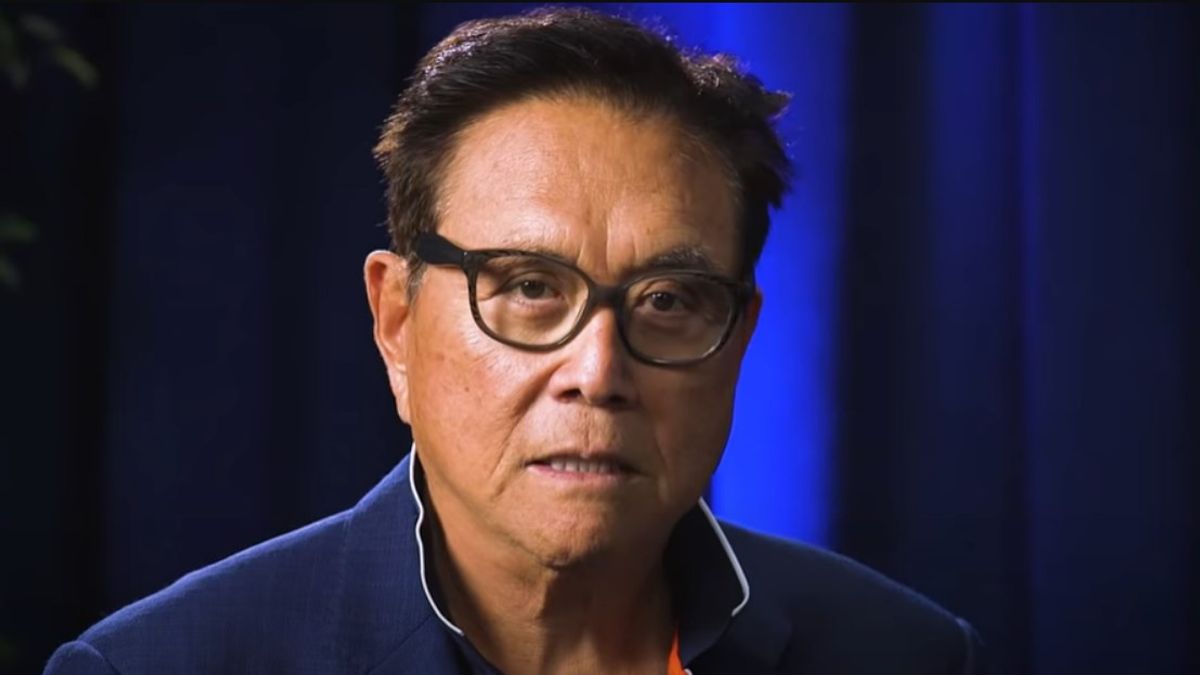

Bitcoin Will Boom If Trump Wins – Robert Kiyosaki

23.07.2024 15:00 1 min. read Alexander Stefanov

Billionaire investor Robert Kiyosaki is once again championing Bitcoin, suggesting that a potential Trump presidency could significantly enhance its value.

Kiyosaki envisions that Trump’s policies, such as weakening the US dollar and stimulating domestic production, would benefit Bitcoin and other assets by making exports more competitive and boosting economic growth. According to Kiyosaki, a weaker dollar could drive up prices for Bitcoin, gold, silver, and stocks.

Kiyosaki’s endorsement comes alongside criticism of President Biden’s energy policies, particularly the cancellation of the Keystone XL pipeline, which he argues has led to inflated oil prices and increased inflation.

He contrasts this with Trump’s potential plan to increase domestic oil production, which Kiyosaki believes could lower oil prices and foster economic expansion.

Adding to the buzz, Kiyosaki has also voiced concerns about the impact of AI on job markets, predicting that Bitcoin, along with gold and silver, could serve as a financial safeguard during such disruptions. Meanwhile, the US government has recently sold off some of its Bitcoin holdings, a move closely monitored by the investment community.

With Trump set to address Bitcoin’s role at an upcoming conference, there is growing anticipation about his plans for the cryptocurrency if he wins the presidency.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read