Bitcoin’s Active Addresses Drop Sharply as ETFs Reshape Market Cycle

16.09.2025 13:33 2 min. read Kosta Gushterov

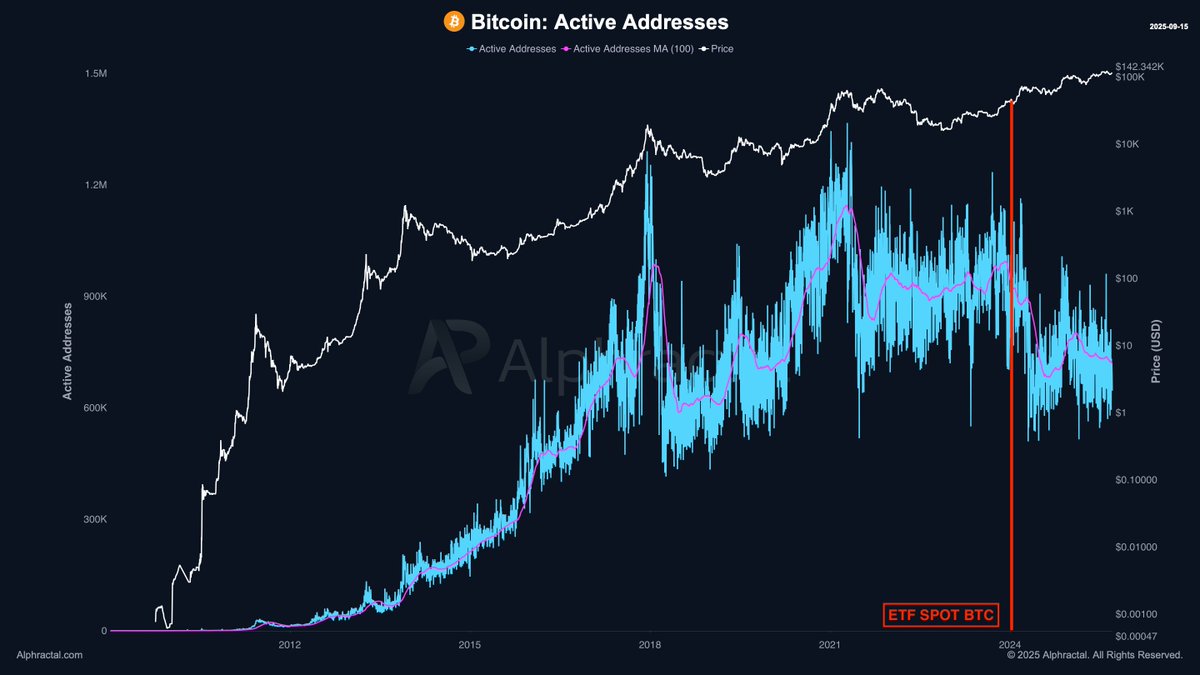

Bitcoin is showing signs that this market cycle may not mirror the patterns of previous ones. While price remains in line with long-term historical trends, fresh data on network activity paints a different picture of what’s driving demand in 2025.

Active addresses decline despite rising prices

One of the most striking shifts is the fall in active addresses. Historically, these surged during bull markets as retail investors rushed on-chain. This time, however, activity has been trending down steadily since 2021, even as Bitcoin climbed to fresh all-time highs above $140,000.

Charts from Alphapractal confirm that current address counts remain well below previous peaks. This suggests that Bitcoin’s growth is increasingly being fueled off-chain rather than through direct wallet activity.

ETFs and centralized platforms change investor behavior

Analysts argue that the launch of spot Bitcoin ETFs in 2024 played a major role in this divergence. The new funds allow institutions and retail investors to gain exposure without opening wallets, moving coins, or worrying about custody.

Centralized exchanges (CeXs) have also lured investors with yield products tied to BTC holdings. By keeping assets parked on these platforms, participants bypass traditional on-chain interactions, suppressing address metrics.

Long-term holders add another layer

Another factor is dormant wallets. Many long-term holders continue to sit on their coins without moving them, further reducing the number of active addresses tracked each day.

This evolution signals that Bitcoin demand may be increasingly shaped by financial products and passive holding strategies rather than grassroots transaction activity.

A new cycle dynamic?

Together, these shifts highlight why this cycle could unfold differently from the past. Bitcoin remains aligned with its broad cyclical trajectory, but the mechanics underneath have changed. Investor demand is increasingly mediated through ETFs, custodians, and CeX products rather than direct blockchain engagement.

That raises an important question: if on-chain activity is no longer the dominant signal of demand, how should markets measure the strength of this cycle? For now, the answer seems clear, price action may still follow the cycle, but the drivers are evolving rapidly.

-

1

Bitcoin’s Pullback Seen as Pause Before Potential Rally Toward $160,000

07.10.2025 10:00 2 min. read -

2

Bitcoin Surges to $117K as US Government Shutdown Boosts Safe-Haven Demand

01.10.2025 19:00 3 min. read -

3

Bitcoin and Ethereum ETFs See Over $1.2 Billion in Inflows as Institutions Accelerate Buying

04.10.2025 18:00 2 min. read -

4

Bitcoin: Here is Why the Price Is Down Today

08.10.2025 9:29 2 min. read -

5

First Bitcoin Treasury Merger Raises Questions About How To Value DATs

28.09.2025 13:00 1 min. read

Bitcoin Miners Raise Billions to Bet on AI and HPC Expansion

Public cryptocurrency mining companies are ramping up fundraising through convertible bonds, marking the largest wave of capital raising in the sector since 2021.

Billions Lost, Fear Rising: The Crypto Sell-Off Nobody Saw Coming

The mood across the crypto market turned bleak this week as investors rushed to exit positions, wiping out roughly $230 billion in value within a single day.

Crypto Panic Alert: Altcoins Hit Double-Digit Losses in 24 Hours

The cryptocurrency market is experiencing a significant downturn, with the total market capitalization dropping to $3.57 trillion, down 5.12% in the past 24 hours.

JPMorgan Exposes the Hidden Drivers of the Historic Crypto Selloff

JPMorgan analysts say the sharp crypto downturn last week, marked by massive liquidations, was mainly fueled by crypto-native investors rather than traditional retail or institutional ETF holders.

-

1

Bitcoin’s Pullback Seen as Pause Before Potential Rally Toward $160,000

07.10.2025 10:00 2 min. read -

2

Bitcoin Surges to $117K as US Government Shutdown Boosts Safe-Haven Demand

01.10.2025 19:00 3 min. read -

3

Bitcoin and Ethereum ETFs See Over $1.2 Billion in Inflows as Institutions Accelerate Buying

04.10.2025 18:00 2 min. read -

4

Bitcoin: Here is Why the Price Is Down Today

08.10.2025 9:29 2 min. read -

5

First Bitcoin Treasury Merger Raises Questions About How To Value DATs

28.09.2025 13:00 1 min. read

The battle between digital and traditional stores of value has entered a new phase.

August presents a paradox for Bitcoin investors. On one hand, it has historically delivered some of the most impressive post-halving gains.

Bitcoin’s current market downturn is unlikely to last much longer, according to crypto analyst Timothy Peterson, who believes a recovery could be on the horizon within the next three months.

A well-known crypto analyst is sounding the alarm on a potential storm brewing for Bitcoin—one that could be fueled not by speculators, but by institutions themselves.

Bitcoin’s price trajectory suggests that a bear market is unlikely this year, according to Ki Young Ju, CEO of CryptoQuant.

Bitcoin’s historical price cycles could be shifting, according to Bitwise Chief Investment Officer Matt Hougan.

Bitcoin’s price movements have long shown a striking correlation with the broader business cycle, and new analysis suggests that pattern is holding true once again.

Bitcoin's market behavior has shifted significantly in the current cycle, showcasing patterns distinct from previous bull runs, according to insights from Glassnode, a blockchain analytics platform.

Bitcoin’s return to six-figure territory has reignited market optimism, but unlike the short-lived surge seen in January, the current rally appears to be built on firmer ground.

Jason Calacanis, a well-known American angel investor, recently shared his thoughts on Bitcoin's future, suggesting that while a total collapse to zero is still technically possible, the likelihood is now under 5%.

Bitcoin’s trajectory for the coming months may hinge on how it performs around the $90,000 mark this January, according to well-known crypto analyst Benjamin Cowen.

Arthur Hayes, the founder of BitMEX, has made a bold statement regarding Bitcoin's role in the changing global financial landscape.

Bitcoin’s price action is flashing a textbook chart pattern that traders can’t ignore: a double top forming just under the $124,000 resistance zone.

Bitcoin’s recent price dip has stirred fresh debate around its connection to global liquidity, with analysts highlighting the relationship between BTC’s trajectory and the expanding M2 money supply.

SkyBridge Capital’s Anthony Scaramucci is signaling a shift in crypto investing, describing Bitcoin as increasingly behaving like a standalone asset class and endorsing Solana as a top candidate for ETF growth.

A well-known analyst who accurately predicted Bitcoin’s pre-halving pullback last year is still optimistic about BTC’s potential for a major upward move, despite recent price corrections.

Crypto analyst EGRAG Crypto has drawn attention to a long-term pattern in Bitcoin’s performance relative to the S&P 500, noting that while the trend remains upward, the degree of exponential growth is steadily decreasing.

Economist Henrik Zeberg believes the crypto market is on the verge of its final bullish surge, with Bitcoin and altcoins gearing up for another major rally.

The crypto market has faced sharp declines recently, with major players like Bitcoin and Ethereum experiencing notable losses.

Bitcoin has long followed a predictable four-year cycle, but this pattern may no longer hold, according to Matt Hougan, Chief Investment Officer at Bitwise.