Top Analyst Shares His Forecast for Bitcoin and the Altcoin markets

01.07.2024 10:30 1 min. read Alexander StefanovRenowned analyst Ali Martinez recently shared his views on Bitcoin and the broader cryptocurrency market.

Martinez highlighted that the simple moving average in the ETH/BTC ratio has exceeded 365, which he interprets as an early indicator of the upcoming altcoin season.

However, the analyst highlighted that the price of the leading cryptocurrency often rises when least expected.

Continuing his Bitcoin analysis, Martinez revealed that 14,000 BTC has been transferred on crypto exchanges in the past four days, which equates to approximately $851 million.

The expert noted that despite these large transfers, the Bitcoin kitty has made significant purchases when the price was in its low ranges, which has caused the buy/sell ratio for BTC to rise.

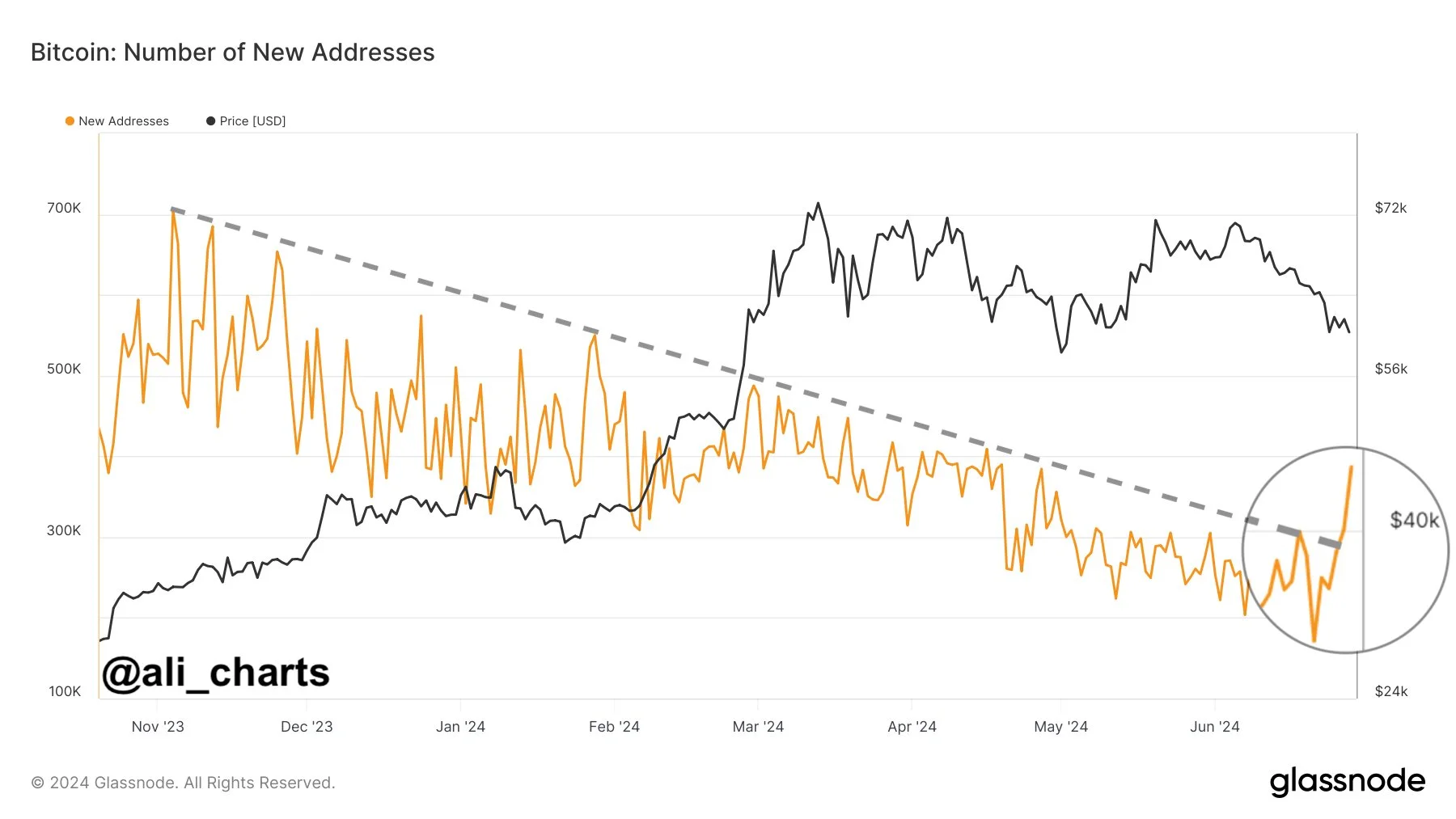

Additionally, Martinez highlighted a resurgence of individual investors in Bitcoin. The number of new BTC addresses on the network has risen to 352,124, marking its highest level since April.

-

1

Institutions Quietly Accumulate as Raoul Pal Reaffirms Long-Term Crypto Thesis

12.10.2025 9:00 2 min. read -

2

Michael Saylor Calls Out Bitcoin Skeptics as Vanguard Becomes His Largest Shareholder

28.09.2025 15:00 1 min. read -

3

Crypto Market Weakens: Bitcoin Holds Line, Ethereum Struggles at $4K

16.10.2025 9:15 1 min. read -

4

Bitcoin: Here Is How Many BTC Public Companies Bought in Q3 2025

08.10.2025 22:00 1 min. read -

5

ETF Inflows Signal Confidence as Bitcoin Consolidates

10.10.2025 13:00 2 min. read

$1.8 Billion in Bitcoin Linked to LuBian Heist Suddenly on the Move

Data reviewed by Web3 researcher OnchainLens, using analytics from Arkham Intelligence, shows that wallets associated with the 2020 LuBian breach shifted a total of 15,959 BTC to four newly created addresses.

Historic Gold Sell-Off Wipes Out $2.5 Trillion, Outpacing Bitcoin’s Market Cap

Gold, long seen as the world’s most stable store of value, shocked investors this week with a dramatic two-day collapse that erased trillions of dollars in market value – a loss surpassing Bitcoin’s entire market capitalization.

Changpeng Zhao Drops Bombshell Prediction: Bitcoin Set to Surpass Gold’s $29 Trillion Market Cap

Bitcoin’s explosive rise in 2025 has reignited one of the most debated questions in finance – can the digital currency truly rival gold as the world’s most valuable asset? As market momentum pushes both assets to historic highs, Binance founder has weighed in with a bold forecast that has caught the attention of investors and analysts alike.

New ETF Could Let Investors Hold Bitcoin, Solana, and XRP – All in One Fund

ProShares has filed with the U.S. Securities and Exchange Commission to launch a new exchange-traded fund based on the CoinDesk 20 Index, which tracks the top 20 cryptocurrencies by market size and liquidity.

-

1

Institutions Quietly Accumulate as Raoul Pal Reaffirms Long-Term Crypto Thesis

12.10.2025 9:00 2 min. read -

2

Michael Saylor Calls Out Bitcoin Skeptics as Vanguard Becomes His Largest Shareholder

28.09.2025 15:00 1 min. read -

3

Crypto Market Weakens: Bitcoin Holds Line, Ethereum Struggles at $4K

16.10.2025 9:15 1 min. read -

4

Bitcoin: Here Is How Many BTC Public Companies Bought in Q3 2025

08.10.2025 22:00 1 min. read -

5

ETF Inflows Signal Confidence as Bitcoin Consolidates

10.10.2025 13:00 2 min. read

Cantor Fitzgerald’s asset management arm is entering the crypto investment space with a new fund designed to offer Bitcoin exposure while cushioning downside risk through gold.

Asset manager WisdomTree has asked the U.S. Securities and Exchange Commission (SEC) to withdraw its S-1 application for a spot Ethereum exchange-traded fund (ETF), more than three years after it was originally filed.

Top executives at two of America's biggest banks are continuing to cash out large portions of their personal stock holdings.

As 2024 draws to a close, Bitcoin (BTC) and the broader cryptocurrency market are poised for a promising year ahead.

Some of the world’s largest financial institutions are joining hands to test a new form of digital money tied to traditional currencies.

Marathon Digital has revealed plans to issue $250 million in convertible senior notes.

Bitcoin mining giants continued to thrive in early 2025, collectively generating close to $800 million in newly minted BTC as prices remained close to all-time highs.

Virgin Voyages, a leading cruise line, has become the first in its industry to accept Bitcoin (BTC) as a payment option.

A new weekly report shared by Wu Blockchain highlights some of the most significant moves across the crypto industry.

A top cryptocurrency ETF issuer has integrated Chainlink's Proof of Reserves to enhance transparrency.

Sports partnerships have always been a good opportunity for crypto companies to gain mainstream recognition.

Binance has announced new futures contracts for multiple cryptocurrencies, sparking a surge in their prices and reinforcing the exchange’s influence over market trends.

Kraken has reinstated crypto staking for U.S. users, marking a significant comeback after regulators forced the exchange to discontinue its previous program two years ago.

OKX, a prominent global cryptocurrency exchange, has announced the cessation of its operations in Nigeria.

In a major move for the crypto industry, Donald Trump's incoming administration is preparing to establish a crypto advisory council that could oversee the creation of a national Bitcoin reserve.

As the crypto market braces for economic headwinds in 2025, investors are seeking tokens that combine solid fundamentals with a vibrant community spirit.

Top crypto investor James Fickel, with a net worth of approximately $400 million, recently lost over $40 million through a series of leveraged trades.

Marathon Digital, a leading player in the crypto mining sector, has expanded its Bitcoin reserves by purchasing an additional $249 million worth of the cryptocurrency.

Check out the Arctic Pablo Coin pre-sale, which could be one of the best cryptocurrency pre-sales in 2025!Baby Doge & DOGS coins are also seeing updates in the market.