential Rebound

Bitcoin was under pressure again, falling below $104,000 this week and stirring renewed anxiety in crypto markets.

Top 3 Altcoins Crypto Whales Are Quietly Accumulating

After a volatile month for the crypto market, attention is shifting back to select altcoins as investors position for a potential rebound ahead of anticipated Fed rate cuts in October.

Crypto Market Bounces Back as Bitcoin and Ethereum Lead Recovery

The cryptocurrency market is showing signs of life today, with total market capitalization climbing to $3.63 trillion, a 2.58% increase from yesterday.

A Red Week for Bitcoin: ETFs Lose Over a Billion Dollars

The week brought a wave of red for Bitcoin exchange-traded funds in the United States, as investors pulled roughly $1.22 billion out of the market.

-

1

Forced Liquidations, Not Fear, Drove XRP’s Wild Drop – Accumulation Follows

11.10.2025 21:00 2 min. read -

2

Too Much Risk, Too Little Liquidity: Why the Market Collapse Was Inevitable

14.10.2025 10:00 2 min. read -

3

VanEck Files Delaware Trust For Staked Ethereum ETF Linked To Lido

04.10.2025 13:00 2 min. read -

4

Memecoins: Culture, Casinos, and Power Laws (Galaxy Report)

02.10.2025 14:30 3 min. read -

5

BNB Breaks Past $1,112 As Treasury Buys And Upgrades Boost Confidence

03.10.2025 12:38 2 min. read

The cryptocurrency market slipped further into the red, falling 1.45% in the past 24 hours and extending its seven-day decline to 6%.

Artur Schaback, co-founder and former CTO of Paxful, faces up to five years in prison after admitting to failing to implement essential Anti-Money Laundering (AML) protocols at the cryptocurrency exchange.

Bitcoin and Ethereum head into a turbulent week as Wall Street digests a series of economic releases that could shape risk sentiment for the rest of September.

Momentum is building across the digital asset space as Bitcoin edges closer to its previous peak near $109,000, igniting renewed speculation about whether a broader altcoin surge is about to follow.

Last week Bitcoin and the wider crypto market experienced a significant down trend and this week might not be so different.

Ethereum (ETH) is showing significant signs of recovery in the current cryptocurrency market cycle.

After Donald Trump won the 2024 U.S. election, crypto markets experienced a significant uptick and Bitcoin reached a new all-time high (ATH).

The global crypto landscape has seen a dramatic rise in wealth creation over the past year, with new data pointing to sharp growth in the number of millionaires, centi-millionaires, and billionaires linked to digital assets.

Bitcoin miners have sold $2 billion worth of BTC since the beginning of June, the fastest sell-off in more than a year and bringing the total to a 14-year low.

Riot Platforms, a leading Bitcoin mining company, reported a 65% year-over-year revenue surge, totaling $84.8 million for the quarter.

Data from cryptocurrency exchanges indicates that significant amounts of capital have left the market over the past month, potentially stalling any short-term upward momentum.

In 2024, cryptocurrency adoption has surged, with global ownership climbing to 617 million, up from 580 million in December 2023.

The cryptocurrency market is experiencing a significant downturn, with the total market capitalization dropping to $3.57 trillion, down 5.12% in the past 24 hours.

Cryptocurrency phishing incidents saw a dramatic increase of over 215% in August, largely due to one major attack that resulted in losses of more than $55 million.

Deribit is launching BTC and ETH options expiring on November 8, 2024, ahead of the US presidential election.

Zoth, a platform specializing in re-staking real-world assets (RWA), has suffered a significant security breach, resulting in the theft of over $8.4 million in crypto.

Friend.tech, a Web3 social media platform, is under scrutiny following allegations of a rug pull.

A recent security breach at the crypto liquid restaking platform Bedrock resulted in a loss of around $2 million due to a smart contract vulnerability in its uniBTC vaults.

Pump.fun’s co-founder, Alon Cohen, recently shared insights about the platform’s innovative approach to token creation, emphasizing its focus on meme coins and the tools it offers users.

WOO X, a popular cryptocurrency trading platform, has been hit by a serious security breach.