U.S. Consumer Confidence Holds Steady Amid Mixed Economic Signals

10.10.2025 17:30 1 min. read Alexander Zdravkov

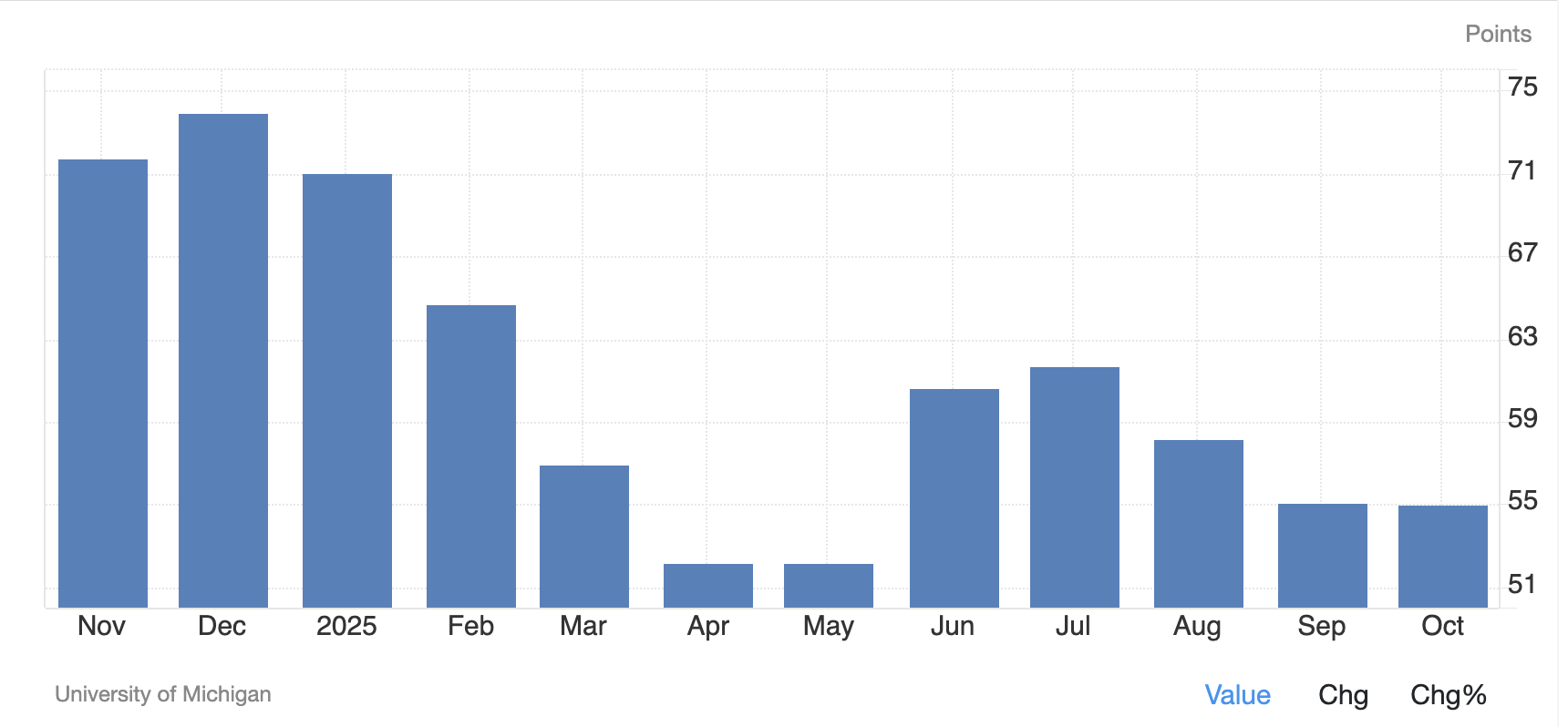

The latest University of Michigan survey shows U.S. consumer sentiment largely unchanged, with the index at 55.0, slightly above economists’ expectations of 54.2. September’s reading was 55.1, indicating little shift in household outlooks.

Americans expressed cautious optimism about current finances and near-term business conditions, but expectations for future personal finances and major purchases softened. The Current Economic Conditions Index inched up to 61.0, while the Expectations Index dipped slightly to 51.2.

Inflation forecasts offered a modest positive note: the one-year outlook fell to 4.6% from 4.7%, while longer-term expectations held steady at 3.7%. Although above the Federal Reserve’s 2% target, the figures suggest consumers do not anticipate a sudden inflation surge.

Analysts note that with confidence near recent lows, upcoming retail sales, employment, and inflation data will be crucial in determining whether households are ready to increase spending as the year closes.

The University of Michigan survey remains a key barometer of consumer outlook, polling over 500 households across the continental U.S. on finances, business conditions, and economic expectations.

-

1

U.S. Jobless Claims Dip to 218,000, Beating Expectations

25.09.2025 15:52 2 min. read -

2

U.S. Government Shutdown Stalls Key Jobs and Inflation Data

03.10.2025 16:03 2 min. read -

3

U.S. Faces Another Shutdown Showdown as Deadline Nears

30.09.2025 15:30 2 min. read -

4

US Shutdown: Here is When it Could Finish According to Polymarket

06.10.2025 18:00 3 min. read -

5

U.S. Consumer Confidence Holds Steady Amid Mixed Economic Signals

10.10.2025 17:30 1 min. read

Wall Street’s New Crystal Ball: Why Bank Earnings Are Critical Amidst Economic Uncertainty

The usual deluge of economic data that guides Wall Street has run dry, interrupted by an ongoing federal government shutdown.

Markets Jittery as U.S.-China Trade Spat Revives Uncertainty in Global Supply Chains

Tensions between the United States and China have flared again after President Donald Trump imposed steep tariffs on Chinese goods, prompting a measured response from Beijing.

US Shutdown: Here is When it Could Finish According to Polymarket

In the beginning of October, 2025, the U.S. federal government entered a shutdown after Congress failed to pass new funding legislation for the 2026 fiscal year.

U.S. Government Shutdown Stalls Key Jobs and Inflation Data

The ongoing U.S. government shutdown is creating uncertainty in financial markets by halting the release of critical economic indicators.

-

1

U.S. Jobless Claims Dip to 218,000, Beating Expectations

25.09.2025 15:52 2 min. read -

2

U.S. Government Shutdown Stalls Key Jobs and Inflation Data

03.10.2025 16:03 2 min. read -

3

U.S. Faces Another Shutdown Showdown as Deadline Nears

30.09.2025 15:30 2 min. read -

4

US Shutdown: Here is When it Could Finish According to Polymarket

06.10.2025 18:00 3 min. read -

5

U.S. Consumer Confidence Holds Steady Amid Mixed Economic Signals

10.10.2025 17:30 1 min. read

A Boston federal court has shut the book on one of crypto’s longest-running fraud cases, ordering the shuttered platform My Big Coin to hand over almost $26 million.

A legal clash between Coin Center and the U.S. Treasury Department over sanctions imposed on Tornado Cash has officially come to an end, following a joint decision to dismiss the case.

A federal court has ordered the return of 94,643 Bitcoin, seized after the 2016 Bitfinex hack, back to the exchange.

A federal court in Texas has blocked the U.S. Treasury from ever reimposing sanctions on the crypto mixing service Tornado Cash, putting an end to a long-running legal saga.

The United States has officially lost its last remaining top-tier credit rating, as Moody’s has downgraded the country's long-standing AAA status to AA1.

In just two months, crypto tax platform CoinLedger observed a staggering 700% surge in the number of U.S. users receiving IRS warning letters, signaling a sharp escalation in federal tax enforcement targeting digital asset holders.

In 2025, with a pro-crypto administration taking shape, U.S. Congress is set to focus on cryptocurrency legislation, especially stablecoins and the FIT21 Act.

In the last quarter of 2024, U.S.-based cryptocurrency startups captured 46% of global venture capital funding, according to a Galaxy Digital report.

Bridgewater's Ray Dalio has expressed grave concerns over the U.S. debt situation, warning that an unsustainable imbalance between debt supply and demand could have severe global repercussions.

Robert Kiyosaki, the author renowned for Rich Dad Poor Dad, has voiced serious concerns about the U.S.’s escalating national debt, which currently stands at a staggering $35 trillion.

Luke Gromen, a macro investor and founder of Forest For The Trees (FFTT), believes gold and Bitcoin are poised to benefit from the worsening fiscal situation in the U.S.

A measure opposing the creation of a U.S. central bank digital currency (CBDC) has been added to the National Defense Authorization Act (NDAA), a key defense funding bill widely considered “must-pass” legislation, according to Bloomberg Law.

Concerns over the unchecked rise of cryptocurrencies have prompted New York Attorney General Letitia James to call on Congress for immediate intervention.

In a statement that marks a major policy shift, U.S. Treasury Secretary Scott Bessent confirmed that blockchain technologies will play a central role in the future of American payments, with the U.S. dollar officially moving "onchain."

The U.S. dollar’s strength in the global financial landscape remains unshaken, as it continues to outperform other currencies, including the Indian rupee.

Analysts are sounding alarms about potential economic trouble ahead for the United States. Several key indicators that have historically predicted downturns are aligning, suggesting a recession may be looming.

Chamath Palihapitiya, billionaire venture capitalist, argues that the U.S. economy may not be as healthy as it appears, suggesting that government spending has driven much of the growth seen in recent years.

The U.S. economy, despite what many think, is experiencing relatively strong growth, which may come as a surprise to many.

Financial educator and author Robert Kiyosaki has raised alarms about the state of the U.S. economy, warning that the nation, despite its status as the largest global economy with a GDP of around $29 trillion, is on a downward path.

CoinShares recently analyzed how the upcoming US elections could impact the cryptocurrency industry.