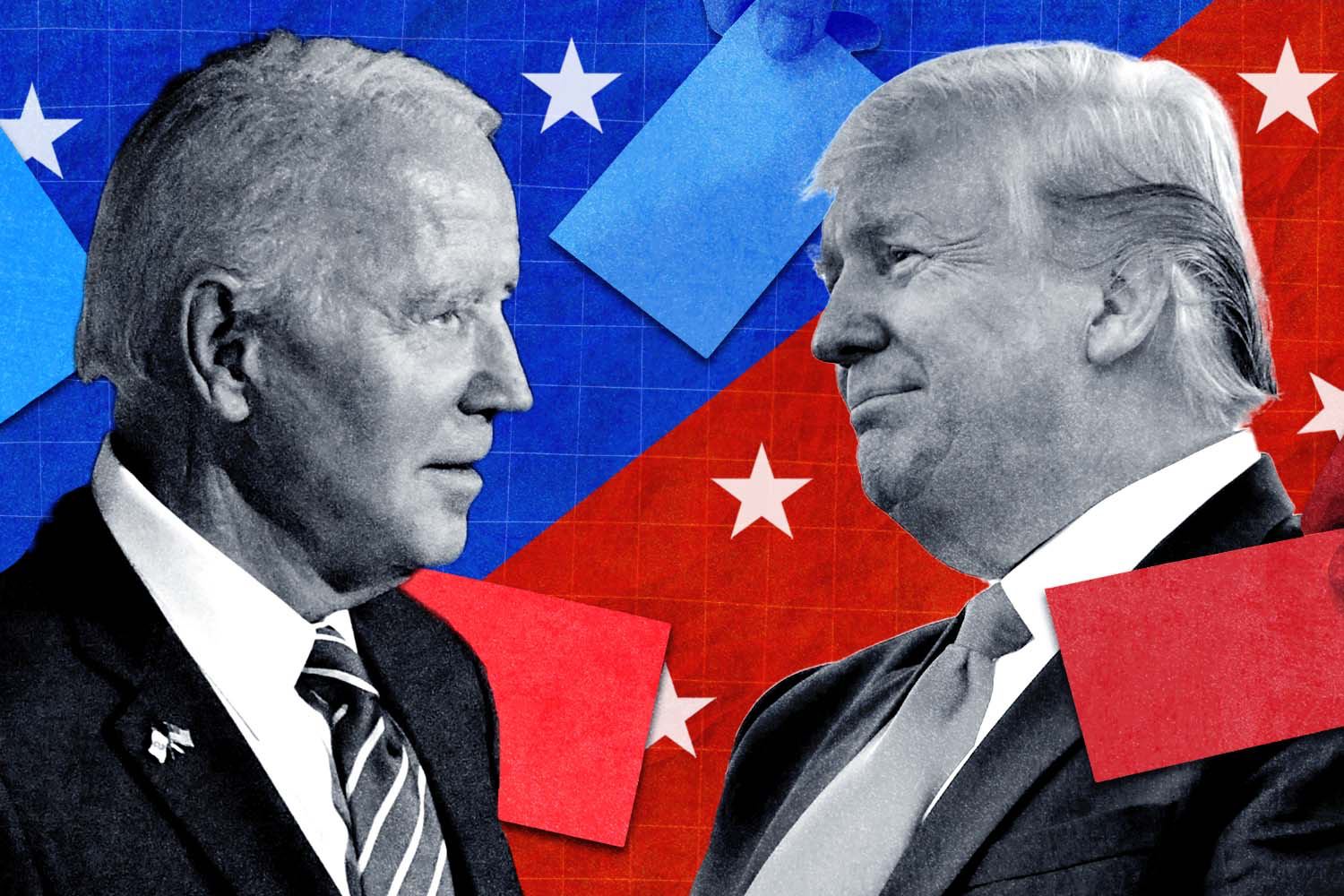

Crypto Platform Expands BTC and ETH Options Ahead of 2024 US Election

17.07.2024 20:00 1 min. read Alexander Stefanov

Deribit is launching BTC and ETH options expiring on November 8, 2024, ahead of the US presidential election.

This move aims to cater to investor strategies anticipating market movements tied to the election, scheduled for November 5.

The top derivatives exchange announced on social media that these early options will allow clients to speculate and hedge positions in response to potential election outcomes. Trading begins at 8 AM UTC on July 18 to facilitate strategic positioning.

Deribit has been a dominant force in the crypto derivatives market, contributing significantly to the $51.1 billion Bitcoin options trading volume, with over $2 billion in open interest in recent trading periods.

READ MORE:

Here’s Why Bitcoin Could Hit $100,000 Soon

This initiative adds election-related options to its diverse array of trading products developed to meet client demands.

The introduction of election-themed options aligns with a broader trend in blockchain-based political finance, enabling global participation in US election events.

This includes platforms like Polymarket, where users can engage in prediction markets on election outcomes amidst heightened market interest following recent political developments.

-

1

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

17.06.2025 8:00 1 min. read -

2

Cardano Moves Toward Ripple Asset Integration as Hoskinson Teases DeFi Expansion

15.06.2025 11:00 2 min. read -

3

Crypto Whale Makes $3.5M Shorting Altcoins on Hyperliquid

15.06.2025 15:00 1 min. read -

4

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

5

Arthur Hayes Sees a “Stablecoin Gold Rush” – and a Graveyard of Future Flops

18.06.2025 13:00 2 min. read

June’s Top-Performing Crypto Projects Across Key Metrics

A new report from on-chain analytics platform Santiment has identified standout crypto projects that posted the largest gains across various performance metrics during June 2025.

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

Robert Kiyosaki, author of Rich Dad Poor Dad, revealed on July 1 that he purchased another Bitcoin, reaffirming his long-term bullish stance—even if it comes with personal risk.

Binance to Delist Five Tokens on July 4

The move follows the exchange’s routine asset evaluations, which are aimed at maintaining quality standards and user protection.

Sui Price Prediction: SUI Surpasses BNB and HYPE Trading Volumes in June – $10 by July?

Sui (SUI) has gone up by nearly 4% in the past 24 hours and its performance is diverging from that of other altcoins after some interesting technical news. Popular trading accounts on X pointed out that Sui’s trading volumes in June surpassed those of well-established tokens like BNB Coin (BNB) and Hyperliquid (HYPER) by $7 […]

-

1

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

17.06.2025 8:00 1 min. read -

2

Cardano Moves Toward Ripple Asset Integration as Hoskinson Teases DeFi Expansion

15.06.2025 11:00 2 min. read -

3

Crypto Whale Makes $3.5M Shorting Altcoins on Hyperliquid

15.06.2025 15:00 1 min. read -

4

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

5

Arthur Hayes Sees a “Stablecoin Gold Rush” – and a Graveyard of Future Flops

18.06.2025 13:00 2 min. read