Altcoins Drain Bitcoin Liquidity as Correlation Breakdown Sparks Caution

20.07.2025 20:00 1 min. read Kosta Gushterov

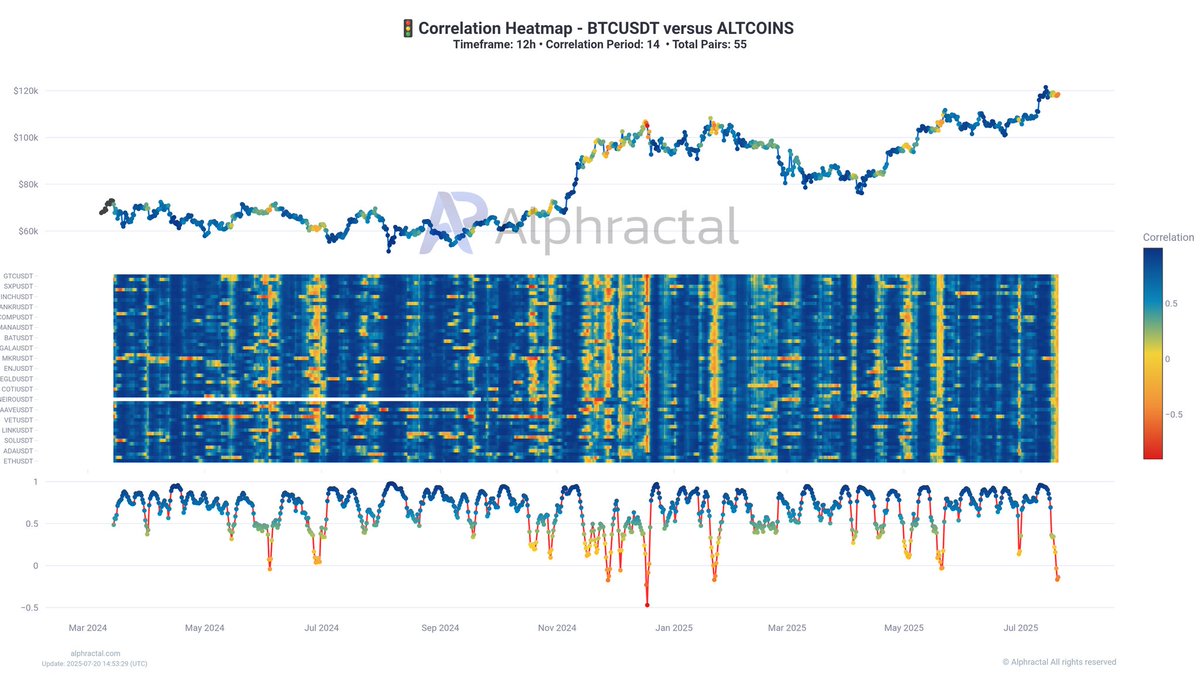

According to a new market update from Alphractal, altcoins have been outperforming Bitcoin in recent days—drawing liquidity away from the leading cryptocurrency and triggering key warning signals.

Traders are seeing more profitable opportunities in altcoins, but one critical indicator now suggests that this trend could be on unstable ground.

The latest Correlation Heatmap from Alphractal reveals that the average correlation between Bitcoin and altcoins has dropped sharply and may even be turning negative. This means altcoins are no longer following Bitcoin’s price movements—a potential red flag for market stability.

Historically, falling BTC-altcoin correlation has preceded periods of intense volatility and mass liquidations, regardless of whether traders are positioned long or short. When altcoins decouple from Bitcoin, it often indicates unsustainable market behavior or shifting capital that eventually corrects sharply.

Alphractal warns that traders should remain vigilant and use data-driven tools like correlation metrics to navigate current conditions. The charts included in the update illustrate a clear divergence between Bitcoin and altcoin positioning, reinforcing the view that short-term profits in altcoins may come with heightened risk.

As liquidity continues to migrate into the altcoin space, market participants should prepare for potential turbulence ahead.

-

1

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

2

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

3

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read -

4

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

5

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read

Major Token Unlocks This Week: SOL, TRUMP, AVAIL Lead the Pack

A wave of large token unlocks is set to hit the crypto market between July 21 and July 28, with significant implications for both price action and investor sentiment.

Here’s Why Crypto is up Today: Altcoin Season Hopes Spark New Momentum

Crypto prices jumped again today as Ethereum’s tech upgrades, altcoin breakouts, and rising leverage fueled fresh momentum.

Top Trending Cryptocurrencies Today: Qubic, Conflux, and Tezos

The crypto market is seeing a burst of activity, with several altcoins outperforming the broader market.

Here is What New Crypto Traders Should Focus on, According to Top Analyst

Entering any fast-paced financial market can be overwhelming for newcomers. The promise of high returns often tempts beginners to jump into risky opportunities without fully understanding the dynamics at play.

-

1

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

2

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

3

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read -

4

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

5

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read