Best Crypto to Buy Now as Bitcoin Wallets Accumulate

10.10.2025 11:14 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Bitcoin has entered one of its strongest phases this year. After rallying past its previous all-time high before cooling near the $123,000 range, the market remains firmly optimistic. What stands out is how quickly sentiment has turned positive again after the correction, with most analysts expecting Q4 to become one of Bitcoin’s most profitable quarters.

Altcoins are following suit as liquidity rotates back into risk assets and investors position for another leg up. Despite high prices, selling pressure remains low and confidence is strong, indicating a mature cycle where conviction outweighs fear. The market’s pulse is green, and optimism is building across every major segment.

Bitcoin Holders Refuse to Sell as Adoption Expands

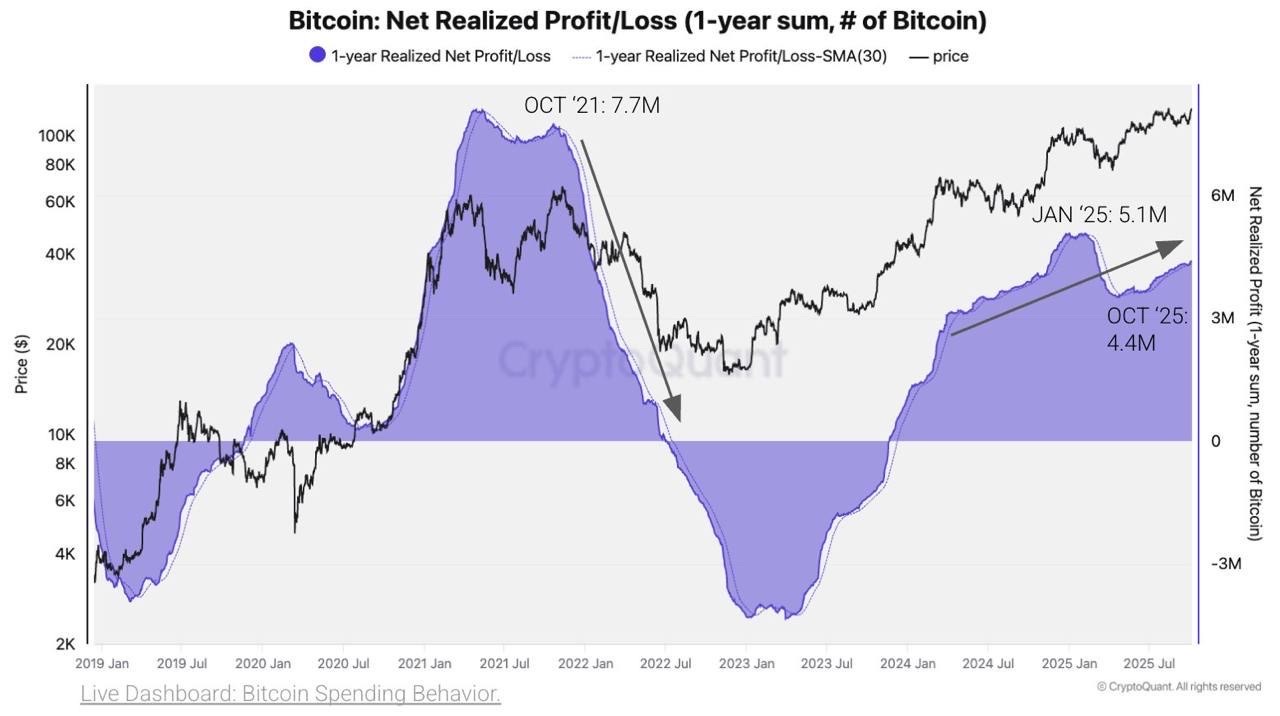

The data tells a clear story: long-term Bitcoin wallets are not selling and continue to accumulate. Even after reaching record price levels, profit-taking remains far lower than typical bull-market norms. This restraint signals deep conviction among whales who continue storing coins in cold wallets rather than moving them to exchanges.

Retail sentiment mirrors this, supported by the belief that the next wave of gains may only just be beginning. Such behaviour has historically preceded major breakouts, and this time, it is being reinforced by genuine adoption momentum.

One of the most defining developments of this trend arrived from Jack Dorsey’s Block. Its Square product has officially introduced a Bitcoin wallet designed for small businesses, allowing merchants to receive BTC directly through Square’s payment system. The company confirmed that sellers can now convert up to half of their daily sales into Bitcoin with zero fees.

we need a de minimis tax exemption for everyday bitcoin transactions https://t.co/zZRg4E3keu

— jack (@jack) October 8, 2025

This shift transforms perception. It introduces Bitcoin as functional currency at street level, linking real commerce with blockchain finance. The initiative, titled Simplifying Bitcoin for Main Street, underscores a movement where adoption follows confidence, not hype. Alongside this, Ethereum and XRP are showing renewed strength, hinting that the current bullish phase could expand across altcoins.

With Bitcoin holders locked in and institutional adoption accelerating, many traders now look toward emerging altcoins that combine active ecosystems with strong fundamentals.

These projects tend to perform best when Bitcoin steadies at high levels, creating a rare window where new capital flows toward assets still early in their growth cycles. For investors seeking higher upside, this phase of the market is where the next leaders are often found.

Best Crypto to Buy Now As Demand Flows Into Altcoins

Best Wallet Token

As Bitcoin stabilises at historic highs, interest in secure and well-integrated crypto wallets has grown sharply. Best Wallet Token sits at the centre of that trend, positioned as one of the most promising assets in the Web3 utility space.

The project’s presale has already raised over 16 million dollars, a figure that reflects how strongly investors view its long-term potential. Best Wallet combines multi-chain accessibility with advanced user controls, allowing seamless storage, trading, and staking across major blockchains including Solana, Ethereum, and BNB Chain.

What sets it apart is its evolving ecosystem that transforms a simple wallet into a rewards-driven financial tool. Users earn through its point-based system, which tracks engagement and activity across partnered dApps, creating a genuine use case beyond speculation. This mechanism has gained traction because it builds loyalty without complexity, something most DeFi wallets have failed to achieve.

💥 $16M Raised & Counting! 💥

We’re building the wallet for the next era of crypto:

✅ Buy new tokens early, directly in-app

✅ Buy and swap across chains in one place

✅ Full portfolio control, no clutterDownload the app today! 📲 https://t.co/Ykt3PTsnvy pic.twitter.com/aKKy9x1LMu

— Best Wallet (@BestWalletHQ) September 22, 2025

In a market where Bitcoin’s strength fuels curiosity toward supporting infrastructure, Best Wallet represents a direct play on adoption. Its model captures the flow of capital moving from storage to participation, giving token holders exposure to the next phase of digital finance.

With exchange listings ahead and strong community traction, the project aligns perfectly with a quarter where sentiment favours real utility and sustainable design. For investors looking beyond hype, Best Wallet Token delivers substance in a market hungry for reliability.

Snorter

While Bitcoin’s price action sets the tone, it is platforms like Snorter that define how retail participation evolves. Snorter is an AI-powered Telegram bot that simplifies the trading process into a fast, conversational experience.

What started as a compact trading assistant has expanded into a full ecosystem that connects wallets, charts, and signals directly within Telegram’s familiar interface. The project has already raised millions in its presale, attracting both traders and developers seeking easier access to decentralised tools.

Its strength lies in utility, not marketing. Snorter removes the friction that often deters new traders by offering instant order execution, real-time price tracking, and integrated portfolio management without requiring separate browser extensions or third-party apps. Everything operates through natural chat commands, turning what was once a complex process into a smooth interaction.

In a bullish market where engagement and accessibility are vital, Snorter represents the bridge between traditional retail enthusiasm and technical efficiency. The project’s mascot-driven identity adds a touch of personality, but beneath it lies an architecture capable of scaling with user demand.

As Bitcoin holders stay firm and liquidity expands into altcoins, projects that empower direct participation tend to lead early momentum. Snorter fits that profile, balancing function with familiarity. Its model captures the essence of this cycle: speed, convenience, and control, all driven through one of the most active communication platforms in crypto.

Pepenode

Pepenode embodies a different kind of momentum, one built on activity and engagement rather than speculation. The project’s mine-to-earn model transforms participation into tangible rewards, allowing users to mine tokens through gamified tasks that blend computing activity with on-chain verification.

Each mining session contributes to network strength, giving the project both a functional and community-driven base. It has already drawn widespread attention, with top creators like ClayBro and others covering its potential to redefine how meme-rooted projects build real economic systems.

Unlike typical meme coins that depend on social hype alone, Pepenode introduces structure. Users can increase mining power through referrals, upgrades, and staking cycles, forming a self-reinforcing ecosystem. Its design reflects an understanding of how audiences evolve, they want projects that entertain yet still deliver measurable progress.

The current market favours such narratives. As Bitcoin’s stability encourages diversification, Pepenode’s model appeals to those seeking early exposure to projects that reward interaction. It positions itself as both an entry point for casual users and a long-term holding for miners who see value in building rather than trading.

With its multi-layered economy and consistent visibility across social media, Pepenode could become one of the few meme-linked assets to develop real endurance. In a bullish climate, where conviction guides investment decisions, Pepenode represents participation made rewarding, an ecosystem that grows stronger the more users engage.

Bitcoin Hyper

Bitcoin Hyper is one of the few new projects that ties itself directly to the asset driving this bull cycle. It operates as a Bitcoin-based Layer 2 network that extends Bitcoin’s potential beyond store-of-value use and into programmable functionality.

The project’s design focuses on scalability and transaction speed, giving developers the ability to build decentralised applications on a Bitcoin-backed foundation. It brings the reliability of Bitcoin’s security model into a new environment built for movement, not storage.

The project has also gained significant attention from analysts and creators who highlighted its potential to become one of the most adopted Bitcoin-linked ecosystems of the year. That exposure reflects growing recognition of how Bitcoin Hyper could bridge the gap between traditional crypto assets and modern DeFi frameworks. By allowing smart contract operations without leaving the Bitcoin standard, it positions itself as both a technological and strategic advancement in the market.

And just like that…

BOOM! 22M Raised! 🔥⚡️ pic.twitter.com/UEeJ2ukj79

— Bitcoin Hyper (@BTC_Hyper2) October 6, 2025

In the current cycle, where Bitcoin’s price stability signals broader market confidence, Bitcoin Hyper’s model fits naturally. It benefits from the same sentiment driving Bitcoin’s rise while offering utility that appeals to builders and long-term holders alike.

As more projects integrate Bitcoin into functional systems, this Layer 2 stands out for offering what investors now seek: innovation that remains rooted in credibility. Bitcoin Hyper captures the same conviction that defines this market, holding strong, building quietly, and preparing for the next phase of growth.

Conclusion

Every market cycle creates a window where conviction outweighs speculation, and this seems to be one of those moments. Bitcoin’s resilience has reaffirmed confidence across the board, setting the stage for projects that demonstrate real design and purpose. The tokens highlighted above reflect that shift toward substance.

Each carries a framework built on usability, adoption, and timing that aligns with the current sentiment. With Bitcoin holders standing firm and liquidity turning toward innovation, these projects represent some of the most credible and potentially rewarding opportunities in an increasingly selective market.

-

1

Best Crypto Presales to Buy for Explosive Uptober Gains

06.10.2025 18:09 5 min. read -

2

Best Crypto to Buy Now as Google Makes First Move Into Crypto Mining

26.09.2025 18:21 8 min. read -

3

Best Crypto to Buy Now As Bitcoin Price Close to New All-Time High

02.10.2025 19:52 8 min. read -

4

Best Meme Coins Next To Follow Mog Coin 30% Price Rise

03.10.2025 11:56 8 min. read -

5

Dogecoin Price Prediction: 3 Reasons Why DOGE Can Hit $1 in Uptober

07.10.2025 17:15 6 min. read

Best Crypto Presales to Buy During the Dip: Which Coins Will 100x?

On Friday, the crypto market plunged as Donald Trump revealed plans for 100% tariffs on Chinese imports, reigniting trade war concerns and highlighting the current deep instability in macroeconomic conditions. Liquidations across the cryptocurrency market topped $19 billion in a 24-hour period, marking what could be the largest liquidation event in crypto history. Many prices […]

XRP Price Prediction: $XRP Slides In Crypto Crash, Time To Buy The Dip?

US President Donald Trump’s new tariffs on China resulted in the biggest liquidation event in crypto’s history. Nearly $20 billion worth of leveraged positions were liquidated within an hour, while the total crypto market cap momentarily fell by nearly $900 billion. Altcoins were hit the hardest, with many top assets plummeting by nearly 80% before […]

Best Meme Coins to Buy as Market Crash Pushes Low-Cap Tokens to Zero

The crypto market has just witnessed one of its most brutal corrections of the year. Triggered by renewed tariff tensions under the Trump administration, Bitcoin crashed from its all-time high to as low as $104,000 within a single day. The speed of the drop sent shockwaves across exchanges, liquidating traders and pulling altcoins into steep […]

The Underpriced Altcoin That’s Turning Crypto Payments Into Everyday Cash – Meet $SPY

You pull up your crypto wallet at checkout, tap to pay, and the transaction goes through like normal. No special equipment needed. No confused cashier. Just a simple transaction that works with the same card machine already sitting on the counter. That scenario is exactly what SpacePay is building. The London-based fintech startup has found […]

-

1

Best Crypto Presales to Buy for Explosive Uptober Gains

06.10.2025 18:09 5 min. read -

2

Best Crypto to Buy Now as Google Makes First Move Into Crypto Mining

26.09.2025 18:21 8 min. read -

3

Best Crypto to Buy Now As Bitcoin Price Close to New All-Time High

02.10.2025 19:52 8 min. read -

4

Best Meme Coins Next To Follow Mog Coin 30% Price Rise

03.10.2025 11:56 8 min. read -

5

Dogecoin Price Prediction: 3 Reasons Why DOGE Can Hit $1 in Uptober

07.10.2025 17:15 6 min. read