Ethereum ETFs Entered August With Positive Results

02.08.2024 11:15 1 min. read Kosta Gushterov

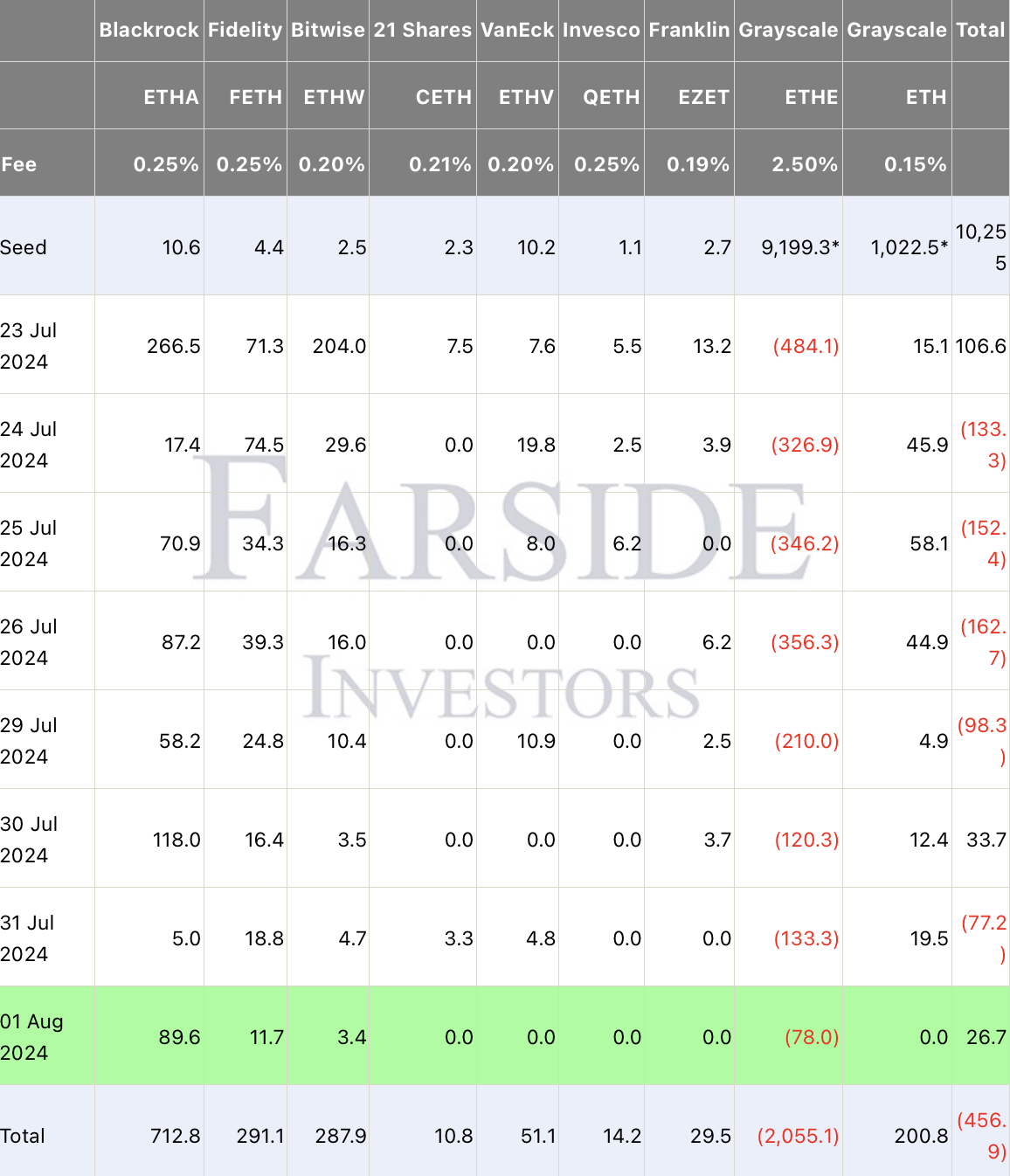

U.S. based spot Ethereum (ETH) exchange traded funds (ETFs) posted positive results on Aug. 1, although Grayscale's ETHE saw outflows equal to $78 million for the day.

On Thursday, these ETFs recorded total net inflows of $26.7 million, with BlackRock’s iShares Ethereum Trust (ETHA) leading the way with $89.6 million raised.

Bitwise’s ETHW and Fidelity’s FETH attracted $3.4 million, $11.7 million, respectively.

Unlike the other eight Ethereum spot ETFs, which launched as new funds, ETHE was originally a trust that provided institutional investors with exposure.

Prior to its conversion, ETHE managed $9 billion worth of Etherеum. As of August 1, outflows exceeded 22% ($2.055 billion) of the original fund.

In contrast, the Grayscale Ethereum Mini Trust (ETH) reported neither inflows nor outflows.

Overall, the most significant inflows since inception have been recorded by the BlackRock, Bitwise and Fidelity funds, which have attracted $712.8 million, $287.9 million and $291.1 million, respectively, since launch through August 1.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

BNB Chain is set to upgrade the BNB Smart Chain (BSC) by cutting the block time in half, from 1.5 seconds down to 0.75 seconds.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read