Litecoin Surges as Whales Add 181K LTC Amid ETF and Treasury Boost

10.09.2025 22:00 1 min. read Kosta Gushterov

Litecoin (LTC) has seen a sharp uptick in activity, outperforming several altcoins after a wave of bullish developments triggered renewed whale accumulation.

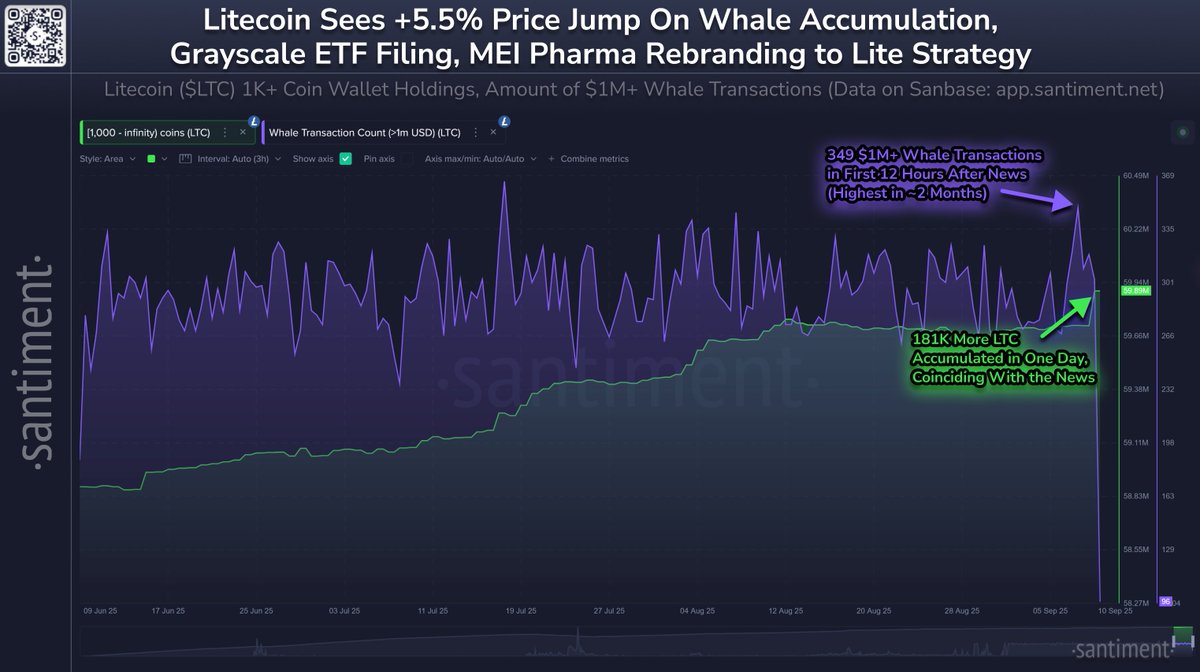

Data from Santiment shows wallets holding over 1,000 LTC collectively added 181,000 coins in a single day, marking one of the largest daily jumps in recent months.

The surge came alongside two key catalysts. First, Grayscale filed for a Litecoin ETF, extending its push to convert crypto trusts into exchange-traded products after doing the same with Bitcoin and Ethereum.

Second, MEI Pharma announced a rebrand to Lite Strategy and disclosed that it had secured $100 million worth of LTC for its corporate treasury, signaling institutional interest in the asset.

Whale behavior confirmed the impact of these events. Santiment recorded 349 transactions above $1 million within 12 hours of the announcements, the highest concentration of large-scale activity in more than two months.

This spike coincided with a 5.5% price gain for LTC, reinforcing how quickly investor sentiment can pivot when both institutional adoption and regulatory steps align.

For Litecoin, which has often been overshadowed by larger assets like Bitcoin and Ethereum, this combination of whale accumulation, ETF momentum, and treasury allocation could mark the start of renewed relevance.

Analysts suggest the coming weeks will show whether the rally has legs or if it’s another short-lived spike in a volatile market.

-

1

Top 3 Trending Cryptos Today: CREPE, RICE AI, and Zcash Lead Market Momentum

05.10.2025 12:56 2 min. read -

2

Michaël van de Poppe Reveals Which Altcoins He’s Buying and Selling Now

28.09.2025 17:00 2 min. read -

3

Top Trending Cryptos: AI Tokens and Stablecoin Partnerships Lead Market Momentum

06.10.2025 13:46 2 min. read -

4

VisionSys AI Partners With Marinade Finance to Launch $2B Solana Treasury

01.10.2025 21:00 2 min. read -

5

REX-Osprey Launches First Ethereum Staking ETF in the U.S.

25.09.2025 22:00 2 min. read

Zerobase Puts the Community First With Massive Airdrop

Zerobase has unveiled a major ZBT token airdrop designed to put its community front and center.

Ethereum Dips, But Smart Money Sees Opportunity

Ethereum recently saw a sharp drop, but some experts suggest it may be a healthy pause rather than a sign of trouble.

The USDe Crash: Ethena’s Algorithmic Stablecoin Tested by Market Pressure

Ethena’s algorithmic stablecoin USDe faced intense market pressure during yesterday’s crypto sell-off, plunging to around $0.65 on Binance before partially stabilizing.

Top 5 Trending Cryptocurrencies Today: Market Fear Persists, But Altcoins Steal the Spotlight

The crypto market remains volatile, with total capitalization dipping slightly below $3.75 trillion, yet trading activity shows that investors are still hunting for emerging altcoins.

-

1

Top 3 Trending Cryptos Today: CREPE, RICE AI, and Zcash Lead Market Momentum

05.10.2025 12:56 2 min. read -

2

Michaël van de Poppe Reveals Which Altcoins He’s Buying and Selling Now

28.09.2025 17:00 2 min. read -

3

Top Trending Cryptos: AI Tokens and Stablecoin Partnerships Lead Market Momentum

06.10.2025 13:46 2 min. read -

4

VisionSys AI Partners With Marinade Finance to Launch $2B Solana Treasury

01.10.2025 21:00 2 min. read -

5

REX-Osprey Launches First Ethereum Staking ETF in the U.S.

25.09.2025 22:00 2 min. read

Litecoin has experienced a notable uptick in user engagement in 2024, with daily active addresses reaching an average of 401,000, marking a 10% increase from the previous year's 366,000.

Logan Paul, a popular social media figure, is under scrutiny for allegedly profiting from cryptocurrency promotions without revealing his financial ties, as reported by the BBC.

Lomond School in Scotland is set to make history as the first educational institution in the United Kingdom to accept Bitcoin for tuition payments, marking a significant step in the broader adoption of digital assets in traditional sectors.

The London Stock Exchange Group (LSEG) has officially launched a blockchain-based platform, marking a significant step in the exchange operator’s entry into digital assets.

After years of inactivity, a once-silent crypto whale has suddenly stirred, transferring a significant amount of Bitcoin (BTC), as noted by on-chain monitoring.

Bitcoin’s long-term holders have been offloading significant amounts of their holdings this month as the cryptocurrency’s price hovers around the $92,000 mark.

Macro analyst Lyn Alden is optimistic about Bitcoin's long-term prospects due to the rising interest payments on the US national debt, which has surpassed $35 trillion.

As the crypto market grows, investors are looking for cheap tokens with the potential for explosive growth.

Bitcoin miner activity has hit a notable low point, according to the latest analysis from crypto research firm Alphractal.

Ethereum transaction fees have plummeted to just $0.41, marking their lowest point in four years.

The cryptocurrency market is gearing up for another explosive year, with analysts highlighting LuckHunter (LHUNT) as a standout investment for 2025.

The cryptocurrency market keeps evolving quickly, which allows smart investors to discover substantial new possibilities.

Over the past decade and a half, the crypto trading industry has witnessed remarkable growth, evolving into a market with daily trading volumes in the hundreds of billions.

The Terra Luna Classic (LUNC) community is expressing strong discontent over eToro’s recent decision to delist its tokens.

Luxembourg has become the first Eurozone nation to allocate part of its sovereign wealth fund to Bitcoin, with officials confirming a 1% investment into regulated Bitcoin exchange-traded funds (ETFs).

Renowned crypto expert Benjamin Cowen has issued a cautionary note regarding Bitcoin's potential breakout above the $70,000 mark, suggesting that a key macroeconomic indicator could influence its trajectory.

Meme coins linked to Donald Trump experienced a dramatic surge ahead of the 2024 U.S. election but have sharply declined in value since his victory announcement.