Investors Crushed as Bitcoin Treasury Firms Collapse Under Their Own Hype

19.10.2025 12:00 2 min. read

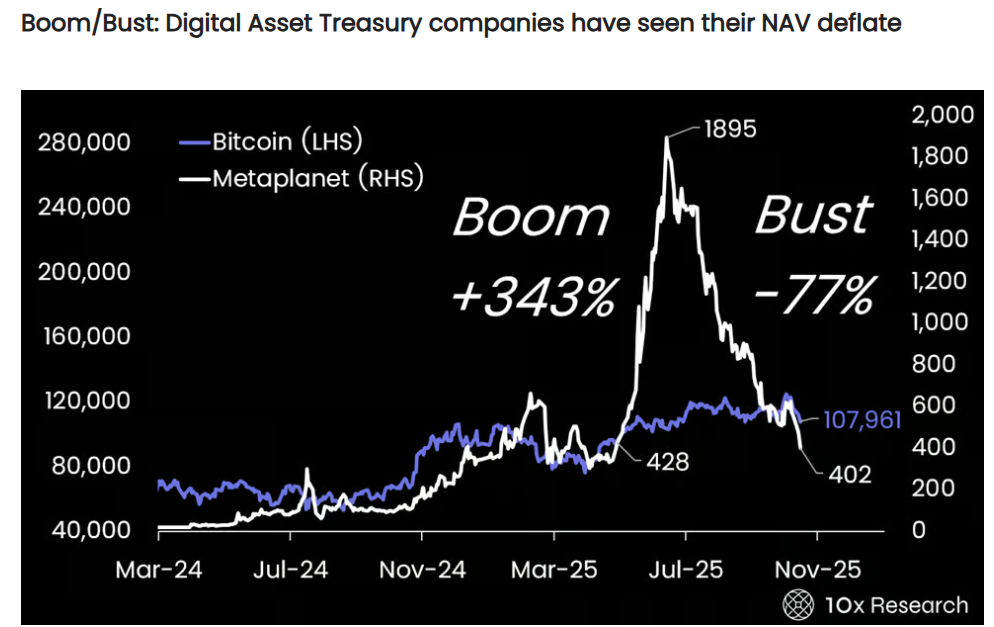

The recent plunge in Bitcoin’s price has erased billions from investors who sought exposure through Digital Asset Treasury Companies (DATCOs) - firms that buy and hold Bitcoin as part of their balance sheet strategies.

According to 10x Research, this sector’s decline has wiped out roughly $17 billion in retail wealth, with shareholders in companies like MicroStrategy and Metaplanet taking the hardest hit.

DATCOs became a popular entry point for investors hoping to ride Bitcoin’s rally indirectly. These companies often sold their shares at hefty premiums over the value of their Bitcoin reserves, using the proceeds to accumulate more of the cryptocurrency. The approach worked flawlessly in bull markets, when optimism pushed valuations far beyond the underlying assets. But as enthusiasm cooled and Bitcoin’s price momentum faded, those premiums collapsed, exposing how inflated the sector had become.

10x Research estimates that investors collectively overpaid by around $20 billion for Bitcoin exposure through these premium-priced equities. The selloff has mirrored the broader digital asset correction, with MicroStrategy’s stock down more than 20% since August and Tokyo-based Metaplanet losing over 60% in the same period.

The pullback also crushed the once-vaunted market-to-net-asset-value (mNAV) ratios of DATCOs – a metric that reflects investor confidence. MicroStrategy now trades at roughly 1.4x its Bitcoin holdings, while Metaplanet has slipped below parity for the first time since embracing its Bitcoin treasury model in 2024. Across the industry, nearly one-fifth of all listed Bitcoin treasury firms are trading below their net asset value.

Despite Bitcoin reaching an all-time high of $126,000 earlier this month, the correction intensified after U.S. President Donald Trump’s tariff threats against China triggered a wave of selling.

Still, some analysts, such as Brian Brookshire of H100 Group AB, believe these declines are part of the natural cycle of Bitcoin-linked equities. He described mNAV ratios as “volatile and temporary,” arguing that such corrections do not undermine the sector’s long-term fundamentals.

Yet 10x Research struck a more sober tone, calling the downturn “the end of financial alchemy” – a point where hype and premium-fueled growth give way to earnings reality. With volatility cooling and speculative momentum fading, Bitcoin treasury firms now face a crucial test: proving they can thrive without the illusion of endless upside.

-

1

BBVA Brings Bitcoin and Ethereum Trading to European Retail Investors

02.10.2025 13:50 2 min. read -

2

Bitcoin Monthly Pattern: Analyst Notes Key First-Week Price Trends

02.10.2025 20:00 2 min. read -

3

“Everyday Money” – Jack Dorsey Wants Bitcoin to Finally Live up to its Promise

10.10.2025 8:30 2 min. read -

4

Can Bitcoin Outlast Stocks in the Age of Artificial Intelligence?

15.10.2025 8:30 3 min. read -

5

Institutions Quietly Accumulate as Raoul Pal Reaffirms Long-Term Crypto Thesis

12.10.2025 9:00 2 min. read

Bitcoin and Ethereum Lead Crypto Rally as Market Cap Hits $3.83 Trillion

The cryptocurrency market is showing positive momentum, with the total market capitalization reaching $3.83 trillion, up 2.17%.

Elon Musk’s SpaceX Quietly Shifts $257M in Bitcoin – Is a Massive Sell-Off Coming?

Elon Musk’s SpaceX has once again stirred speculation in the crypto world after two company-linked wallets moved roughly $257 million in Bitcoin, marking its second major onchain activity in three months.

Crypto Investors Hit Pause as ETFs Keep Losing Millions

U.S. Spot Bitcoin exchange-traded funds (ETFs) are experiencing sustained withdrawals, with Monday marking the fourth consecutive day of net outflows.

Forget the Halving – This Is What Could Trigger the Next Brutal Crypto Downturn

Market analyst Willy Woo believes the next crypto bear market could be unlike any before – not driven by Bitcoin’s halving cycle, but by a global economic slowdown.

-

1

BBVA Brings Bitcoin and Ethereum Trading to European Retail Investors

02.10.2025 13:50 2 min. read -

2

Bitcoin Monthly Pattern: Analyst Notes Key First-Week Price Trends

02.10.2025 20:00 2 min. read -

3

“Everyday Money” – Jack Dorsey Wants Bitcoin to Finally Live up to its Promise

10.10.2025 8:30 2 min. read -

4

Can Bitcoin Outlast Stocks in the Age of Artificial Intelligence?

15.10.2025 8:30 3 min. read -

5

Institutions Quietly Accumulate as Raoul Pal Reaffirms Long-Term Crypto Thesis

12.10.2025 9:00 2 min. read

Investors are turning to Dogwifhat (WIF) and Fartcoin as the meme coin hype grows, while FXGuys ($FXG) is all set for the most explosive rally of the year. Here’s why!

Investors are optimistic about the continued growth of the cryptocurrency market, with many expecting a peak in 2025.

Market optimism is growing as investors anticipate economic policies under Donald Trump’s leadership to stimulate growth, with U.S. stocks and the dollar positioned as likely beneficiaries.

In times of market uncertainty, when fear often dominates the headlines, savvy investors see opportunity.

Despite a turbulent week in the markets, investors poured $3.17 billion into digital asset funds, showing strong confidence in cryptocurrencies even as US-China tariff tensions rattled prices.

Investors are growing impatient with the stagnant prices of Cardano and Ethereum. As a result, many are turning their attention to XYZVerse, a new project that promises exceptional returns.

A trader recently faced a substantial loss after investing in the Joe Biden-themed Jeo Boden (BODEN) token, a situation unfolding amid rising expectations for a potential memecoin season.

As FXGuys continues to gain momentum, investors are shifting their focus from Solana to what is quickly becoming one of the top defi coins in the market.

A significant downturn in the cryptocurrency market has brought an end to the 16-day streak of inflows into US Spot Bitcoin ETFs, highlighting growing investor unease.

Ella Zhang, head of YZi Labs (formerly Binance Labs), has observed a noticeable change in crypto investment patterns.

The crypto market is currently witnessing a significant shift in liquidity as investors transfer large amounts of capital into stablecoins amid growing uncertainty.

JPMorgan Chase analysts are raising concerns as the U.S. national debt nears $35 trillion.

Coinbase Institutional, the institutional arm of the US-based digital asset exchange platform, anticipates further consolidation in the crypto market this quarter.

Fundstrat's Tom Lee suggests that staying optimistic in the face of recent market declines could be more rewarding for investors than retreating into caution.

Bitcoin has been making headlines with its impressive surge following Donald Trump's victory, but many altcoins are still far from their all-time highs.

Nike is facing a new legal battle after a group of NFT and crypto asset buyers accused the company of leaving them with major financial losses.

Investors have pulled nearly $2 billion from Grayscale's Ethereum ETF (ETHE) since it transitioned from a trust, with the fund's value now at $6.7 billion due to declining Ethereum prices.

Iranian authorities have imposed new restrictions on domestic cryptocurrency exchanges following a large-scale cyberattack on Nobitex, the country’s leading trading platform.

Iran is offering a $20 reward to citizens who report unauthorized cryptocurrency miners as the country deals with power shortages and a severe heatwave.