Bitcoin ETFs Register Their Best Performance in 48 Days

23.07.2024 12:39 1 min. read Kosta Gushterov

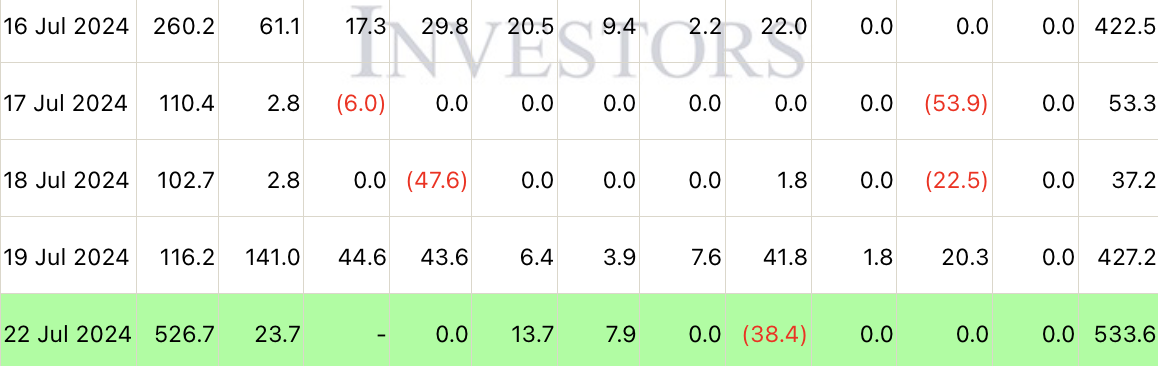

On Monday (July 22), US-based spot Bitcoin exchange traded products (ETFs) saw their highest inflows since June 4.

Farside reported that a total of $533.6 million flowed into spot BTC ETFs on Monday, marking the start of the third consecutive week in which these investment products have recorded positive inflows.

The majority of these inflows, amounting to $526.7 million, were attributable to BlackRock’s iShares Bitcoin Trust (IBIT).

Additionally, the Fidelity (FBTC), Invesco (BTCO) and Franklin Templeton (EZBC) funds saw inflows of $23.7 million, $13.7 million and $7.9 million, respectively.

Despite upbeat market sentiment, VanEck’s ETF (HODL) saw outflows of $38.4 million. Other products, including BTCW, ARK,BRRR, GBTC and DEFI, remained neutral.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

Analysis Firm Explains Why Bitcoin’s Breakout Looks Different This Time

Bitcoin’s surge to new all-time highs is playing out differently than previous rallies, according to a July 11 report by crypto research and investment firm Matrixport.

Bitcoin Reaches New All-Time High Above $116,000

Bitcoin surged past $116,000 on July 11, marking a new all-time high amid intense market momentum.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read