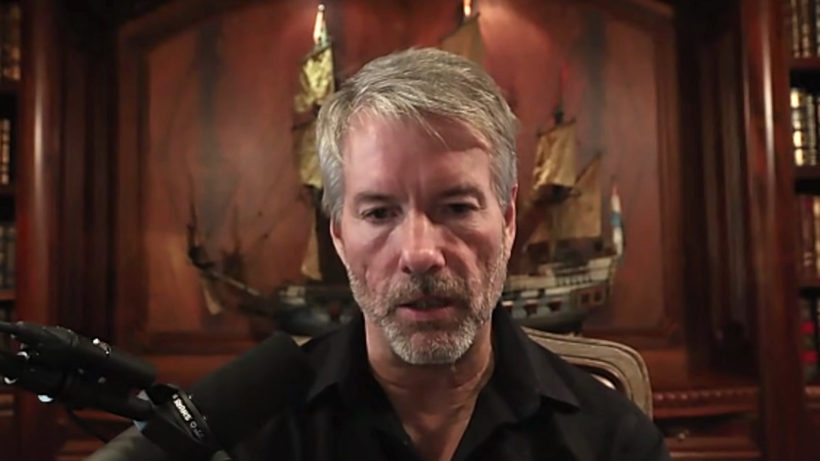

Top Economist Warns of a Major Risk for Michael Saylor’s Bitcoin Strategy

26.02.2025 18:14 1 min. read Kosta Gushterov

Peter Schiff, a prominent critic of Bitcoin, has identified large-scale withdrawals from Bitcoin exchange-traded funds (ETFs) as the biggest threat to Michael Saylor’s strategy.

Schiff believes that these redemptions would significantly impact Bitcoin’s price, driving it lower, which in turn would cause even greater losses for companies like MicroStrategy (MSTR), which holds substantial Bitcoin reserves.

Schiff argues that many of the investors buying into Bitcoin ETFs are newcomers to the crypto space, viewing their purchases more as speculative trades than long-term investments.

He points out that these traders may quickly pull out if Bitcoin’s price falls, leading to a sharp drop in value.

This, he suggests, is why Saylor’s decision to heavily leverage MSTR in Bitcoin investments is a risky move. Recently, Bitcoin’s price tumbled to a multi-month low of $86,141, and MicroStrategy’s stock saw a steep decline, falling more than 11%.

-

1

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

2

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

3

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

4

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read

American State Bans Crypto Investments and Payments in Sweeping New Law

Connecticut has officially distanced itself from government adoption of digital assets like Bitcoin. On June 30, Governor Ned Lamont signed House Bill 7082 into law, placing sweeping restrictions on how the state and its agencies can engage with cryptocurrencies.

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

-

1

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

2

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

3

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

4

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read