Bitcoin Miners Raise Billions to Bet on AI and HPC Expansion

17.10.2025 20:00 2 min. read Alexander Zdravkov

Public cryptocurrency mining companies are ramping up fundraising through convertible bonds, marking the largest wave of capital raising in the sector since 2021.

This surge could enable miners to pivot toward AI and high-performance computing (HPC), but it also brings risks of mounting debt and shareholder dilution.

Record Bond Issuances

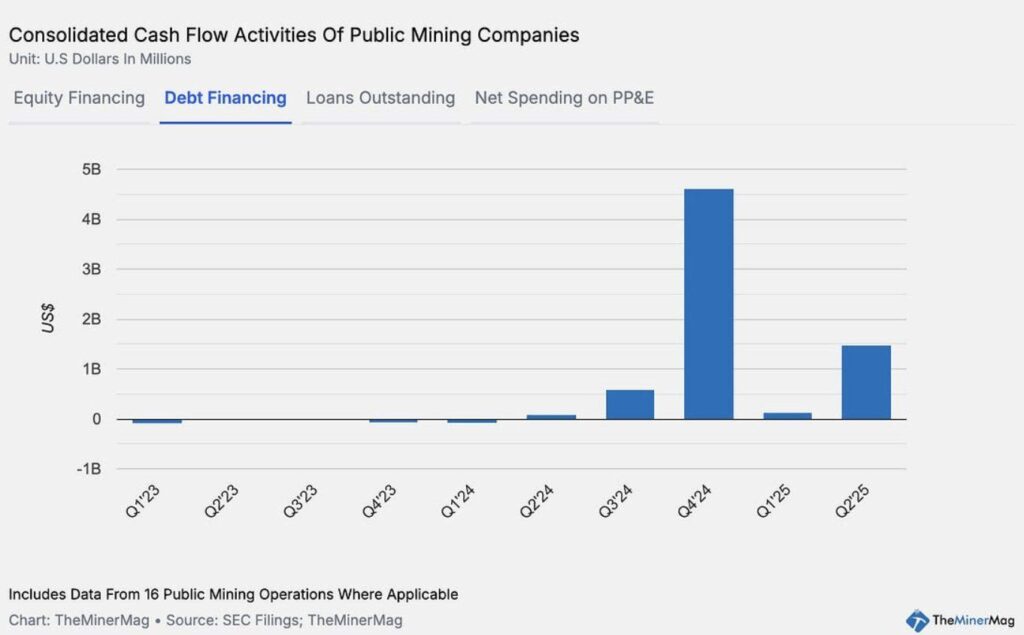

In 2025, companies like Bitfarms and TeraWulf have announced multi-billion-dollar bond offerings. Bitfarms unveiled a $500 million convertible note due 2031, while TeraWulf proposed a $3.2 billion senior secured note to expand data center operations. Across 15 public mining firms, total debt and convertible note issuances hit $4.6 billion in Q4 2024, dipping below $200 million earlier this year before rebounding to $1.5 billion in Q2 2025.

Unlike the 2021 cycle, where mining rigs were used as loan collateral, today’s convertible bonds shift financial risk from equipment repossession to potential equity dilution. This model gives companies operational flexibility but pressures them to deliver stronger revenues to protect shareholder value.

Opportunities Beyond Mining

Some miners are exploring new revenue streams beyond Bitcoin production. This includes building HPC and AI infrastructure, offering cloud services, or leasing hash power. For example, Bitfarms secured a $300 million loan from Macquarie to fund HPC development at its Panther Creek project. If successful, these ventures could provide more stable long-term income than traditional mining.

The market has responded positively to debt announcements, often sending mining stocks higher as investors anticipate growth. However, if expansion fails to produce sufficient returns, shareholders could face significant dilution, while the high mining difficulty and declining margins add additional pressure.

The sector is effectively testing the limits of financial engineering, balancing growth ambitions with the risks inherent in debt-financed expansion, as it seeks to evolve from purely energy-intensive Bitcoin mining to a more diversified, data-driven business model.

-

1

Liquidity thins, Sentiment Breaks — Bitcoin Enters Fragile Phase

11.10.2025 22:00 2 min. read -

2

Rumored Bitcoin Hard Fork Sparks Controversy Over Blockchain Censorship

28.09.2025 12:00 2 min. read -

3

Bitcoin’s ‘Scarcity Magnet’ Could Drive Prices Toward $1 Million, Says Analyst

05.10.2025 18:00 2 min. read -

4

Bitcoin, Ethereum, and Solana Drive Record $5.95 Billion Inflows, CoinShares Reports

06.10.2025 17:30 2 min. read -

5

BBVA Brings Bitcoin and Ethereum Trading to European Retail Investors

02.10.2025 13:50 2 min. read

ETP Investors Pull Back After Market Turbulence, Though Trading Remains Strong

Last week saw a mixed performance for crypto investment products managed by firms like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, as investors reacted to the historic Oct. 10 liquidation event.

Strategy Doubles Down on BTC with $18.8M Purchase

MicroStrategy Expands Bitcoin Holdings to Over 640,000 BTC After Latest $18.8M Purchase

Coinbase Report Reveals: Institutions Are Buying the Bitcoin Dip Again

Institutional confidence in Bitcoin is quietly mounting again, with nearly seven out of ten professional investors expecting prices to climb over the next few months, according to new data from Coinbase.

Bitcoin Roars Back Above $111K – Is the Next Bull Run Already Starting

Bitcoin bounced back above $111,000 on Monday, marking a swift turnaround after nearly a week of sluggish trading.

-

1

Liquidity thins, Sentiment Breaks — Bitcoin Enters Fragile Phase

11.10.2025 22:00 2 min. read -

2

Rumored Bitcoin Hard Fork Sparks Controversy Over Blockchain Censorship

28.09.2025 12:00 2 min. read -

3

Bitcoin’s ‘Scarcity Magnet’ Could Drive Prices Toward $1 Million, Says Analyst

05.10.2025 18:00 2 min. read -

4

Bitcoin, Ethereum, and Solana Drive Record $5.95 Billion Inflows, CoinShares Reports

06.10.2025 17:30 2 min. read -

5

BBVA Brings Bitcoin and Ethereum Trading to European Retail Investors

02.10.2025 13:50 2 min. read

Bitcoin miners appear to be reloading their reserves after a lengthy period of offloading their holdings.

Bitcoin miners are actively transferring large amounts of BTC from their wallets as the cryptocurrency’s price surges to record highs above $93,000.

Bitcoin is once again testing fresh highs after climbing past $104,000, reigniting optimism across the crypto space.

Bitcoin miners are operating under their most challenging conditions yet, as record-high network difficulty, falling hashprice, and climbing energy costs converge with a new rival: artificial intelligence.

Bitcoin miners are facing tough times as they encounter new challenges. Last Wednesday, mining difficulty surged dramatically, and Bitcoin's value dropped by $10,000 in one day.

Since November 12, Bitcoin miners have transferred over 45,000 BTC to exchanges, driven by the cryptocurrency’s price surge beyond $90,000.

Bitcoin miners’ revenue reached a two-month high on Thursday, amid rising demand for the cryptocurrency.

Bitcoin mining in Russia has surged, with demand for industrial mining equipment tripling compared to the same period in 2023, according to Prime.

Worries are growing in the cryptocurrency world about the centralization of Bitcoin mining, which could undermine the foundational decentralized ethos of the cryptocurrency.

Hut 8, a prominent Bitcoin mining company based in North America, has unveiled a bold strategy to boost its financial position.

IREN recently joined the ranks of publicly listed Bitcoin (BTC) mining companies on Wall Street, posting a remarkable increase in revenue over the past year thanks to the rising value of cryptocurrencies.

Interaction with regulators is essential for the Bitcoin (BTC) mining industry.

Bitcoin mining has reached an unprecedented level of difficulty, exceeding 100 trillion, coinciding with the U.S. election day.

The Bitcoin network has kicked off the year by reaching a groundbreaking milestone, as its mining difficulty hit an all-time high.

Bitcoin mining has recently come under fire again, this time due to a report from The Economist that has stirred debate about the industry's environmental impact.

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin mining is experiencing unprecedented difficulty levels, which have reached an all-time high as of early August.

The U.S. Bitcoin mining sector is gearing up for potential challenges after President Donald Trump announced new tariffs, set to take effect on April 5.

Rhodium Enterprises, a Bitcoin (BTC) mining company that recently filed for bankruptcy, has received court approval to secure a loan in US dollars or Bitcoin.

MARA Holdings, a leading Bitcoin mining company, has significantly bolstered its cryptocurrency reserves with a recent acquisition of 15,574 BTC, valued at around $1.5 billion.