Chainlink Price Prediction As Whales Buy The Dip: Will LINK Hit $100?

17.10.2025 12:41 4 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Crypto prices are facing significant selling pressure as weakness in U.S. regional banks has stirred fears of credit stress, prompting risk‐off sentiment and driving investors out of volatile assets.

Yet, smart money investors remain confident in another explosive bull rally that could push large-cap crypto prices to new highs.

Chainlink has emerged as one of the most in-demand coins among top investors, with whales buying the dip. Just today, Lookonchain flagged a $16.94 million $LINK purchase by a whale wallet from Binance.

A newly created wallet 0x8879 withdrew 934,516 $LINK($16.94M) from #Binance 2 hours ago.https://t.co/L4mc3pkkfQ pic.twitter.com/8sewND0EyG

— Lookonchain (@lookonchain) October 16, 2025

With old “dino” coins like Zcash and BNB recently showing considerable bullish strength, whales are betting that LINK could be the next to explode.

Chainlink price predictions from prominent analysts continue to indicate a high possibility of a new all-time high by year-end, with $100 emerging as a potential long-term target.

Chainlink Price Prediction: How High Can LINK Go?

Chainlink continues to be one of the most fundamentally sound crypto assets on the market.

Its strength lies in a deep and diversified technology stack, even beyond its cutting-edge Oracle services. Its decentralized price feeds, off-chain computation, privacy oracles, verifiable random functions (VRF), and flagship Cross-Chain Interoperability Protocol (CCIP) that enables secure communication across blockchains, have made Chainlink perhaps the most indispensable company in the crypto industry.

It also powers Proof of Reserves to verify asset backing and features an automated compliance engine that allows institutions to enforce on-chain regulatory requirements. With banks and institutions looking to launch their own stablecoin, Chainlink’s use case in the industry is only going to skyrocket.

On Thursday, Chainlink announced that it has launched the first native real-time oracle on MegaETH to deliver sub-second data.

CHAINLINK $LINK LAUNCHES FIRST NATIVE REAL-TIME ORACLE ON MEGAETH TO DELIVER SUB-MILLISECOND DATA FOR NEXT-GEN DEFI

— The Wolf Of All Streets (@scottmelker) October 16, 2025

On the institutional front, Chainlink has built partnerships and pilots with some of the largest players in global finance. It has collaborated with Swift, UBS, and J.P. Morgan to bridge traditional payment systems with tokenized assets.

Banks such as Citi, BNP Paribas, and BNY Mellon have also participated in Chainlink interoperability pilots, while Fidelity International and Sygnum use it to bring fund NAV data on-chain. Other partners include Euroclear, ANZ, Clearstream, and Lloyds.

Even the US Department of Commerce have partnered with Chainlink to publish macroeconomic data.

Now could be a good time to invest in LINK, considering Chainlink co-founder is set to speak at the Federal Reserve’s Payments Innovation Conference.

The ONLY altcoin at the upcoming Federal Reserve Payments Conference?

Chainlink pic.twitter.com/m0ichZIXLU

— Deezy (@deezy_BTC) October 15, 2025

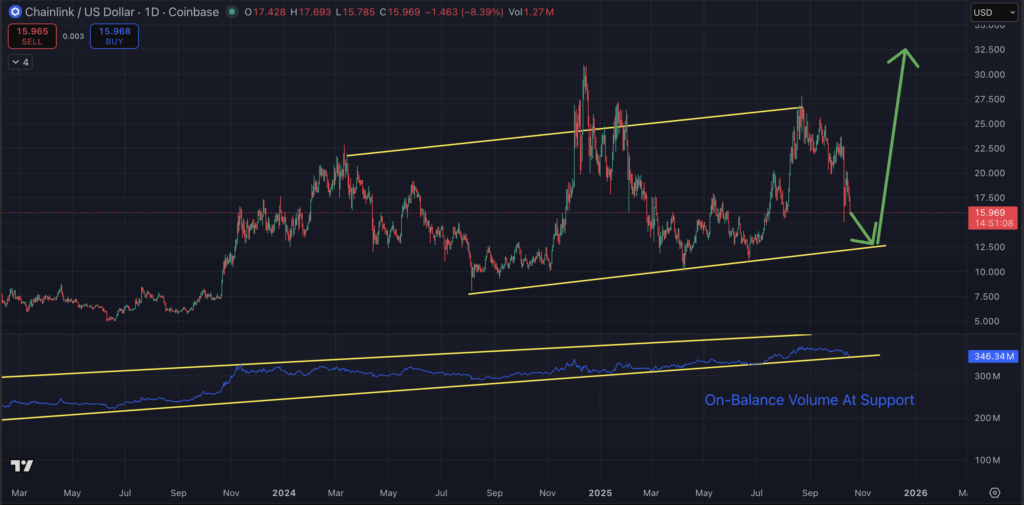

LINK’s technical analysis supports this thesis as well. With its on-balance volume (OBV) now at a key support level, there is a strong likelihood of a bounce back. In fact, the Chainlink price is close to forming a bullish divergence with its OBV.

More risk-averse investors can wait for a successful retest of the lower trendline of Chainlink’s ascending parallel wedge.

Top analysts continue to give bullish Chainlink price predictions in the long term. Blockchainedbb is projecting LINK to hit $55 by year-end, while Crypto Tony expects a top anywhere between $280 and $450.

Pepenode Tipped As The Next 100x Crypto

The success of BNB, Zcash and Chainlink indicates that the utility coins are in high demand. Unsurprisingly, investors are even giving preference to high-utility meme coins over run-of-the-mill scam tokens.

For instance, Pepenode (PEPENODE) has raised nearly $2 million in its ICO, with smart money investors and whales among the early buyers.

The project has already made a mark for itself, thanks to a unique mine-to-earn ecosystem. Pepenode’s virtual mining system allows holders to use their tokens to build digital server rooms and purchase Miner Nodes, which generate hashpower and produce rewards.

The entire process takes place off-chain, starting from the presale itself, requiring no GPUs, electricity, or physical equipment. As users upgrade their mining facilities, efficiency increases while a deflationary burn permanently removes a large portion of tokens from circulation, creating long-term scarcity.

Rewards earned through the system include both $PEPENODE and leading meme coins like Pepe and Fartcoin, giving investors multiple streams of value within a single, gamified ecosystem.

Besides, investors can just stake their coins and earn passive income, currently at a reward rate of nearly 700% per annum.

Considering the popular Pepe the Frog theme, low market cap and high utility, it is no surprise that many are viewing Pepenode as a potential 100x crypto.

-

1

Best Meme Coins to Buy Now as TRUMP ETF Officially Hits the Market

10.10.2025 10:36 8 min. read -

2

Best Meme Coins to Buy as Top Projects Trade at Cheap Prices

13.10.2025 9:13 9 min. read -

3

Best Crypto to Buy Now as Bitcoin Wallets Accumulate

10.10.2025 11:14 7 min. read -

4

Bitcoin, XRP, Ethereum Price Predictions: Buy the Dip or Sell?

17.10.2025 11:55 5 min. read -

5

BNB Smashes ATH as Uptober Takes Off: Next Cryptos to Explode

03.10.2025 19:34 7 min. read

Pump.fun Token Price Prediction: Experts Predict A 3x Rally While Snorter Could 10x

The Pump.fun coin (PUMP) is showing signs of a classic bottom, and a new uptrend could be on the horizon. After defending a key ascending support level on Friday, the PUMP price has already rallied by nearly 30%, trading as high as $0.0040. Meanwhile, rumours are also circulating that Pump.fun will soon announce its airdrop […]

Best Meme Coins to Buy Now As MemeCore Price Dips 10%

The meme coin market may soon be preparing for a comeback after a turbulent few weeks. Despite the recent pullback, there is growing optimism that this phase could set the foundation for the next leg of growth. Bitcoin and other leading altcoins have started to recover steadily, reflecting a return of confidence and liquidity across […]

Best Crypto to Buy Now As Binance Stocks Up on BTC and ETH

The crypto market appears ready to regain its pace after a period of cautious movement. Liquidity seems to be making a steady return, hinting at potential growth in the coming weeks. Several macro indicators now point toward a bullish phase, including renewed institutional activity and rising exchange inflows. Bitcoin and Ethereum, the two largest digital […]

Ethena Price Prediction As Its Co-founder Buys $25M $ENA: Best Altcoin To Buy?

Crypto assets that show resilience during a broad market downturn tend to have strong latent demand, making them excellent bets for when the market outlook improves. Ethena (ENA) fits the bill perfectly. While most large-cap assets are in the red and Bitcoin is down nearly 4%, the Ethena price is up 30% over the past […]

-

1

Best Meme Coins to Buy Now as TRUMP ETF Officially Hits the Market

10.10.2025 10:36 8 min. read -

2

Best Meme Coins to Buy as Top Projects Trade at Cheap Prices

13.10.2025 9:13 9 min. read -

3

Best Crypto to Buy Now as Bitcoin Wallets Accumulate

10.10.2025 11:14 7 min. read -

4

Bitcoin, XRP, Ethereum Price Predictions: Buy the Dip or Sell?

17.10.2025 11:55 5 min. read -

5

BNB Smashes ATH as Uptober Takes Off: Next Cryptos to Explode

03.10.2025 19:34 7 min. read

Chainlink (LINK) has posted an impressive 43.99% monthly gain, climbing to $21.15, as a mix of fundamental, on-chain, and technical catalysts drive renewed investor confidence.

Recent data indicates that Chainlink has gained significant traction in social media discussions, which could be a positive sign for its price.

Bitcoin (BTC) and altcoin markets remain under pressure, but Chainlink (LINK) shows signs of whale accumulation at current prices.

Chainlink has received formal recognition from the White House as a foundational technology in the digital asset ecosystem.

Chainlink (LINK) has emerged as one of the strongest-performing large-cap cryptocurrencies this week, rallying 12.36% in the past seven days and reaching $24.85, according to CoinMarketCap data.

Chainlink (LINK) has broken above the $24 mark, with on-chain data signaling a surge in market enthusiasm not seen in months.

Chainlink (LINK) has climbed 3.9% over the past 24 hours, breaking above the critical $15 resistance zone amid rising interest in real-world asset (RWA) tokenization and strengthening technical indicators.

At SmartCon 2024, Chainlink unveiled a significant upgrade to its platform, introducing a new modular architecture aimed at enhancing flexibility and usability for developers and businesses.

Chainlink has unveiled a new interoperability solution that could dramatically lower barriers for financial institutions entering the digital asset space.

Recent analysis from Glassnode, a prominent market intelligence firm, highlights significant on-chain growth for Chainlink (LINK), driven by rising prices and improving fundamentals.

Solana (SOL) has faced challenges in maintaining its value, struggling to surpass $145 since July 3 amid a broader cryptocurrency market downturn.

Changpeng Zhao, known as CZ and the former CEO of Binance, has been banned from the company for life.

A bizarre conspiracy theory claiming that Binance founder Changpeng “CZ” Zhao is secretly working for the U.S. Federal Reserve has gone viral on social media, prompting a firm denial from Zhao himself.

Binance founder Changpeng ‘CZ’ Zhao has issued a warning about the growing threat of AI-generated deepfake videos circulating online.

Binance founder Changpeng "CZ" Zhao, recently revealed in an interview with Bloomberg that he has received proposals for the sale of his controlling stake in the exchange.

Binance founder Changpeng Zhao (CZ) has pledged to personally provide liquidity for select projects participating in BNB Chain’s Memecoin Liquidity Support Program.

Tensions flared between Binance and decentralized trading platform Hyperliquid following last week’s severe crypto market downturn.

Changpeng Zhao (CZ), the founder of Binance, recently reached out to the cryptocurrency community for guidance on how to manage over $1 million that had accumulated in a donation wallet address he once used.