Ethereum Losses 7% of its Value Overnight – Here is Why

25.07.2024 9:16 2 min. read Alexander Stefanov

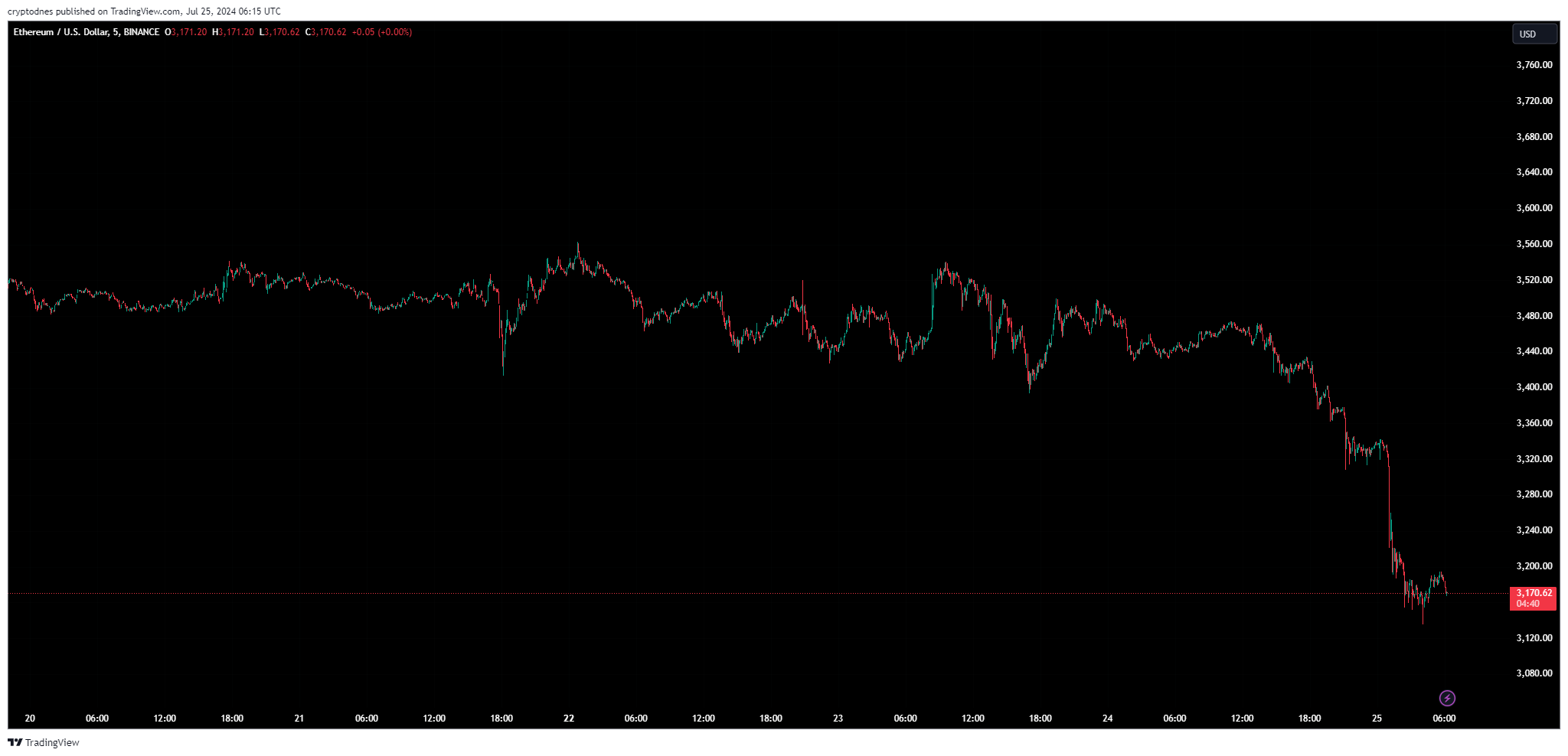

A day after the successful launch of the spot Ethereum ETF, the price of Ethereum has experienced a significant drop which triggered substantial liquidations of long ETH positions within the last 24 hours.

Data from Coinglass reveals that Ethereum liquidations have surpassed those of Bitcoin in the past 24 hours. Specifically, Ethereum liquidations have reached $100.85 million, compared to $83.35 million for Bitcoin.

The approval of the spot Ethereum ETF appears to have become a “sell-the-news” event, similar to what happened with Bitcoin earlier this year. After Ethereum’s price climbed to $3,500 in July, investors seem to be cashing in on the ETF-related excitement.

Additionally, on-chain data indicates that a significant Ethereum whale has been offloading its holdings. According to Spot on Chain, this whale made $173 million in profit by depositing 10,000 ETH, worth $34.2 million, on Kraken just before the price drop. This whale had withdrawn 96,639 ETH from Coinbase at $1,580 per ETH in September 2022. Since March, the whale has moved nearly 40,000 ETH to Kraken and still holds 56,639 ETH, valued at $188 million at the current price.

10xResearch has also pointed out that current distributions from Mt. Gox are putting pressure on the broader cryptocurrency market. They noted that if this trend continues, the crypto market will need more support to rally, with Ethereum possibly being the most vulnerable due to stagnant or declining fundamentals like new users and revenue.

Popular crypto analyst Michael van de Poppe suggests that Ethereum’s price might see a reversal amid significant outflows from the Grayscale Ethereum Trust. He predicts that Ethereum might experience a two-week downward trend before potentially rallying to new all-time highs. According to his analysis, Ethereum could find support around $3,150 before resuming its upward trajectory.

If the markets copy the price action of the #Bitcoin ETF, then it’s likely that we’ll have a slight sell-off due to the outflows of the Grayscale trust.

One-two weeks for downward momentum, before the real surge of Ethereum towards a new all-time high. pic.twitter.com/fmjE7z7We9

— Michaël van de Poppe (@CryptoMichNL) July 24, 2024

At the time of writing Ethereum is trading at $3,180 after a 7.4% decline in the past 24 hours and a $20.95 billion trading volume.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

Ethereum co-founder and Consensys CEO Joe Lubin believes Ethereum’s growing use in corporate treasuries could redefine how traditional finance views the second-largest digital asset.

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

A wave of large-scale altcoin deposits has hit centralized exchanges over the past 24 hours, according to data from on-chain analytics platform Santiment.

Trump’s Truth Social Files For Spot Crypto ETF Holding 5 Cryptocurrencies

Truth Social, the media venture linked to U.S. President Donald Trump, has taken a bold step into the digital asset space with a fresh filing for a spot cryptocurrency exchange-traded fund (ETF).

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

Large-scale investors are steadily increasing long positions in several overlooked altcoins, signaling a potential early-stage accumulation phase.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

4

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read