Investors Withdraw $2 Billion from Grayscale’s Ethereum ETF

01.08.2024 13:30 1 min. read Alexander Stefanov

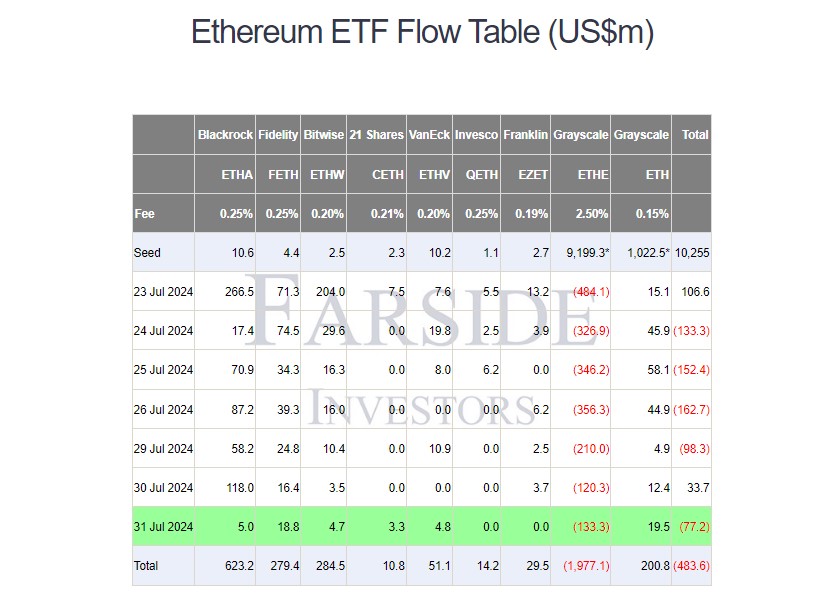

Investors have pulled nearly $2 billion from Grayscale's Ethereum ETF (ETHE) since it transitioned from a trust, with the fund's value now at $6.7 billion due to declining Ethereum prices.

On Wednesday alone, ETHE saw $133 million in withdrawals, though this wasn’t its largest single-day outflow, which was $484 million on its debut.

In contrast, the Grayscale Ethereum Mini Trust (ETH) has seen a positive inflow trend, with $19.5 million added on Wednesday, bringing total inflows to over $200 million.

ETH offers a lower management fee of 0.15%, compared to ETHE’s 2.5%, positioning it as the most cost-effective Ethereum ETF.

Grayscale’s new Bitcoin Mini Trust (BTC), launched yesterday and has already attracted $18 million.

This fund, which also has a 0.15% fee, aims to offer a cheaper alternative to the existing Bitcoin Trust (GBTC) and alleviate some of the selling pressure on GBTC by reallocating some of its assets.

-

1

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

2

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read -

3

Lion Group Bets Big on Altcoins With $500M Hyperliquid Strategy

20.06.2025 12:00 1 min. read -

4

Whale Activity Signals Possible Turning Points for Key Altcoins, Says Santiment

14.06.2025 20:00 2 min. read -

5

Fetch.AI Commits $50M to Token Buyback Amid Platform Growth

20.06.2025 16:00 1 min. read

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

Zak Cole, a prominent Ethereum core developer, has unveiled a bold new initiative aimed at significantly expanding the Ethereum ecosystem and driving the price of ETH to $10,000.

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

According to a new report by CryptoQuant, Chainlink (LINK) is locked in a prolonged accumulation phase between $12 and $15, driven by aggressive whale behavior amid muted retail participation.

Fartcoin Price Prediction: FARTCOIN Eyes $1.5 as ETF Approval Hopes Boost Meme Coins

Fartcoin (FARTCOIN) has gone up by 14.4% in the past 24 hours as meme coins as a whole are rallying during today’s session. The launch of a Solana exchange-traded fund (ETF) this week along with Canary Capital’s positive steps toward getting a Pudgy Penguins (PENGU) ETF approved are favoring a bullish Fartcoin price prediction. Fartcoin. […]

Solana Staking ETF Ranks in Top 1% of ETF Launches on Day One

The newly launched SSK Solana Staking ETF delivered a standout performance on its first trading day, ranking in the top 1% of all ETF launches, according to Bloomberg ETF analyst Eric Balchunas.

-

1

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

2

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read -

3

Lion Group Bets Big on Altcoins With $500M Hyperliquid Strategy

20.06.2025 12:00 1 min. read -

4

Whale Activity Signals Possible Turning Points for Key Altcoins, Says Santiment

14.06.2025 20:00 2 min. read -

5

Fetch.AI Commits $50M to Token Buyback Amid Platform Growth

20.06.2025 16:00 1 min. read