Memecoin Registers Impressive 1,834% Gain Since the Beginning of the Year

26.06.2024 12:00 1 min. read Alexander Stefanov

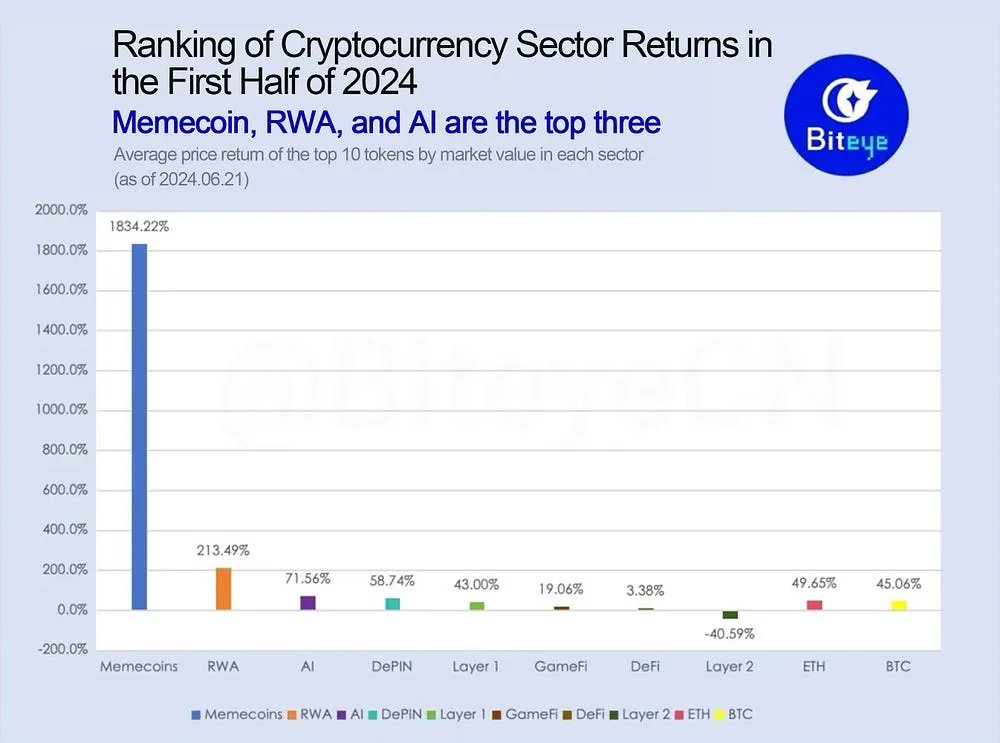

According to data from BitEye, meme coins have registered an impressive 1,834% return since the start of 2024, making them the most profitable sector.

The Real Tokenized Asset (RWA) sector comes in second, providing 214% returns to investors. Blockchain projects from the Artificial Intelligence (AI) and Decentralized Physical Infrastructure Networks (DePIN) sectors saw returns of 72% and 59% respectively.

Then it’s the turn of digital assets like Bitcoin and Ethereum as ETH brought in almost 50% return since the beginning of the year and Bitcoin around 45%.

Tier 1 platforms had an average return of 43%. Sectors such as gaming and decentralized finance (DeFi) lagged, but still posted modest returns of 19% and 3%, respectively.

On the other hand, the second-tier platform sector declined significantly, with losses averaging around 40.6%.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

Arthur Hayes has radically changed his stance on crypto markets. After months of caution, the BitMEX co-founder now believes a powerful altcoin rally is on the horizon.

Ethereum ETFs Signal Strong July Surge

Ethereum exchange-traded funds are gaining momentum, with recent inflows ranking among the top ten ever recorded.

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Ethereum Jumps 8% to Reclaim $3,000

Ethereum surged 8.4% in the past 24 hours, reaching $3,010 as renewed interest in altcoins follows Bitcoin’s explosive rally.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read