Vitalik Buterin Reveals 90% of His Wealth Is in Ethereum Amid Community Concerns

28.08.2024 10:30 2 min. read Alexander Stefanov

Ethereum co-founder Vitalik Buterin recently addressed concerns about Ethereum's role as a store of value, especially after scrutiny surrounding the Ethereum Foundation's (EF) recent financial activities.

Buterin revealed that about 90% of his net worth is in ETH, signaling his confidence in the cryptocurrency.

This comes amid debates within the Ethereum community regarding the platform’s significance in decentralized finance (DeFi) and the importance of ETH’s value for securing the network under its Proof of Stake (PoS) system. Some community members have expressed concern that the EF hasn’t strongly advocated for ETH as a store of value, especially in light of recent significant transactions.

One such transaction involved the transfer of 35,000 ETH (valued at $94 million) to the Kraken exchange, raising eyebrows over the potential market impact. Aya Miyaguchi, the EF’s Executive Director, explained that the move was part of routine treasury management to meet operational costs, including grants and salaries, which require fiat currency.

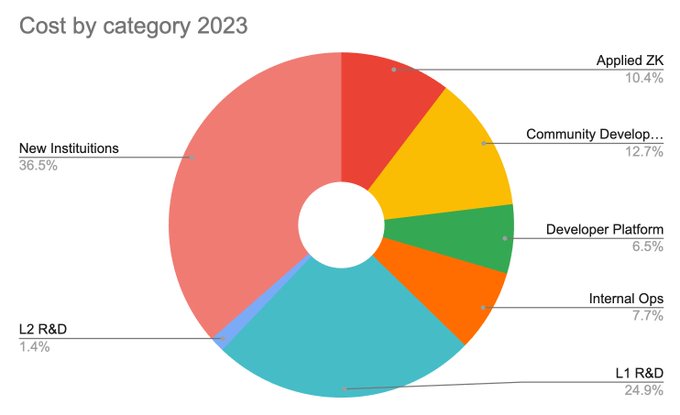

In response to transparency concerns, EF member Josh Stark provided a breakdown of the Foundation’s expenditures, including grants supporting the Ethereum ecosystem. The Foundation also plans to release a detailed financial report by the end of the year to address ongoing concerns.

Despite the criticism, some community members defended the EF, pointing out that its spending is relatively minor compared to Ethereum’s market cap. Meanwhile, Buterin’s views on DeFi, particularly the sustainability of yields, have also sparked discussions, with some in the community emphasizing DeFi’s critical role in the crypto space.

As these conversations unfold, Ethereum “whales” have been observed selling large amounts of ETH, further fueling discussions about the platform’s future.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

4

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read -

5

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read

Grayscale Confidentially Files for New SEC-registered Offering Amid Growing Crypto Market demand

Grayscale Investments announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S.

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

According to on-chain analytics firm Nansen, several blockchain networks are witnessing a sharp rise in user activity, led by Sonic, which recorded an impressive 89% growth in active addresses over the past 7 days.

Here is How to Read the Crypto Fear and Greed Index

In the volatile world of cryptocurrency, investor psychology is one of the most powerful forces behind price movement.

These Are the Most Trending Altcoins Right Now, According to CoinGecko

Crypto analysis platform CoinGecko has revealed the most talked-about altcoins in recent hours, highlighting a surge in investor interest across a range of sectors—from meme coins to DeFi and gaming tokens.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

4

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read -

5

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read