Sei Network Sees Explosive Q2 Growth as DeFi and AI Drive Momentum

15.09.2025 20:00 2 min. read Kosta Gushterov

Sei Network has posted one of its strongest quarters yet, with fresh data from Messari showing sharp increases across price, adoption, and DeFi activity.

The Layer-1 blockchain is gaining traction as it prepares for its highly anticipated Giga upgrade and deepens its integration with AI-driven initiatives.

Q2 by the Numbers

- SEI price jumped 63.5% quarter-over-quarter, underscoring growing investor demand.

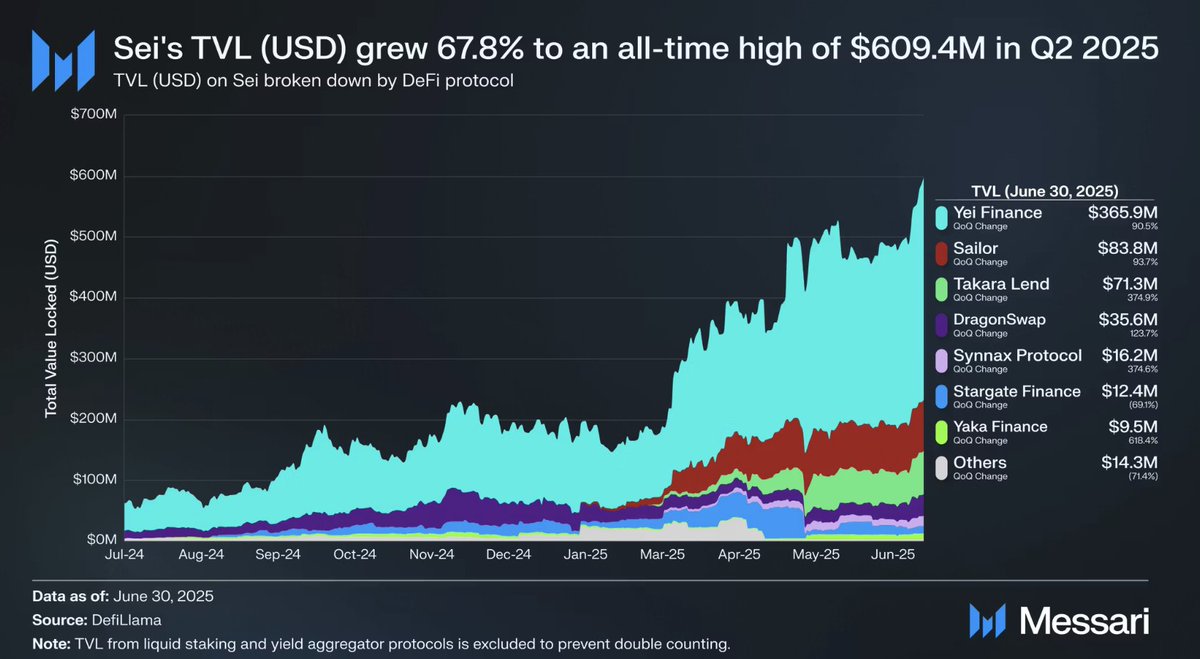

- DeFi total value locked (TVL) surged 67.8%, hitting a record $609.4 million by June 30, 2025.

- Daily active addresses climbed 36.6%, highlighting rising user engagement across the ecosystem.

Much of this growth has been attributed to the network’s transition toward EVM-only compatibility, a move that significantly expands developer access and improves interoperability with Ethereum-native applications.

Driving Forces: DeFi and AI

The largest share of Sei’s TVL is concentrated in Yei Finance ($365.9M), followed by projects like Sailor ($83.8M), Takara Lend ($71.3M), and DragonSwap ($35.6M). Collectively, these DeFi platforms account for the majority of the chain’s activity and liquidity growth.

Alongside DeFi, Sei is also investing in artificial intelligence use cases, with initiatives designed to merge blockchain performance with AI-powered financial tools. This positioning aligns the project with one of the most dominant narratives of 2025: the convergence of AI and crypto.

Looking Ahead

As Sei gears up for the Giga upgrade, analysts are watching whether the project can sustain its rapid expansion. If momentum continues, Sei could strengthen its position as one of the leading new-generation blockchains bridging DeFi, AI, and EVM compatibility.

-

1

Michaël van de Poppe Reveals Which Altcoins He’s Buying and Selling Now

28.09.2025 17:00 2 min. read -

2

Top 3 Trending Cryptos Today: CREPE, RICE AI, and Zcash Lead Market Momentum

05.10.2025 12:56 2 min. read -

3

VisionSys AI Partners With Marinade Finance to Launch $2B Solana Treasury

01.10.2025 21:00 2 min. read -

4

Top Trending Cryptos: AI Tokens and Stablecoin Partnerships Lead Market Momentum

06.10.2025 13:46 2 min. read -

5

REX-Osprey Launches First Ethereum Staking ETF in the U.S.

25.09.2025 22:00 2 min. read

Forced Liquidations, Not Fear, Drove XRP’s Wild Drop – Accumulation Follows

XRP’s latest market drama unfolded in spectacular fashion as the token plunged from $2.83 to $1.77 in just a few hours before finding its footing around $2.45.

Canary Capital edges closer to SEC approval for Solana and XRP ETFs

Canary Capital is making significant progress toward introducing exchange-traded funds (ETFs) for Solana (SOL) and XRP, signaling renewed momentum in the U.S. crypto investment space.

Crypto Joins Traditional Assets in Morgan Stanley’s Wealth Management Platform

Morgan Stanley is taking a major leap into digital finance, allowing every one of its clients – from individual investors to retirees – to gain exposure to cryptocurrencies.

Bitcoin Crash Triggers $19B Liquidation Wave Across Exchange

A wave of liquidations has rocked the crypto market, wiping out billions in leveraged positions as major tokens tumbled to multi-week lows.

-

1

Michaël van de Poppe Reveals Which Altcoins He’s Buying and Selling Now

28.09.2025 17:00 2 min. read -

2

Top 3 Trending Cryptos Today: CREPE, RICE AI, and Zcash Lead Market Momentum

05.10.2025 12:56 2 min. read -

3

VisionSys AI Partners With Marinade Finance to Launch $2B Solana Treasury

01.10.2025 21:00 2 min. read -

4

Top Trending Cryptos: AI Tokens and Stablecoin Partnerships Lead Market Momentum

06.10.2025 13:46 2 min. read -

5

REX-Osprey Launches First Ethereum Staking ETF in the U.S.

25.09.2025 22:00 2 min. read

UK judge sentenced self-proclaimed Bitcoin creator Craig Wright to a year in prison for contempting the court.

Craig Wright, the renowned computer scientist who asserts he is Satoshi Nakamoto, founded Bitcoin SV in 2018, branding it as the genuine Bitcoin, with "SV" denoting "Satoshi Vision."

While many in the hedge fund world remain hesitant about Bitcoin’s long-term relevance, especially beyond the Trump era, Eric Semler is moving in the opposite direction—and doing so aggressively.

Semler Scientific, a healthcare technology firm, has expanded its Bitcoin reserves with the purchase of 237 BTC for $23 million, at an average price of just over $98,000 per coin.

Semler Scientific, a company specializing in medical devices, recently revealed that it is still buying Bitcoin.

Semler Scientific has quietly built up a sizable Bitcoin position, acquiring 111 BTC between mid-February and late April for a total of $10 million.

Semler Scientific, a healthcare company based in California, has expanded its Bitcoin holdings, acquiring an additional 303 BTC for $29.3 million between November 25 and December 4.

Nasadq-listed Semler Scientific, a leader in developing technology to help healthcare providers manage chronic diseases, has provided an update on its Bitcoin (BTC) holdings and performance.

Healthcare company Semler Scientific has significantly expanded its Bitcoin holdings with a new purchase of 215 BTC, worth $17.7 million.

Semler Scientific has been steadily increasing its Bitcoin holdings, investing over $88 million in the cryptocurrency over the past several weeks.

Semler Scientific has revealed plans to raise $75 million through a private offering of convertible senior notes maturing in 2030.

Senate Banking Committee Chairman Tim Scott believes that 12 to 18 Senate Democrats could ultimately support a comprehensive market structure bill for digital assets.

John Deaton, the founder of CryptoLaw and prominent XRP advocate, is a notable contender in the Massachusetts Senate race, running against Senator Elizabeth Warren.

The U.S. Senate has confirmed Jonathan Gould as the next head of the Office of the Comptroller of the Currency (OCC), moving his nomination to President Donald Trump for final approval.

The U.S. Senate has voted 70-28 to overturn an IRS rule that imposed strict reporting requirements on certain crypto entities, sending the measure to President Donald Trump for approval.

Senators Tim Scott, Cynthia Lummis, Bill Hagerty, and Bernie Moreno (R-OH) have released a discussion draft of a new digital asset market structure bill—framed as the Senate counterpart to the CLARITY Act.

A long-anticipated bill aimed at regulating stablecoins is reportedly headed for a full Senate vote this May, according to Politico.

In a significant development for the U.S. cryptocurrency sector, Senator Cynthia Lummis has been appointed chair of the Senate Banking Subcommittee on Digital Assets.

Senator Cynthia Lummis, recognized for her pro-crypto stance, intends to propose that the Federal Reserve (Fed) hold Bitcoin (BTC) as a strategic reserve asset, similar to gold and foreign currencies.

Senator Elizabeth Warren has continued her vocal opposition to cryptocurrencies, despite losing some of her legislative backing.