Aster Price Prediction As Airdrop Claims Go Live, Exchange Starts Token Buyback

14.10.2025 3:54 4 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

The new perpetual DEX Aster (ASTER) is back in the spotlight as token claims for Season 2 of its airdrops are finally live.

The ASTER price is showing a mild bounce back, opposite of the sharp sell-off that investors were expecting heading into the event.

In another major bullish development, Aster DEX has completed the first round of its token buyback, purchasing 100 million ASTER coins worth over $140 million.

There is also growing speculation that the exchange may turn token buybacks into a recurring program, with an official announcement expected soon to offset any selling pressure from airdrop claims. Considering Aster’s massive trading volume and rapidly rising revenue, a sustained buyback initiative could act as a powerful bullish catalyst for ASTER.

Prominent analysts remain bullish with their Aster price predictions, with $4 emerging as a consensus price target. However, interested buyers need to be cautious of a key resistance level, which could push the price even lower.

ASTER Airdrop Claims Go Live, Is A Larger Crash Coming?

Season 2 of Aster’s airdrop, Genesis, is now complete and token claims are finally live.

Typically, airdrops lead to heavy selling pressure as recipients rush to lock in quick profits. However, sentiment around ASTER remains notably bullish.

Several community members on social media say they’re holding rather than selling, including trader Marcell, who described himself as all-in on Aster after buying from $0.14 to $1.90.

Marcell said the Aster team has been highly responsive and well backed by Yzi Labs and Binance co-founder CZ Zhou, adding that he believes ASTER could eventually flip HYPE and become one of the top ten cryptos.

He also called BNB x ASTER his biggest spot holding, reflecting the growing confidence in the project despite the airdrop unlock.

Notably, Aster hasn’t followed the traditional route of handing large allocations to whales. Instead, the project distributed smaller airdrops to a wider base of users, creating broader excitement and stronger on-chain engagement.

Binance co-founder CZ even retweeted RuneCrypto’s post praising this model, highlighting how rewarding everyday traders helps build lasting network momentum rather than short-term hype.

This means that the token price won’t crash from profit-taking by just a few whales. Instead, the Aster price is up by over 9% from Monday’s lows, trading at $1.48 at press time.

320 million aster tokens were airdropped

price went from $1.35 to $1.48we're going to go so high

BULLLLLLLISH pic.twitter.com/HYq9NvTlzS

— Alex (@ShiLLin_ViLLian) October 13, 2025

Aster Announces $140 Million Token Buyback, Is A New Scheme Coming?

Aster has completed its first $140 million token buyback, purchasing 100 million ASTER coins from the market. The timing couldn’t be better; the exchange has generated over $8.6 billion in trading volume and $229 million in fees over the past 30 days, according to DeFiLlama.

Aster has completed a round of buyback of 100M $ASTER tokens.

All purchased tokens are held at the following on-chain address:https://t.co/cpPEWTa0ki

— Aster (@Aster_DEX) October 10, 2025

With that kind of revenue, Aster has enough firepower to continue buying back large amounts of its own token without draining reserves. If the team turns this into a recurring program, it could become one of the most bullish catalysts in the entire market.

Aster Price Prediction: Is It Time To Buy?

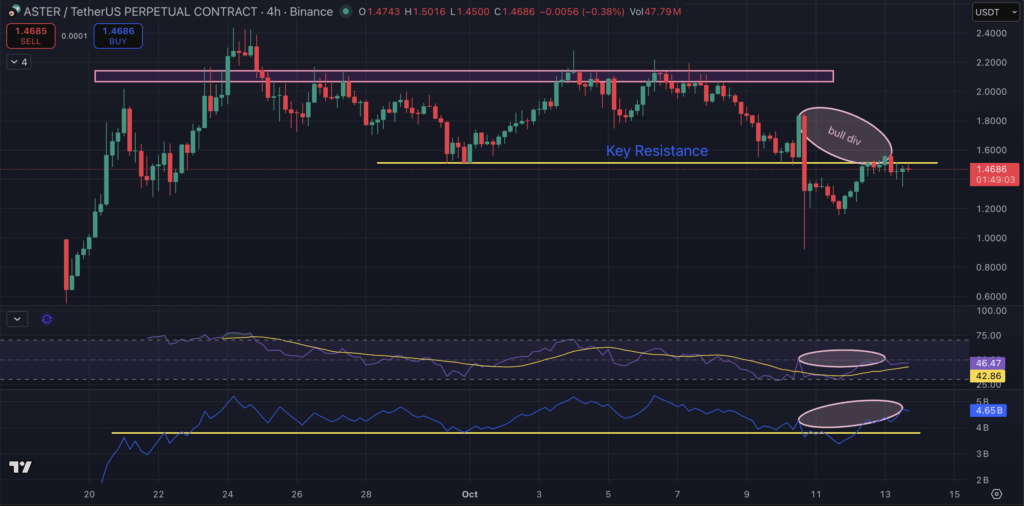

The ASTER price is flashing early signs of strength after forming clear bullish divergences on both the RSI and On-Balance Volume (OBV) indicators.

This suggests that while prices made lower highs, buying momentum quietly increased under the surface. However, investors are closely watching the $1.51 level, a key resistance zone that has rejected multiple rallies in recent weeks.

A breakout above it could confirm a bullish trend reversal, while rejection here may lead to another retest of support near $1.20 and $1.

Experts continue to predict that the Aster price will hit $4 in the mid-term and $10 in the long term.

New DEX Coin Best Wallet Token Tipped As The Next 10x Crypto

Best Wallet Token (BEST) is quickly emerging as a top contender among new utility tokens. It powers Best Wallet, a multi-chain, non-custodial crypto wallet that gives users full control of their assets with anonymous, no-KYC onboarding.

The BEST token has already raised over $16.5 million, which suggests strong community support and high upside potential. After all, BEST provides attractive perks in the Best Wallet ecosystem, including low transaction fees, high staking rewards and exclusive features.

As a multi-chain wallet, Best Wallet supports more than sixty blockchains and allows users to trade, store, and track tokens in one place.

However, besides the traditional wallet capabilities, Best Wallet aims to evolve into a complete all-in-one crypto hub, merging DeFi, trading, and payments into one ecosystem.

Some of its cutting-edge features include derivatives trading inside the wallet, a browser extension, an NFT gallery, and more sophisticated tools like limit/stop orders, MEV protection, market analytics, and the Best Card for spending crypto.

These upgrades aim to turn Best Wallet into a full crypto ecosystem. With BEST at the core of the platform, it is no surprise that many are calling it the next 10x crypto.

-

1

Best Crypto to Buy Now As Bitcoin, Ethereum ETFs Hit $1B Inflows

03.10.2025 19:40 8 min. read -

2

Aster Price Prediction As Airdrop Claims Go Live, Exchange Starts Token Buyback

14.10.2025 3:54 4 min. read -

3

Zcash Soars 40% to Hit $4B Market Cap, Bitcoin Hyper Tipped to Explode Next

11.10.2025 11:18 4 min. read -

4

Best Meme Coins to Buy As Floki Price Rises 30% Today

04.10.2025 19:36 8 min. read -

5

Experts Say Gold Price To Top Soon, Could Bitcoin and Bitcoin Hyper Explode Next?

16.10.2025 21:55 4 min. read

Best Meme Coins to Buy As Crypto Prices Form Market Bottom

The latest crypto downturn has, paradoxically, reignited optimism across the market. While prices tumbled sharply, many traders now believe that the worst may be over. Bitcoin’s ability to rebound swiftly after the recent selloff has restored a sense of balance that had been missing for weeks. With each pullback met by strong buying pressure, confidence […]

Bitcoin Price Prediction, BNB Latest News and the Best Crypto to Buy Now

If you checked your portfolio in the last 24 hours, you probably got a shock. The crypto market just took another big hit, with Bitcoin briefly falling below the $104,000 level and dragging most altcoins down with it. A combination of factors caused this slide. A huge wave of traders using borrowed money got liquidated, […]

ChatGPT Predicts Price of XRP, Cardano, Best Wallet Token by End of 2026

The crypto market is taking another beating – down about 5% since yesterday, with Bitcoin sitting under $106,000 and the total market cap below $3.6 trillion. This drop started last week when Trump floated the idea of 100% tariffs on Chinese imports, which sent risk assets spiraling. Add in other negative factors, such as rising […]

Snorter Presale Nears $5M With Just 3 Days Left to Join: Next 100x Crypto?

After a brief rally earlier this week, the broader crypto market is experiencing another dip today. However, some of the capital flowing out of the market’s leading tokens is quickly finding its way to tokens that could explode soon. During this rotation, investors are showing increasing interest in the newest Telegram-based Solana trading bot solution, […]

-

1

Best Crypto to Buy Now As Bitcoin, Ethereum ETFs Hit $1B Inflows

03.10.2025 19:40 8 min. read -

2

Aster Price Prediction As Airdrop Claims Go Live, Exchange Starts Token Buyback

14.10.2025 3:54 4 min. read -

3

Zcash Soars 40% to Hit $4B Market Cap, Bitcoin Hyper Tipped to Explode Next

11.10.2025 11:18 4 min. read -

4

Best Meme Coins to Buy As Floki Price Rises 30% Today

04.10.2025 19:36 8 min. read -

5

Experts Say Gold Price To Top Soon, Could Bitcoin and Bitcoin Hyper Explode Next?

16.10.2025 21:55 4 min. read

Aster has quickly transformed from an ambitious newcomer into one of the most profitable names in crypto.

During a keynote speech at the Bitcoin 2024 conference on July 26, Michael Saylor, co-founder of MicroStrategy, made a bold prediction that Bitcoin (BTC) could reach $13 million per coin by 2045.

Bitcoin-focused investment firm Strategy Inc. (formerly MicroStrategy) is facing mounting legal pressure as at least five law firms have filed class-action lawsuits over the company’s $6 billion in unrealized Bitcoin losses.

The long-awaited U.S. inflation data for August has landed, offering new insight into the economy just days before the Federal Reserve’s critical policy meeting. Inflation surprises on the upside

Blockchain gaming reached a notable peak in August with 4.2 million daily active users, as reported by DappRadar.

On July 9, the Australian Securities Exchange (ASX) gave DigitalX permission to launch its spot Bitcoin ETF, which will begin trading on July 12 under the ticker symbol BTXX.

Australia’s efforts to combat crypto-related fraud have intensified, with the country’s Securities and Investments Commission (ASIC) targeting 95 companies allegedly involved in deceptive schemes like pig butchering scams.

Australia is ramping up its efforts to regulate the cryptocurrency sector to enhance consumer protection and curb fraudulent practices.

Australia has no immediate plans to launch a national cryptocurrency reserve, despite the U.S. announcing such a move earlier this month.

Australia's financial regulator, ASIC, has dismantled over 600 crypto scams in the past year, highlighting the evolving use of AI by fraudsters.

Australia’s Monochrome Asset Management has introduced the first inaugural ETF that directly holds Ethereum, a significant advancement for the country’s cryptocurrency sector.

Australia is reshaping its approach to digital assets with new draft legislation aimed at bringing exchanges and custody platforms under the same rules as traditional finance.

Australia's Treasury Department is seeking public input on how to implement a global cryptocurrency transaction reporting standard as part of its effort to enhance tax transparency and reduce international tax evasion.

Australia's central bank has decided to prioritize the development of a wholesale central bank digital currency (CBDC) over a retail version.

Australia’s cybersecurity minister Tony Burke is drafting legislation that would give the country’s financial intelligence agency, AUSTRAC, the authority to restrict or ban crypto ATMs viewed as “high-risk products.”

Australia is tightening its grip on cryptocurrency regulation with new proposals aimed at preventing financial crimes such as money laundering and terrorist financing.

Australia is stepping up its digital currency efforts with the next phase of Project Acacia, a pilot focused on testing central bank digital currency (CBDC) and tokenized finance in real-world applications.