BTC’s Consolidation Creates Opportunity for Cutoshi’s Token Scarcity to Spark a New Bull Run

17.02.2025 9:01 4 min. read Alexander Stefanov

Bitcoin’s price has oscillated between $96,200 and $100,000 this week, mirroring the stabilization period that precedes fundamental changes in markets.

While experts debate whether BTC will break through $122,000 or drop below $95,500, this stability presents fertile ground for future tokens like Cutoshi (CUTO) to find an audience.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Let’s break down the current offerings of both BTC and Cutoshi.

BTC’s Strategic Pause

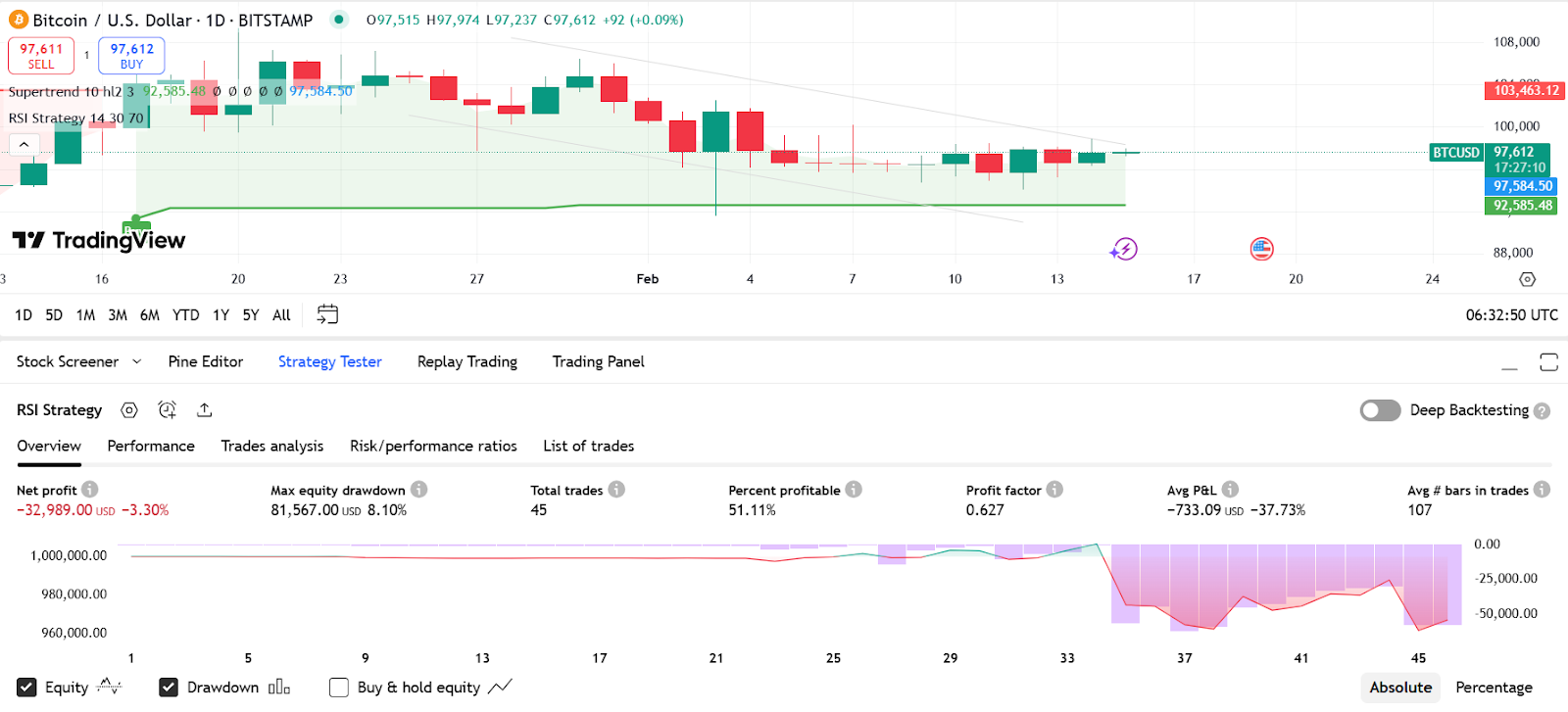

Source: Tradingview (BTC to USD)

BTC trades at $97,558.94, an increase of 0.8% over the last 24 hours, as markets absorb recent volatility. BTC’s consolidation patterns resemble those seen before previous bull cycles, according to an RSI of 58, indicating possible momentum. However, underlying uncertainties, including ongoing geopolitical tensions and ETF inflows reducing to $802 million per week, remain, leaving buyers wary. Past BTC data indicates that these kinds of consolidation tend to lead to explosive breakouts. For instance, BTC surged 105% in 15 weeks before stabilizing, a pattern that could repeat if it holds above $90,000.

Cutoshi Fuels the MemeFi Ecosystem

Cutoshi (CUTO) blends meme culture with decentralized finance (DeFi) utilities, inspired by Satoshi Nakamoto’s vision of financial freedom. Unlike typical meme coins, Cutoshi offers a multi-chain decentralized exchange (DEX), yield farming, and an educational platform—tools designed to onboard everyday users into DeFi. Verified by Solidproof, its ecosystem rewards participation: users earn $CUTO tokens by completing quests or providing liquidity, while a built-in burn mechanism reduces supply over time.

Scarcity Meets Opportunity

While BTC’s infinite supply debate resurfaces, Cutoshi’s deflationary model stands out. With a fixed supply of 440 million tokens—7% already burned—$CUTO becomes scarcer as adoption grows. This scarcity mirrors BTC’s early days but with added DeFi incentives.

The presale has raised $1.7 million at $0.031 per token, signaling strong early interest. Analysts compare its trajectory to Shiba Inu’s 2021 rally, noting the token burns and CEX listings could drive similar demand. Currently, Cutoshi is offering a 35% deposit bonus for 5 days owing to Valentine’s week!

BTC vs. $CUTO: Divergent Paths, Shared Potential

BTC remains the crypto benchmark, but its consolidation phase pushes investors toward niche opportunities. Cutoshi’s appeal lies in its hybrid nature: playful branding backed by tangible utilities. For example, its DEX charges 0.25% fees, redistributing 80% to liquidity providers—a feature PancakeSwap users already value. Meanwhile, BTC’s stability offers a safe harbor, but it’s 141% annual gain leaves less room for exponential growth than newer tokens.

Cutoshi also taps into Satoshi Nakamoto’s ethos of decentralization. Its academy educates users on blockchain basics, addressing the knowledge gap that hinders mass DeFi adoption. This focus on utility over hype positions $CUTO as a deflationary memecoin with staying power, contrasting meme rivals reliant solely on social trends.

BTC vs. Cutoshi: Where to Bet in 2025?

BTC’s consolidation isn’t a stall—it’s a setup. History shows such phases end with rallies, and savvy investors diversify into high-potential tokens during these lulls. Unlike BTC, Cutoshi’s presale progress and tokenomics suggest it could emerge as a Next Shiba Inu Rival, especially as its DEX and farming mechanisms go live.

Yes, BTC still remains the kingpin of crypto portfolios—but projects like Cutoshi, inspired by Satoshi Nakamoto, represent the next wave of utility. In a market where even stable giants pause, scarcity-driven tokens thrive, and Cutoshi could be the breakout memeFi needs.

Need more expert reviews on the Lucky Cat? Checkout this video: CUTOSHI: A New Meme Token in the DeFi Ecosystem with Real Utility // Active Presale

Cutoshi Stage 4 Presale Live

- Price: $0.031 per $CUTO

- Supply: 440,000,000 tokens (ERC-20)

- Website: https://cutoshi.com

- Telegram: https://t.me/cutoshicommunity

- X (Twitter): https://x.com/CutoshiToken

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now Amid UK Trade Bodies’ Call for Stronger Blockchain Policies

03.04.2025 15:14 7 min. read -

2

Best Crypto to Buy Now Amid Trump Family’s Bitcoin Mining Move

01.04.2025 13:13 7 min. read -

3

Best Crypto to Buy Now as Pantera Predicts Bitcoin Price is Massively Undervalued

04.04.2025 14:01 7 min. read -

4

Best Crypto to Buy Now Before the SEC Roundtable With Industry Leaders

09.04.2025 12:24 8 min. read -

5

Best Crypto to Buy Now as Russia and China Adopt Bitcoin for Energy Trades

10.04.2025 15:21 5 min. read

Trump Coin Pumps Over 30%, This Meme Coin is Set for Even Bigger Gains

The crypto sector is witnessing a massive revival, with meme coins leading the charge. From a total market cap of $43.5 billion just weeks ago, the overall meme coin market has now surged to $56.2 billion, a staggering 29% jump reflecting renewed investor confidence. This rally has brought massive gains for top-tier tokens, particularly Official […]

SOL Strategies Raises $500M to Buy Solana Ecosystem Tokens

A surge in institutional confidence has arrived for Solana – SOL Strategies, a Canadian-based investment company, has raised $500 million through a convertible note offering, with the capital specifically earmarked for acquiring SOL tokens. This move signals a renewed faith in Solana’s future and hints at a broader shift in how large-scale players approach crypto […]

Best Crypto to Buy Now as Russia’s Bitcoin Ban Targets New Regions

While Bitcoin is trading in the green and most of the regulatory news coming from the Western front have been positive, not all is well in the East. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. The latest […]

Best Crypto to Buy Now: Bitcoin Price No Longer Correlated to Wall Street?

There’s a growing sense that the crypto market is beginning to shed its long-standing correlation to stocks and seeming dependency on Wall Street cues. Where traditional financial markets flinch at political drama or economic shocks, Bitcoin and its peers now appear to be responding through an entirely different lens—one forged by distrust in institutions and […]

-

1

Best Crypto to Buy Now Amid UK Trade Bodies’ Call for Stronger Blockchain Policies

03.04.2025 15:14 7 min. read -

2

Best Crypto to Buy Now Amid Trump Family’s Bitcoin Mining Move

01.04.2025 13:13 7 min. read -

3

Best Crypto to Buy Now as Pantera Predicts Bitcoin Price is Massively Undervalued

04.04.2025 14:01 7 min. read -

4

Best Crypto to Buy Now Before the SEC Roundtable With Industry Leaders

09.04.2025 12:24 8 min. read -

5

Best Crypto to Buy Now as Russia and China Adopt Bitcoin for Energy Trades

10.04.2025 15:21 5 min. read