Bitcoin Price Prediction: Does JPMorgan’s $165K Forecast Still Hold After Friday’s Pullback?

15.10.2025 16:37 4 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Bitcoin reached an all-time high (ATH) of $126,080 on October 6, as the so-called “debasement trade” narrative fueled a frenzy of institutional investment. Around the same time, JPMorgan predicted that Bitcoin could reach $165,000 by the end of 2025, saying that it’s currently “undervalued” compared to gold.

But after Friday’s crypto market crash, in which Bitcoin dipped below $109,000, does the idea of Bitcoin as a hedge against macroeconomic risks still hold, or is it now showing signs of being another high-beta speculative asset?

Bitcoin price predictions remain bullish for the market-leading cryptocurrency, driven by its ability to stay above key structural levels despite the crash. Additionally, gold surpassed $4,200 an ounce for the first time ever on Wednesday, reflecting strong demand for hard assets outside of government control.

While the outlook for Bitcoin appears bullish, seasoned crypto natives are well aware of the potential for larger returns through Bitcoin-related altcoins. One project gaining serious recognition right now is Bitcoin Hyper, a new Bitcoin Layer 2 that has raised over $23 million in its presale.

Bitcoin’s “Debasement Trade” Narrative Still Has Room to Run

A research paper led by JPMorgan analysts suggested that Bitcoin is undervalued compared to gold, concluding that BTC could reach as high as $165,000 to stay in parity, based on volatility-adjusted comparisons. However, this was published when Bitcoin was rising in tandem with waning confidence in the US Dollar and growing concerns about global political stability. Has its role changed after the recent flash crash?

In a recent interview with Decrypt, Pepperstone research strategist Dilin Wu outlined a potential scenario where BTC could lose its safe-haven status, but notes that without this, it is likely to remain fixated as a debasement trade.

“If real rates climb significantly and stay high, the dollar strengthens long-term, or there’s a clear outflow of institutional funds – such as large ETF withdrawals – Bitcoin’s role as a debasement hedge would be reevaluated,” Wu said, adding, “Absent these conditions, Bitcoin’s upward momentum remains very much intact.”

And so given the anticipation of interest rate cuts and a weakening dollar, it appears that Bitcoin remains a viable hedge against macroeconomic risk.

Meanwhile, Elon Musk, the world’s richest man, made headlines yesterday by writing on X that “Bitcoin is based on energy,” adding that governments “can issue fake fiat currency,” but it’s “impossible to fake energy.”

Not only does this underscore Bitcoin’s key role in the debasement trade, but it suggests Musk may be considering a potential BTC purchase, which could boost bullish market sentiment.

Elon Musk, the world richest man, just said that 'bitcoin is based on energy'

Governments can print fake money, but "impossible to fake energy."

Do you think he is lining up another BTC purchase? 👀 pic.twitter.com/vi478af14A

— Gordon (@AltcoinGordon) October 14, 2025

Bitcoin’s scarcity-driven design, combined with a strong, borderless infrastructure and institutional interest, creates a unique setup that’s hard to find elsewhere, even in gold.

Options Market Hints at BTC Move Toward $130,000

Analyst Crypto Seth noted that after Friday’s flash crash, the Bitcoin options market shows a premium cluster between $115,000 and $130,000. He says this indicates that “investors interpret the pullback as a leverage reset rather than a shift in trend.”

Generally, options market liquidity suggests short-term moves, possibly indicating that the rally to between $115,000 and $130,000 could occur within the next few weeks, paving the way for BTC to rally toward JPMorgan’s $165,000 target before the end of the year.

$BTC options markets reveal a premium cluster between $115K and $130K, indicating traders are still positioned for upside continuation.

Even after the sharp futures liquidation, call option demand remains strong, signaling that investors interpret the pullback as a leverage… pic.twitter.com/XCH8gPtqiT

— Crypto Seth (@seth_fin) October 15, 2025

With that in mind, it seems that there’s real potential for Bitcoin to gain momentum in the coming weeks and possibly hit new highs. And if that happens, it could open up new growth opportunities for ecosystem tokens as liquidity shifts – that’s where Bitcoin Hyper comes in.

Could Bitcoin L2 Bitcoin Hyper Outperform as Bitcoin Rises?

One major issue Bitcoin currently faces is a decline in network activity, with the number of monthly active users dropping from a peak of 26 million in 2024 to 21 million in September 2025.

One reason for this could be the limited speed and functionality of the Bitcoin network, which can handle only about seven transactions per second and is mainly restricted to sending and receiving operations.

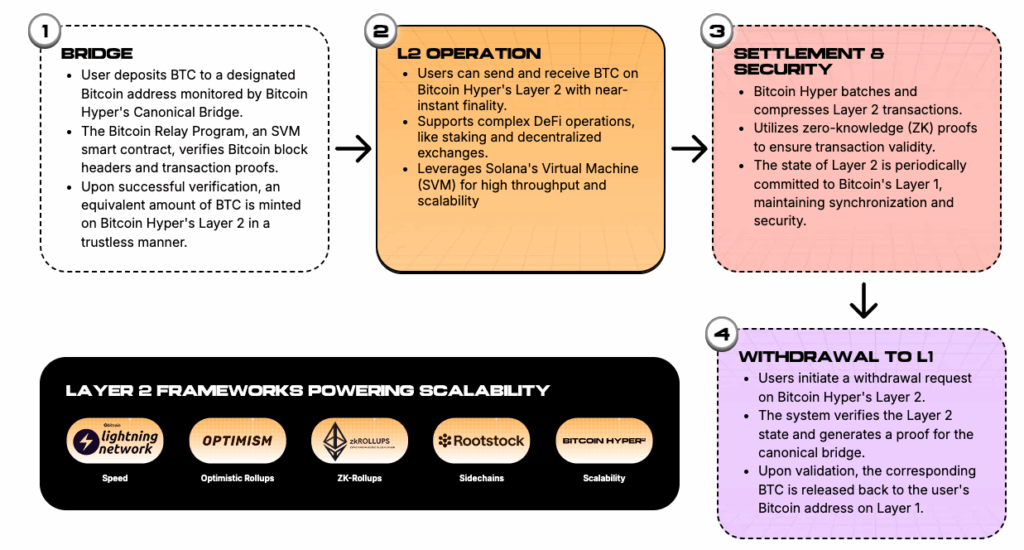

Bitcoin Hyper is developing a Bitcoin Layer 2 to address these issues directly, aiming to provide infrastructure capable of processing thousands of TPS and supporting smart contracts, without sacrificing the security guarantees of the L1.

Its goal is to unlock new use cases on Bitcoin, such as DeFi, payments, meme coins, and RWAs, which could attract more users, increase liquidity, and ultimately solidify Bitcoin as a leader in financial technology.

The project is gaining significant attention during its ongoing presale, with Crypto Tech Gaming recently calling it the best altcoin for 2025.

Currently, HYPER is holding a presale, having raised $23.7 million to date. Approximately $200,000 of that amount came in over the past 24 hours, indicating strong momentum.

With such high investor interest and a promising use case, everything seems aligned for HYPER to surge once it hits exchanges, and it could well outperform BTC due to its lower market cap.

-

1

Tapzi’s Presale Boom: The Next Big 1000x Crypto Story After Binance Coin’s Q4 Rally

10.10.2025 10:17 6 min. read -

2

XRP Price Prediction: Which Is the Best Crypto to Buy Now for Highest ROI?

10.10.2025 14:47 5 min. read -

3

Bitcoin Price Prediction: BTC Set for New All-Time High After Price Recovery?

13.10.2025 15:26 4 min. read -

4

Best Meme Coins to Buy Now as TRUMP ETF Officially Hits the Market

10.10.2025 10:36 8 min. read -

5

Best Meme Coins to Buy as Top Projects Trade at Cheap Prices

13.10.2025 9:13 9 min. read

Best Meme Coins to Buy Now As MemeCore Price Dips 10%

The meme coin market may soon be preparing for a comeback after a turbulent few weeks. Despite the recent pullback, there is growing optimism that this phase could set the foundation for the next leg of growth. Bitcoin and other leading altcoins have started to recover steadily, reflecting a return of confidence and liquidity across […]

Best Crypto to Buy Now As Binance Stocks Up on BTC and ETH

The crypto market appears ready to regain its pace after a period of cautious movement. Liquidity seems to be making a steady return, hinting at potential growth in the coming weeks. Several macro indicators now point toward a bullish phase, including renewed institutional activity and rising exchange inflows. Bitcoin and Ethereum, the two largest digital […]

Ethena Price Prediction As Its Co-founder Buys $25M $ENA: Best Altcoin To Buy?

Crypto assets that show resilience during a broad market downturn tend to have strong latent demand, making them excellent bets for when the market outlook improves. Ethena (ENA) fits the bill perfectly. While most large-cap assets are in the red and Bitcoin is down nearly 4%, the Ethena price is up 30% over the past […]

Snorter Presale Enters Final 24 Hours with $5M Raised as Analyst Predicts 100x Gains

Snorter ($SNORT), a new Solana trading bot, is closing its token presale tomorrow (20 October), having now raised over $5 million from early backers. The project aims to disrupt the trading bot space and become the leading choice for Solana meme coin traders, offering unparalleled features, easy access via Telegram, and the lowest fees on […]

-

1

Tapzi’s Presale Boom: The Next Big 1000x Crypto Story After Binance Coin’s Q4 Rally

10.10.2025 10:17 6 min. read -

2

XRP Price Prediction: Which Is the Best Crypto to Buy Now for Highest ROI?

10.10.2025 14:47 5 min. read -

3

Bitcoin Price Prediction: BTC Set for New All-Time High After Price Recovery?

13.10.2025 15:26 4 min. read -

4

Best Meme Coins to Buy Now as TRUMP ETF Officially Hits the Market

10.10.2025 10:36 8 min. read -

5

Best Meme Coins to Buy as Top Projects Trade at Cheap Prices

13.10.2025 9:13 9 min. read

Bitcoin is holding near $115,500, but traders are turning their attention to the Federal Reserve’s upcoming rate decision.

Crypto trader Scient has provided an in-depth analysis of Bitcoin's trading levels and strategies, guiding both current holders and prospective investors.

Crypto enthusiast known as "Thomas" has forecasted that Bitcoin could reach $1 million by 2030, regardless of whether Donald Trump or Kamala Harris wins the U.S. presidential election.

Bitcoin climbed 2% in the last 24 hours, bringing its price to $122,300 at the time of writing and extending a 12% weekly gain. The move outperformed the broader crypto market’s +1.9% rise, reinforcing bullish momentum across the sector.

A popular crypto analyst is revisiting his Bitcoin price predictions for the end of this year, as the cryptocurrency continues to battle through a correction.

On November 21, the price of Bitcoin reached an all-time high of $97,600, fueled by renewed optimism following Donald Trump’s re-election as President of the United States.

In a week filled with economic expectations and market fluctuations, the crypto market has seen significant volatility, with the price of Bitcoin rising after Federal Reserve Chairman Jerome Powell's comments at the Jackson Hole Economic Symposium.

Analysts from a leading research firm project Bitcoin could hit $200,000 by the end of 2025, regardless of the U.S. election outcome.

Bitcoin (BTC) has recently plummeted to a four-month low, shedding over 25% from its peak of $73,135 on March 13, triggering a significant downturn across the cryptocurrency market.

Swissblock has issued a new market update, highlighting that the percentage of Bitcoin (BTC) supply currently in profit has dropped back to around 91%, down from unsustainably high levels flagged earlier in the week.

Bitcoin’s rally to July’s all-time high brought a sharp spike in realized profits, but analysts argue the cycle looks different this time.

John Carvalho, a well-known Bitcoin supporter, has introduced a new proposal that seeks to overhaul how Bitcoin is quantified and represented.