Ethereum ETFs Entered August With Positive Results

02.08.2024 11:15 1 min. read Kosta Gushterov

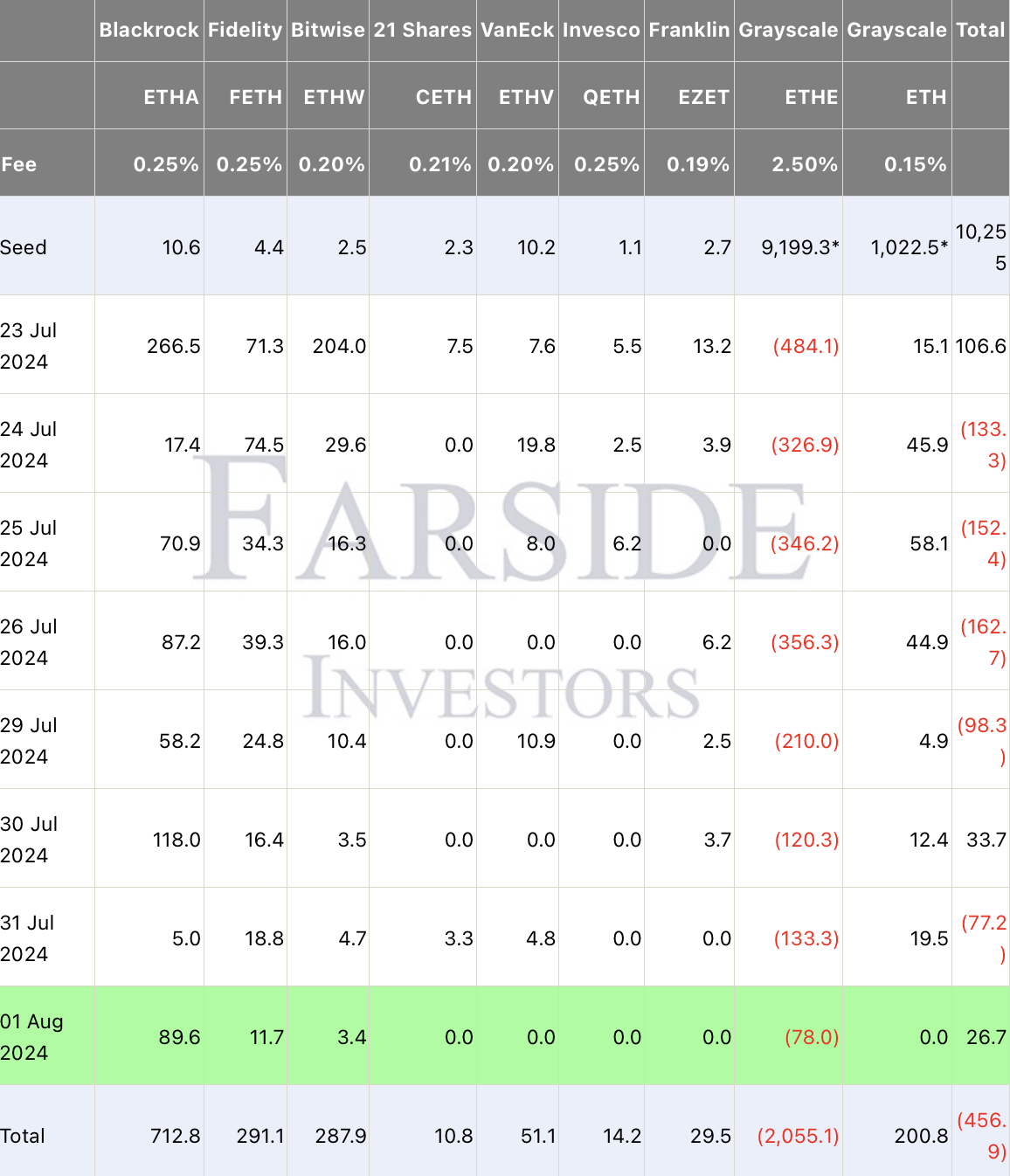

U.S. based spot Ethereum (ETH) exchange traded funds (ETFs) posted positive results on Aug. 1, although Grayscale's ETHE saw outflows equal to $78 million for the day.

On Thursday, these ETFs recorded total net inflows of $26.7 million, with BlackRock’s iShares Ethereum Trust (ETHA) leading the way with $89.6 million raised.

Bitwise’s ETHW and Fidelity’s FETH attracted $3.4 million, $11.7 million, respectively.

Unlike the other eight Ethereum spot ETFs, which launched as new funds, ETHE was originally a trust that provided institutional investors with exposure.

Prior to its conversion, ETHE managed $9 billion worth of Etherеum. As of August 1, outflows exceeded 22% ($2.055 billion) of the original fund.

In contrast, the Grayscale Ethereum Mini Trust (ETH) reported neither inflows nor outflows.

Overall, the most significant inflows since inception have been recorded by the BlackRock, Bitwise and Fidelity funds, which have attracted $712.8 million, $287.9 million and $291.1 million, respectively, since launch through August 1.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

4

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

Solana (SOL) is approaching a critical technical level that could trigger a major breakout. According to crypto analyst Ali Martinez, a weekly close above $170 may ignite a new bull run and potentially open the door for a rally toward the $2,000 mark.

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

Smart contract platforms Ethereum and Solana are shaping the crypto market’s future with big upgrades and shifting strategies.

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

Arthur Hayes has radically changed his stance on crypto markets. After months of caution, the BitMEX co-founder now believes a powerful altcoin rally is on the horizon.

Ethereum ETFs Signal Strong July Surge

Ethereum exchange-traded funds are gaining momentum, with recent inflows ranking among the top ten ever recorded.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

4

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read