Strategy Nears $80B in Bitcoin, Closes in on Top U.S. Corporate Treasuries

07.10.2025 22:00 2 min. read Kosta Gushterov

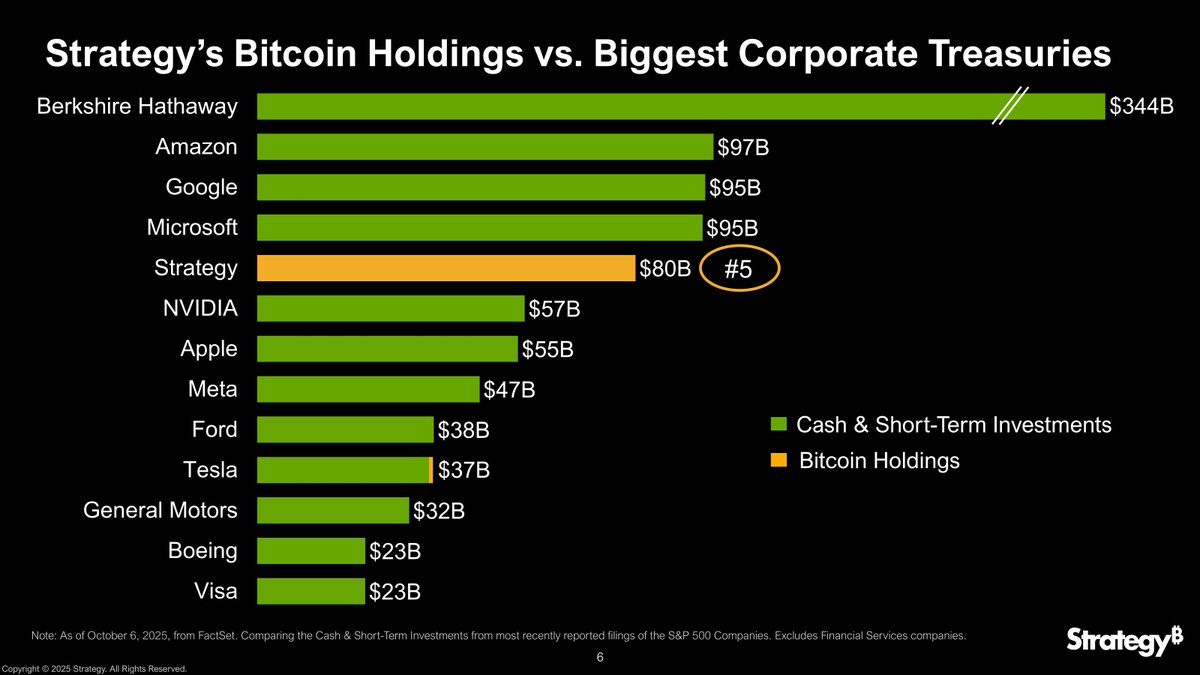

Strategy Inc. (MSTR) is rapidly ascending the ranks of America’s largest corporate treasuries, now holding nearly $80 billion in Bitcoin, according to a new company update shared on X (formerly Twitter).

The milestone places Strategy at #5 among all U.S. corporations by treasury size, surpassing giants like Apple, Meta, and Tesla, and closing in on Microsoft, Google, and Amazon.

The visual shared by Strategy compared its Bitcoin holdings to traditional cash and short-term investments across top S&P 500 firms. Berkshire Hathaway remains far ahead with $344 billion, but Strategy’s rise underscores how digital assets are beginning to rival fiat reserves on major corporate balance sheets.

Bitcoin as a Corporate Reserve Asset

Strategy’s aggressive accumulation strategy has positioned Bitcoin as its primary treasury asset, reflecting founder Michael Saylor’s long-standing thesis that BTC serves as a superior store of value to cash. The company’s total Bitcoin portfolio now exceeds 640,000 BTC, aligning with recent price strength that has pushed Bitcoin back near record highs.

The firm’s Bitcoin valuation has now overtaken NVIDIA ($57B) and Apple ($55B) in treasury scale, a feat that underscores Bitcoin’s growing legitimacy as a balance-sheet asset class.

The Road to Second Place

“Closing in on the #2 spot among all U.S. corporate treasuries,” Strategy wrote in its post, highlighting its intention to continue expanding Bitcoin reserves relative to competitors. With Amazon and Microsoft both sitting around $95 billion in cash holdings, Strategy could soon surpass either if Bitcoin appreciates further or if new purchases are announced.

This growth marks a major validation point for corporate Bitcoin adoption, showing that crypto-treasury strategies can achieve scale comparable to Fortune 500 cash management. As market confidence in Bitcoin strengthens, Strategy’s balance sheet now serves as a live case study for how digital assets can anchor corporate financial strategy.

-

1

Ohio Approves Bitcoin and Crypto Payments for State Services

25.09.2025 16:10 1 min. read -

2

Vancouver Launches Firefighter Mental Health Fund With Bitcoin Donations

20.09.2025 16:00 2 min. read -

3

Bitcoin Extends Rally Above $125K Reaching New All Time High

05.10.2025 8:51 2 min. read -

4

Bitcoin Market Signals: Grave Stone Doji and Long-Term Holder Behavior Point to Critical Shift

28.09.2025 20:00 2 min. read -

5

CoinGecko Survey Shows Fewer New Investors Start With Bitcoin

28.09.2025 10:00 2 min. read

Historic Week for Crypto Fundraising Between BTC Peak and Market Drop

Last week saw a historic rebound in crypto venture activity, with $3.5 billion raised across 28 funding rounds, marking the highest weekly total ever recorded.

Bitcoin Miner MARA Boosts Holdings as Prices Rebound

Bitcoin miner MARA Holdings boosted its corporate Bitcoin holdings by 400 BTC, valued at approximately $46.3 million, purchasing from institutional liquidity provider FalconX.

Trader Who Netted $192M Returns With Another Massive Bet Against BTC

A trader known for one of the most profitable crypto shorts of the year is back in action, reigniting speculation about insider moves behind recent market turmoil.

BlackRock Bitcoin Fund Witnesses “Head-Turning” Growth, Nears $100 Billion Valuation

The BlackRock iShares Bitcoin Trust ETF (IBIT) is nearing $100 billion in assets under management (AUM). Despite being 438 days old, this ETF has cemented its place as the company’s most profitable. IBIT’s Headed for the Stars IBIT hit its near-$100 billion valuation in just 435 days. According to reports, the ETF hit astronomical valuation […]

-

1

Ohio Approves Bitcoin and Crypto Payments for State Services

25.09.2025 16:10 1 min. read -

2

Vancouver Launches Firefighter Mental Health Fund With Bitcoin Donations

20.09.2025 16:00 2 min. read -

3

Bitcoin Extends Rally Above $125K Reaching New All Time High

05.10.2025 8:51 2 min. read -

4

Bitcoin Market Signals: Grave Stone Doji and Long-Term Holder Behavior Point to Critical Shift

28.09.2025 20:00 2 min. read -

5

CoinGecko Survey Shows Fewer New Investors Start With Bitcoin

28.09.2025 10:00 2 min. read

Strategy, the rebranded identity of MicroStrategy, is preparing to raise up to $2.1 billion through the sale of preferred stock as part of its ongoing effort to grow its Bitcoin portfolio.

MicroStrategy, now rebranded as Strategy, has made another move to expand its Bitcoin holdings, filing with the U.S. Securities and Exchange Commission (SEC) to offer $500 million worth of shares.

Bitcoin’s sharp retreat under the $111,000 mark has rattled global markets, setting off a chain reaction across cryptocurrencies and crypto-linked equities.

Michael Saylor, co-founder of Strategy (formerly MicroStrategy), has hinted at another major Bitcoin purchase after a brief pause in acquisitions.

Michael Saylor, the executive chairman and co-founder of Strategy (previously known as MicroStrategy), recently updated his followers on the company’s performance in the first two months of 2025.

After a brief pause in its Bitcoin acquisition streak, MicroStrategy appears poised to return to the market.

Strategy (NASDAQ: MSTR), the Bitcoin-focused treasury and software firm, has posted its strongest financial quarter in company history, driven by record-breaking gains from its Bitcoin holdings.

Michael Saylor’s Strategy has just added 10,100 BTC—worth about $1.05 billion—to its balance sheet, lifting the company’s total stash to roughly 592,100 coins.

Crypto-linked equities have carved out a unique position in global markets, offering exposure to digital assets without the direct volatility of token trading.

Strategy Inc. (NASDAQ: MSTR) continues to attract significant attention on Wall Street as the company doubles down on its identity as a Bitcoin proxy stock.

Strategy (MSTR) slides as investors weigh dilution, volatility, and its evolving role as both software firm and digital asset giant.

Strategy (NASDAQ: MSTR) surged on Monday, climbing 5.62% to close at $326.42, after the company disclosed another addition to its already massive Bitcoin holdings.

Strategy (MSTR) stock faces pressure despite Bitcoin’s rally. Analysts debate fair value, risks, and whether ETFs and options are eroding its premium.

Strategy has once again expanded its Bitcoin treasury, underscoring its long-standing conviction in the leading cryptocurrency.

After a profitability warning, Strategy, the company formerly known as MicroStrategy, announced plans to raise $2 billion through the issuance of zero-interest convertible senior notes.

The firm formerly known as MicroStrategy is back in the spotlight after its executive chairman, Michael Saylor, shared a cryptic social media post suggesting fresh Bitcoin acquisitions could be imminent.

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

As Bitcoin rebounded past $105,000 with a sharp 5% rally, Strategy's Michael Saylor sent a cryptic but confident message to the crypto world.

As of June 30, 2025, Strategy (formerly MicroStrategy) holds 597,000 BTC purchased for $42.4 billion — now worth approximately $64.4 billion.

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.