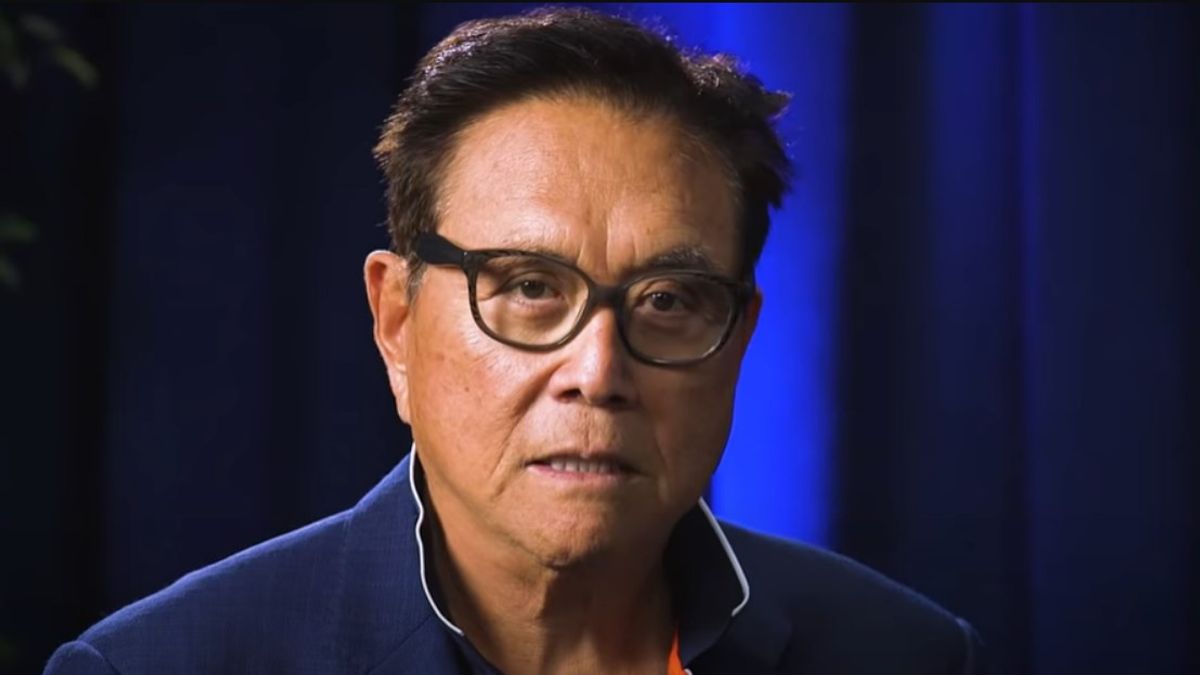

Bitcoin Will Boom If Trump Wins – Robert Kiyosaki

23.07.2024 15:00 1 min. read Alexander Stefanov

Billionaire investor Robert Kiyosaki is once again championing Bitcoin, suggesting that a potential Trump presidency could significantly enhance its value.

Kiyosaki envisions that Trump’s policies, such as weakening the US dollar and stimulating domestic production, would benefit Bitcoin and other assets by making exports more competitive and boosting economic growth. According to Kiyosaki, a weaker dollar could drive up prices for Bitcoin, gold, silver, and stocks.

Kiyosaki’s endorsement comes alongside criticism of President Biden’s energy policies, particularly the cancellation of the Keystone XL pipeline, which he argues has led to inflated oil prices and increased inflation.

He contrasts this with Trump’s potential plan to increase domestic oil production, which Kiyosaki believes could lower oil prices and foster economic expansion.

Adding to the buzz, Kiyosaki has also voiced concerns about the impact of AI on job markets, predicting that Bitcoin, along with gold and silver, could serve as a financial safeguard during such disruptions. Meanwhile, the US government has recently sold off some of its Bitcoin holdings, a move closely monitored by the investment community.

With Trump set to address Bitcoin’s role at an upcoming conference, there is growing anticipation about his plans for the cryptocurrency if he wins the presidency.

-

1

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read -

2

Quantum Advances Put Bitcoin’s Security to the Test

16.06.2025 13:00 2 min. read -

3

Why Rising Energy Prices Could Supercharge Bitcoin, According to Expert

18.06.2025 16:00 1 min. read -

4

Michael Saylor Signals Fresh BTC Buy as Strategy Rides Out Geopolitical Turbulence

16.06.2025 8:00 1 min. read -

5

South Korea Moves Toward Spot Crypto ETFs and Stablecoin Oversight

20.06.2025 15:00 1 min. read

Arthur Hayes Warns of Bitcoin Pullback to $90,000: Here is Why

BitMEX co-founder Arthur Hayes has issued a cautious outlook for Bitcoin and the broader crypto market, predicting a possible short-term downturn as the U.S. government shifts its liquidity strategy.

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

Bitcoin’s bullish undercurrent continues to strengthen as on-chain data and derivatives market behavior reveal aggressive accumulation from long-term holders and whales.

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

As institutional adoption of Bitcoin accelerates, U.S. asset management giant Franklin Templeton has issued a cautionary note on the growing trend of crypto-based treasury strategies.

Bitcoin Climbs to $109,500: Why the Price is Up?

Bitcoin rose 1.78% over the past 24 hours to reach $109,500 at the time of writing, driven by surging institutional inflows into spot ETFs, easing global trade tensions, and strengthening technical momentum.

-

1

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read -

2

Quantum Advances Put Bitcoin’s Security to the Test

16.06.2025 13:00 2 min. read -

3

Why Rising Energy Prices Could Supercharge Bitcoin, According to Expert

18.06.2025 16:00 1 min. read -

4

Michael Saylor Signals Fresh BTC Buy as Strategy Rides Out Geopolitical Turbulence

16.06.2025 8:00 1 min. read -

5

South Korea Moves Toward Spot Crypto ETFs and Stablecoin Oversight

20.06.2025 15:00 1 min. read