How Did Bitcoin ETFs Perform During Yesterday’s “Carnage”?

06.08.2024 12:14 1 min. read Kosta Gushterov

After August 5, one of the worst days for both crypto and stock markets, many investors chose to move away from risky assets, which affected Bitcoin ETFs in the US.

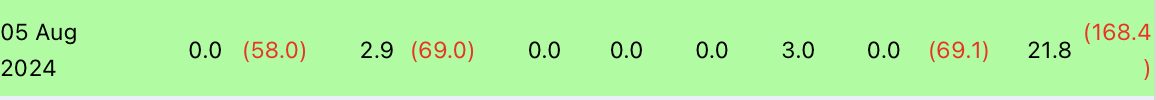

Bitcoin spot ETFs saw a collective outflow of $168.4 million on August 5 amid ongoing market volatility.

The Grayscale Bitcoin Trust, a prominent crypto investment vehicle, saw outflows totaling $69.1 million.

However, Grayscale’s smaller ETF, often referred to as a mini ETF, saw inflows of $21.8 million. Fidelity’s FBTC, one of the most well-known in the market, saw the largest outflow – $58 million.

Similarly, ARKB of ARK 21Shares saw a significant outflow of $69 million. Although Cathie Wood’s ARK Investment Management is a strong proponent of cryptocurrencies, the outflows show that even the most bullish investors are reevaluating their positions in response to market dynamics.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded no inflows or outflows, along with BTCO, EZBC, BRRR, and BTCW.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read