Aster Price Prediction As Investors Buy The Dip: $4 In October?

10.10.2025 13:04 4 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

New DEX coin Aster (ASTER) has been among the hardest-hit cryptocurrencies in the ongoing market crash, as investors front-ran a potential supply overhang from its upcoming airdrop.

After trading as high as $2.19 on the news of its Binance spot listing, the Aster price fell over 30% to $1.52 on Friday.

However, buyers are starting to step in at key support levels. Prominent trader and WeRate co-founder Quinten disclosed that he has increased both his spot holdings and his 2x long position around the $1.54 mark.

Bought more $ASTER here at $1.54, both spot and 2X leverage.

Way oversold now and the market is acting like a pussy because of the airdrop that will become tradable in 4 days. But guess what, Binance farmed their own airdrop and will receive most of it, and other people… pic.twitter.com/UZMC4xp44P

— Quinten | 048.eth (@QuintenFrancois) October 10, 2025

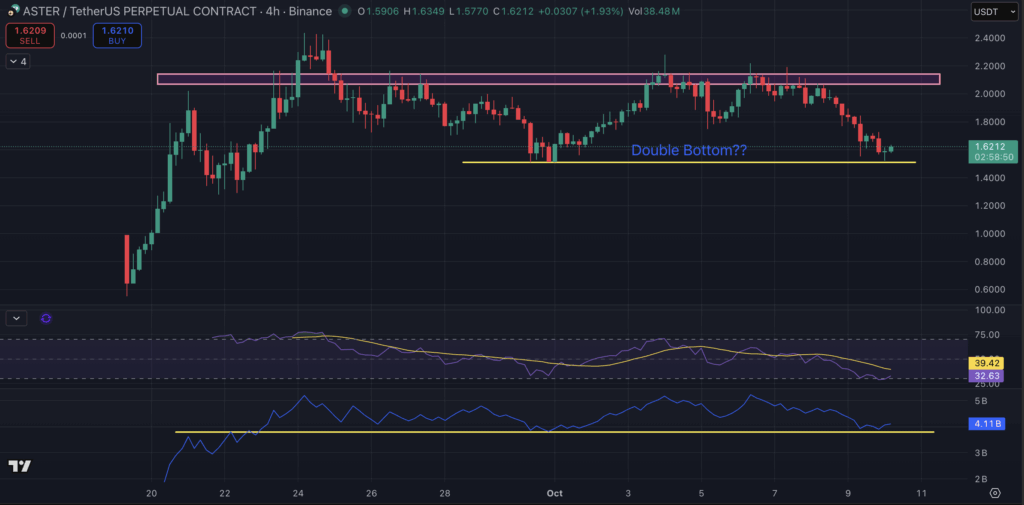

With a potential double bottom brewing on its price chart, Aster appears poised for a bounce back. Several top analysts remain confident in their prediction that the Aster price will hit $4 in October or early November.

Aster’s success is bullish for all DEX and platform coins. Even low-caps like the Best Wallet Token are in high demand, with many calling it the next 10x crypto.

Will The Upcoming Aster Airdrop Result In A Bigger Crash?

Season 2 of the Aster airdrop, Genesis, is now complete and token claims will begin on October 14. The Airdrop Checker will go live today, allowing token holders to check their eligibility for the upcoming claims.

It’s happening today!

The $ASTER Stage 2 Airdrop Checker will go live at 13:00 UTC, Oct 10.Thank you for being part of this incredible journey.

Stay tuned! Eligibility checking opens in just a few hours. pic.twitter.com/j95olVdmUw— Aster (@Aster_DEX) October 10, 2025

Token prices often come under heavy selling pressure after claims go live, as airdrop recipients typically take profits on their newly received tokens.

However, trader and WeRate co-founder Quinten argues that the supply overhang from Aster’s airdrop may not be as bearish as the market expects.

First, he points out that Binance insiders, and possibly the exchange itself, farmed a large portion of the airdrop, meaning a significant share of the supply will likely remain off the open market.

Second, given the strong long-term bullish sentiment around Aster and Changpeng “CZ” Zhou’s open endorsement, most recipients are expected to hold rather than sell, anticipating higher valuations ahead.

Third, Quinten characterizes Aster as CZ’s “revenge project” against Hyperliquid, suggesting the Binance co-founder is determined to drive its valuation beyond that of his rival platform.

Finally, with rumours of an Aster buyback program circulating, Quinten believes the token is poised for a substantial upward repricing, making buying the dip on post-airdrop fears a contrarian but potentially rewarding move.

Aster Price Prediction: $4 in October?

The Aster price fell by nearly 30% from its recent high. However, it is showing strength at a key support level.

During last month’s correction, ASTER found support near $1.51, which now appears to be acting as a strong floor once again. After retesting that level today, the token is showing early signs of a rebound.

Notably, its Relative Strength Index (RSI-14) has dipped into its most oversold zone yet on the 4-hour timeframe, hinting strongly at the possibility of a bullish reversal.

Similarly, on-balance volume (OBV) is beginning to bounce from a key horizontal support area, suggesting that accumulation pressure is building, a development that confirms the double-bottom.

The Aster price is due for a bounce back. Now, a breach of the $2.05 – $2.15 resistance zone will likely result in a new all-time high.

Prominent analyst Vespematic also agrees with the double-bottom thesis in his latest Aster price prediction, projecting the token to hit $4 in October.

Potential double Bottom for $ASTER , $4 on the horizon

Now $ASTER is falling but it won't be long before it bounce back to the red box with the potential to reach $4

buy the dip thanks me later pic.twitter.com/SWFqSM0mlV

— Vespamatic – SMI 🇮🇩 (@vespamatic96) October 10, 2025

Experts Call Best Wallet Token The Next 10x Crypto

Aster’s success is bullish for all utility coins, especially for DEX and platform tokens. It highlights how even high utility tokens can deliver attractive returns and not just meme coins.

Even new low-cap platform coins are in high demand. For instance, the Best Wallet Token (BEST) has raised $16.4 million in its ongoing presale.

BEST is the native token of the Best Wallet, a multi-chain, non-custodial and no-KYC crypto wallet.

Unlike traditional wallets like MetaMask and Phantom that support only one or two chains, Best Wallet already supports multiple networks, including Bitcoin, Ethereum, BNB Smart Chain, Solana, Polygon and Base Chain. In fact, it aims to offer support for 60-plus chains in the coming months.

Besides the traditional wallet capabilities, such as buying, selling, swapping, sending, and storing crypto at the lowest rates, Best Wallet also offers several cutting-edge features. These include derivatives and futures trading, an all-in-one staking protocol, an in-app crypto news feed, an NFT gallery and more.

The presale staking aggregator is already live and in high demand, as it allows users to buy trending presale coins at the lowest possible rate.

With BEST at the core of the ecosystem, it is no surprise that experts are bullish on its upside prospects and are calling it the next 10x crypto. Many early buyers are even eyeing up to 100x returns.

-

1

Best Crypto to Buy Now as Google Makes First Move Into Crypto Mining

26.09.2025 18:21 8 min. read -

2

Best Crypto to Buy Now As Bitcoin Price Close to New All-Time High

02.10.2025 19:52 8 min. read -

3

Best Meme Coins Next To Follow Mog Coin 30% Price Rise

03.10.2025 11:56 8 min. read -

4

Dogecoin Price Prediction: 3 Reasons Why DOGE Can Hit $1 in Uptober

07.10.2025 17:15 6 min. read -

5

Cropty Wallet Review: A Modern Multi-Platform Crypto Wallet for All Users

24.09.2025 17:39 6 min. read

Best Crypto Presales to Buy During the Dip: Which Coins Will 100x?

On Friday, the crypto market plunged as Donald Trump revealed plans for 100% tariffs on Chinese imports, reigniting trade war concerns and highlighting the current deep instability in macroeconomic conditions. Liquidations across the cryptocurrency market topped $19 billion in a 24-hour period, marking what could be the largest liquidation event in crypto history. Many prices […]

XRP Price Prediction: $XRP Slides In Crypto Crash, Time To Buy The Dip?

US President Donald Trump’s new tariffs on China resulted in the biggest liquidation event in crypto’s history. Nearly $20 billion worth of leveraged positions were liquidated within an hour, while the total crypto market cap momentarily fell by nearly $900 billion. Altcoins were hit the hardest, with many top assets plummeting by nearly 80% before […]

Best Meme Coins to Buy as Market Crash Pushes Low-Cap Tokens to Zero

The crypto market has just witnessed one of its most brutal corrections of the year. Triggered by renewed tariff tensions under the Trump administration, Bitcoin crashed from its all-time high to as low as $104,000 within a single day. The speed of the drop sent shockwaves across exchanges, liquidating traders and pulling altcoins into steep […]

The Underpriced Altcoin That’s Turning Crypto Payments Into Everyday Cash – Meet $SPY

You pull up your crypto wallet at checkout, tap to pay, and the transaction goes through like normal. No special equipment needed. No confused cashier. Just a simple transaction that works with the same card machine already sitting on the counter. That scenario is exactly what SpacePay is building. The London-based fintech startup has found […]

-

1

Best Crypto to Buy Now as Google Makes First Move Into Crypto Mining

26.09.2025 18:21 8 min. read -

2

Best Crypto to Buy Now As Bitcoin Price Close to New All-Time High

02.10.2025 19:52 8 min. read -

3

Best Meme Coins Next To Follow Mog Coin 30% Price Rise

03.10.2025 11:56 8 min. read -

4

Dogecoin Price Prediction: 3 Reasons Why DOGE Can Hit $1 in Uptober

07.10.2025 17:15 6 min. read -

5

Cropty Wallet Review: A Modern Multi-Platform Crypto Wallet for All Users

24.09.2025 17:39 6 min. read

Aster has quickly transformed from an ambitious newcomer into one of the most profitable names in crypto.

During a keynote speech at the Bitcoin 2024 conference on July 26, Michael Saylor, co-founder of MicroStrategy, made a bold prediction that Bitcoin (BTC) could reach $13 million per coin by 2045.

Bitcoin-focused investment firm Strategy Inc. (formerly MicroStrategy) is facing mounting legal pressure as at least five law firms have filed class-action lawsuits over the company’s $6 billion in unrealized Bitcoin losses.

The long-awaited U.S. inflation data for August has landed, offering new insight into the economy just days before the Federal Reserve’s critical policy meeting. Inflation surprises on the upside

Blockchain gaming reached a notable peak in August with 4.2 million daily active users, as reported by DappRadar.

On July 9, the Australian Securities Exchange (ASX) gave DigitalX permission to launch its spot Bitcoin ETF, which will begin trading on July 12 under the ticker symbol BTXX.

Australia’s efforts to combat crypto-related fraud have intensified, with the country’s Securities and Investments Commission (ASIC) targeting 95 companies allegedly involved in deceptive schemes like pig butchering scams.

Australia is ramping up its efforts to regulate the cryptocurrency sector to enhance consumer protection and curb fraudulent practices.

Australia has no immediate plans to launch a national cryptocurrency reserve, despite the U.S. announcing such a move earlier this month.

Australia's financial regulator, ASIC, has dismantled over 600 crypto scams in the past year, highlighting the evolving use of AI by fraudsters.

Australia’s Monochrome Asset Management has introduced the first inaugural ETF that directly holds Ethereum, a significant advancement for the country’s cryptocurrency sector.

Australia is reshaping its approach to digital assets with new draft legislation aimed at bringing exchanges and custody platforms under the same rules as traditional finance.

Australia's Treasury Department is seeking public input on how to implement a global cryptocurrency transaction reporting standard as part of its effort to enhance tax transparency and reduce international tax evasion.

Australia's central bank has decided to prioritize the development of a wholesale central bank digital currency (CBDC) over a retail version.

Australia is tightening its grip on cryptocurrency regulation with new proposals aimed at preventing financial crimes such as money laundering and terrorist financing.

Australia is stepping up its digital currency efforts with the next phase of Project Acacia, a pilot focused on testing central bank digital currency (CBDC) and tokenized finance in real-world applications.

Australian regulators are preparing new laws that will require crypto exchanges to secure a financial services license, according to reports from The Australian Financial Review (AFR).

Australia's Labor government has unveiled a new set of rules aimed at regulating the crypto sector, bringing platforms like exchanges and custody services under existing financial regulations.

Australia is overhauling its cryptocurrency regulations, with the Australian Securities and Investments Commission (ASIC) introducing new rules aimed at making crypto businesses more accountable.

A new YouGov poll shows that 59% of Australian crypto holders favor pro-crypto candidates in upcoming elections.