Bitcoin Loses its Dominance After the News About Mt. Gox

25.06.2024 17:30 2 min. read Alexander Stefanov

Bitcoin (BTC) is usually less volatile than altcoins, but this Monday had a notable exception.

Bitcoin saw a more severe decline than other cryptocurrencies, leading to a significant drop in its market dominance. This decline underscores concerns about the potential impact of upcoming payments to victims of the 2014 hacking attack on Mt. Gox.

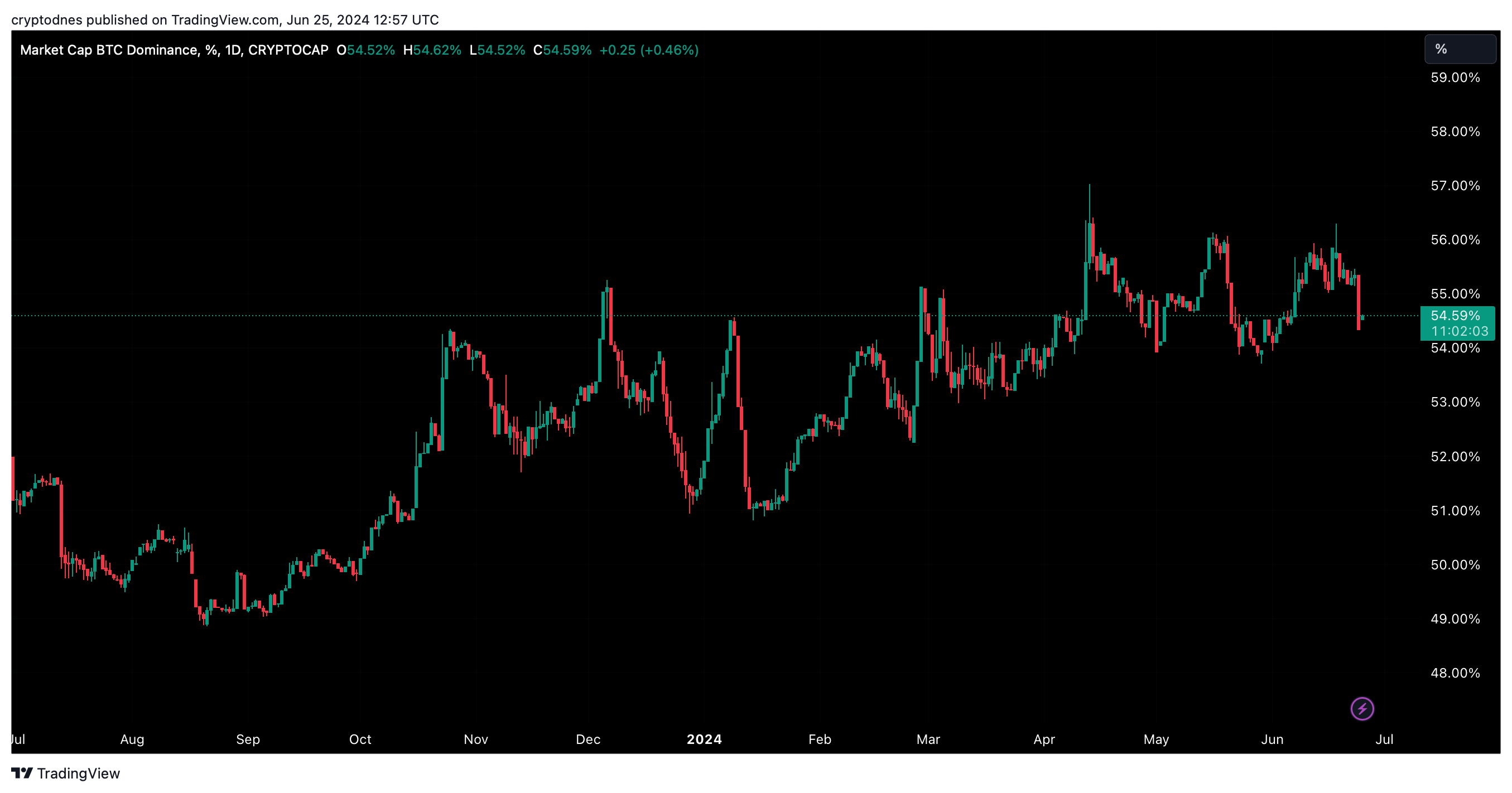

BTC’s market dominance, or its share of the crypto market’s total value, dropped to 54.59 percent as of June 25, marking the biggest one-day decline since Jan. 12 on June 24. This suggests that investors have withdrawn funds from Bitcoin at a faster rate than from other cryptocurrencies.

The sell-off, according to many analysts, was triggered by news that the defunct crypto exchange Mt. Gox plans to distribute 140,000 BTC to victims of hacking attacks in July. This announcement fueled fears that recipients would sell their holdings once they received them, potentially causing prices to drop.

These concerns were further reinforced by increased selling pressure from miners and outflows from spot Bitcoin exchange traded funds (ETFs) since June 7.

Heightened fears of a sell-off have also spurred demand for short-term BTC puts on the Deribit exchange, tracked by Amberdata. Put options provide protection against a decline in the asset’s price. The seven-day and one-month call put spreads, which reflect the premiums traders are willing to pay for asymmetric payments in either direction within one week and one month, turned negative, indicating increased demand for puts.

Despite these concerns, some market observers believe that the actual selling pressure from Mt. Gox benefits may be more moderate. Tagus Capital noted in a market commentary that while the exact Bitcoin amount that will be distributed following potential token sales by Mt. Gox has not been specified, it is part of a broader recovery plan that includes 142,000 BTC, 143,000 Bitcoin Cash (BCH) and fiat currency totaling 69 billion Japanese yen ($432 million).

Tagus Capital also suggested that Mt. Gox’s creditors may prefer to hold on to their BTC rather than sell it immediately. These creditors are thought to be long-term investors who have previously turned down offers to pay out in US dollars and may prefer to hold on to their assets to avoid capital gains taxes on a sale.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read