Memecoin Registers Impressive 1,834% Gain Since the Beginning of the Year

26.06.2024 12:00 1 min. read Alexander Stefanov

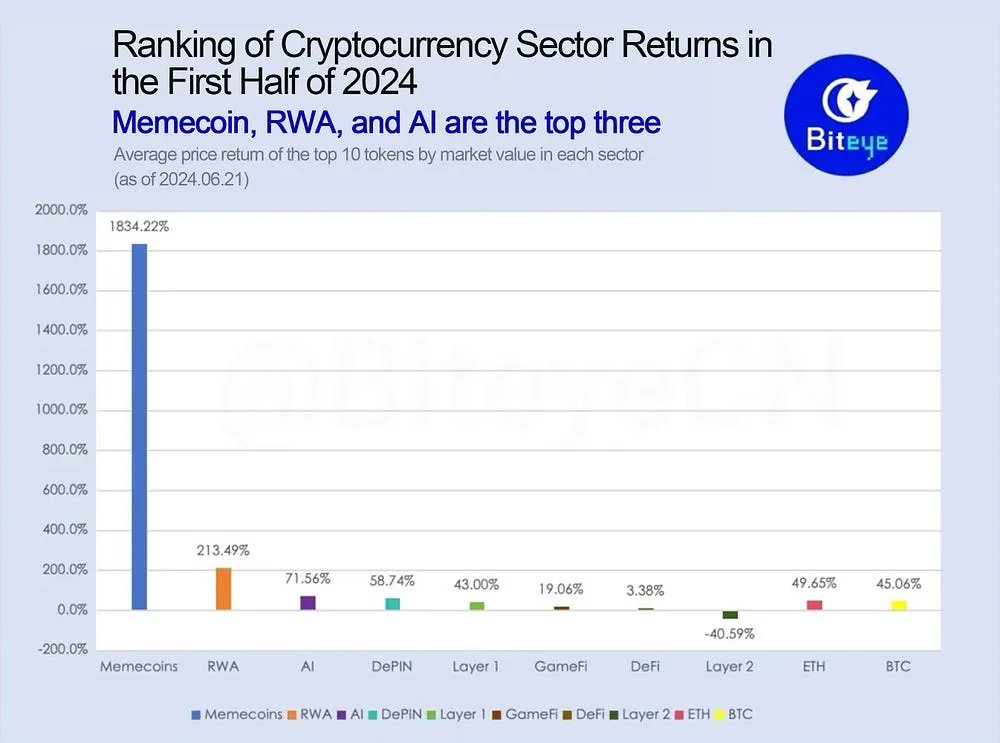

According to data from BitEye, meme coins have registered an impressive 1,834% return since the start of 2024, making them the most profitable sector.

The Real Tokenized Asset (RWA) sector comes in second, providing 214% returns to investors. Blockchain projects from the Artificial Intelligence (AI) and Decentralized Physical Infrastructure Networks (DePIN) sectors saw returns of 72% and 59% respectively.

Then it’s the turn of digital assets like Bitcoin and Ethereum as ETH brought in almost 50% return since the beginning of the year and Bitcoin around 45%.

Tier 1 platforms had an average return of 43%. Sectors such as gaming and decentralized finance (DeFi) lagged, but still posted modest returns of 19% and 3%, respectively.

On the other hand, the second-tier platform sector declined significantly, with losses averaging around 40.6%.

-

1

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read -

4

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

12.06.2025 18:57 3 min. read -

5

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read

Pi Price Prediction: Top Community Member Believes PI Will Drop to $0.40

Pi Coin (PI) has gone down by 33% in the past month and has dropped below a key support at $0.60 as the community has been disappointed by a lack of updates from the Pi Core Team and delays in the migration of Pi tokens to the public mainnet. One notable supporter of Pi whose […]

Pepe Coin Slides but Signals Hint at a Potential Rebound

Pepe Coin is facing tough market conditions, with its price falling to $0.00001042 — over 36% down from its May peak and more than 60% below its all-time high.

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

Ethereum is struggling to hold attention from retail investors, even as larger players ramp up their exposure to the second-largest cryptocurrency.

Fetch.AI Commits $50M to Token Buyback Amid Platform Growth

Blockchain project Fetch.AI has launched a $50 million buyback initiative for its FET token, citing rising platform usage and what it considers an undervalued market price.

-

1

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read -

4

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

12.06.2025 18:57 3 min. read -

5

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read