Bitcoin’s Momentum Remains Strong as Key Metric Signals Room for Major Upside

10.10.2025 17:00 2 min. read Alexander Zdravkov

Despite trading near record highs around $121,657, Bitcoin may still have plenty of room to climb.

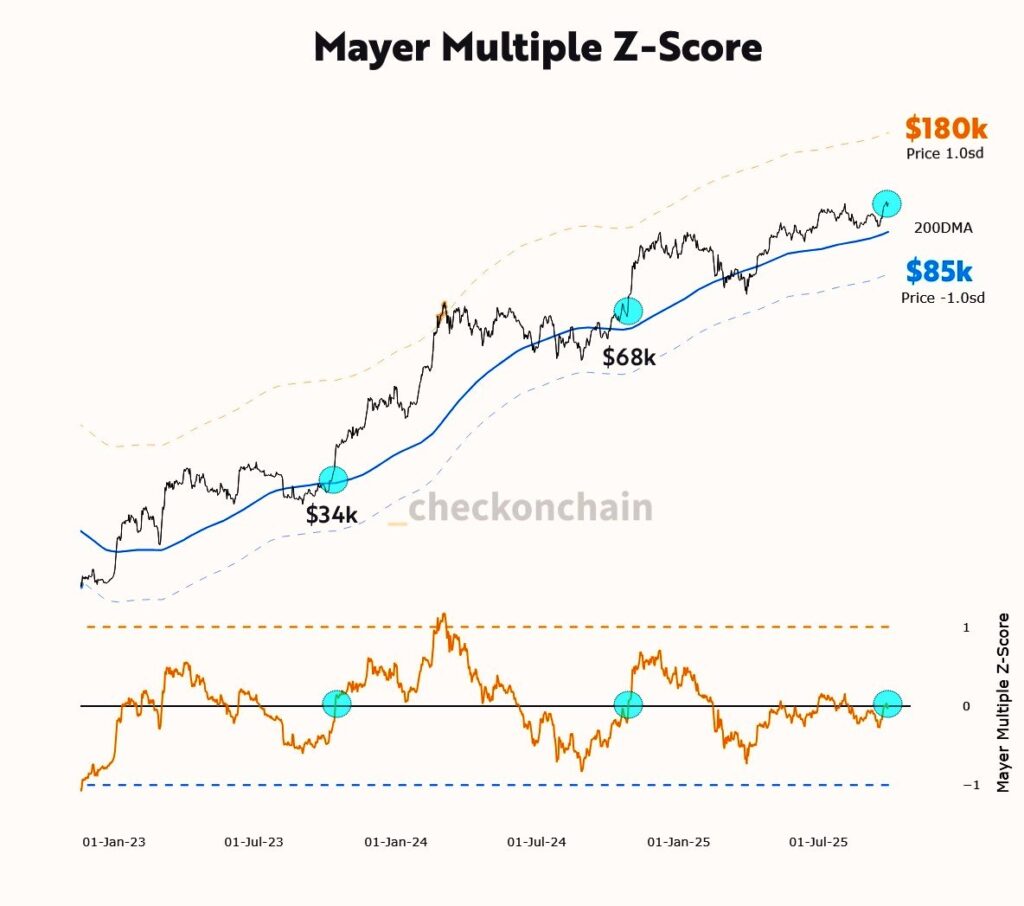

A well-known long-term indicator, the Mayer Multiple, suggests the leading cryptocurrency could stretch as far as $180,000 before becoming overheated.

According to onchain analyst Frank A. Fetter, Bitcoin’s current market position looks “ice cold” compared with previous cycles. The Mayer Multiple, which tracks the relationship between Bitcoin’s price and its 200-week moving average, shows a reading of 1.16 – much closer to levels typically seen in undervalued conditions than those associated with speculative peaks. Historically, the market only enters “overbought” territory when the ratio surpasses 2.4.

That means even as Bitcoin sets new records, its long-term valuation metrics remain unusually subdued. For BTC to hit that 2.4 threshold, its price would need to climb to roughly $180,000.

Some analysts share that optimism. In mid-2025, Axel Adler Jr. described readings near 1.1 as “a strong reserve of energy” for another upward move. With current values sitting just above that mark, many believe the market could still have momentum left for a breakout before year’s end.

Still, not everyone expects a straight path higher. October, often one of Bitcoin’s strongest months, could bring volatile swings before any decisive move. Experts warn that a short-term pullback to the $114,000 – $115,000 range remains possible before the next major push.

Even so, the broader narrative suggests a market that’s far from exhaustion.

-

1

Crypto Treasuries: Discipline or Dotcom Deja Vu?

28.09.2025 22:00 1 min. read -

2

Ohio Approves Bitcoin and Crypto Payments for State Services

25.09.2025 16:10 1 min. read -

3

Vancouver Launches Firefighter Mental Health Fund With Bitcoin Donations

20.09.2025 16:00 2 min. read -

4

Bitcoin Price Prediction from Standard Chartered’s Geoff Kendrick

04.10.2025 8:00 2 min. read -

5

Bitcoin Market Signals: Grave Stone Doji and Long-Term Holder Behavior Point to Critical Shift

28.09.2025 20:00 2 min. read

Volatility Alert: Institutions Question Bitcoin’s Long-Term Value

Hargreaves Lansdown has issued a cautious note on Bitcoin, describing the cryptocurrency as highly speculative and unsuitable for traditional investment portfolios.

Bitcoin Tests Bullish Signal as Market Reacts to Trade Tensions

Bitcoin is once again testing a critical bullish pattern known as the golden cross – a technical setup that has historically preceded explosive rallies.

Deutsche Bank Sees Bitcoin Following Gold’s Footsteps

Analysis from Deutsche Bank reveals that global central banks are amassing gold at a pace unmatched in decades, hinting at shifting priorities in the global monetary system — and potentially paving the way for Bitcoin’s growing relevance.

Institutions Quietly Accumulate as Raoul Pal Reaffirms Long-Term Crypto Thesis

Raoul Pal brushed off the latest crypto market chaos, calling it “just noise” and urging investors to look beyond short-term volatility.

-

1

Crypto Treasuries: Discipline or Dotcom Deja Vu?

28.09.2025 22:00 1 min. read -

2

Ohio Approves Bitcoin and Crypto Payments for State Services

25.09.2025 16:10 1 min. read -

3

Vancouver Launches Firefighter Mental Health Fund With Bitcoin Donations

20.09.2025 16:00 2 min. read -

4

Bitcoin Price Prediction from Standard Chartered’s Geoff Kendrick

04.10.2025 8:00 2 min. read -

5

Bitcoin Market Signals: Grave Stone Doji and Long-Term Holder Behavior Point to Critical Shift

28.09.2025 20:00 2 min. read

Bitcoin’s latest price strength may be masking cracks in its underlying momentum.

Bitcoin's recent price decline has prompted analysts to revisit market patterns, with CryptoQuant suggesting that the current correction follows a historical trend.

According to market analyst Merlijn The Trader, Bitcoin has officially entered the “endgame” phase of its parabolic curve — the last step before what he describes as a vertical lift-off.

A prominent market analyst is optimistic about Bitcoin's future, following its substantial gains over the past month.

Bitcoin may be on the verge of a powerful move that could define the rest of the year, according to one closely followed trader.

Bitcoin recently made headlines by briefly surpassing the $100,000 mark for the first time in its history, but its momentum stalled as it dipped back below this level.

Bitcoin’s political importance is expected to grow significantly after Donald Trump and the Republican Party secured key election victories, according to the New York Digital Investment Group (NYDIG).

While Bitcoin’s recent stagnation has triggered debate over what’s really influencing the market, analysts at K33 Research say exchange-traded fund flows are still the dominant force — far more so than the activity from corporate treasuries.

JPMorgan analysts have found that Bitcoin’s performance closely mirrors small-cap tech stocks, particularly those in the Russell 2000 tech sector.

Bitcoin’s recent consolidation appears to be a pause, not a reversal, as the world’s largest cryptocurrency continues to hover near its all-time highs.

As Bitcoin continues its upward momentum in 2025, analysts are beginning to warn that the current bullish phase might be nearing its peak.

A popular crypto analyst believes Bitcoin could be entering a period of sustained growth, with little chance of significant pullbacks in the near future.

Bitcoin is on the verge of regaining its psychological threshold of $100,000, and analysts at CryptoQuant explain some of the reasons behind the rise.

Mark Yusko, the CEO and Chief Investment Officer of Morgan Creek Capital Management, recently weighed in on Bitcoin's market dynamics.

Economist Henrik Zeberg is cautioning that Bitcoin’s surge may be far less independent than many believe.

Bitcoin may be carving out a new identity as a reliable store of value during periods of financial turbulence, according to the New York Digital Investment Group (NYDIG).

As concerns grow over government debt and global instability, Bitcoin is increasingly seen as a serious alternative to both gold and U.S. Treasuries.

Bitcoin’s reputation as a hedge against economic turmoil is fading as it moves in step with traditional risk assets.

Mike Novogratz, billionaire investor and CEO of Galaxy Digital, weighed in on Donald Trump’s groundbreaking decision to establish a U.S. Strategic Bitcoin Reserve.

Bitcoin reserves on exchanges have hit their lowest level in seven years, signaling a tightening supply that could push prices higher.