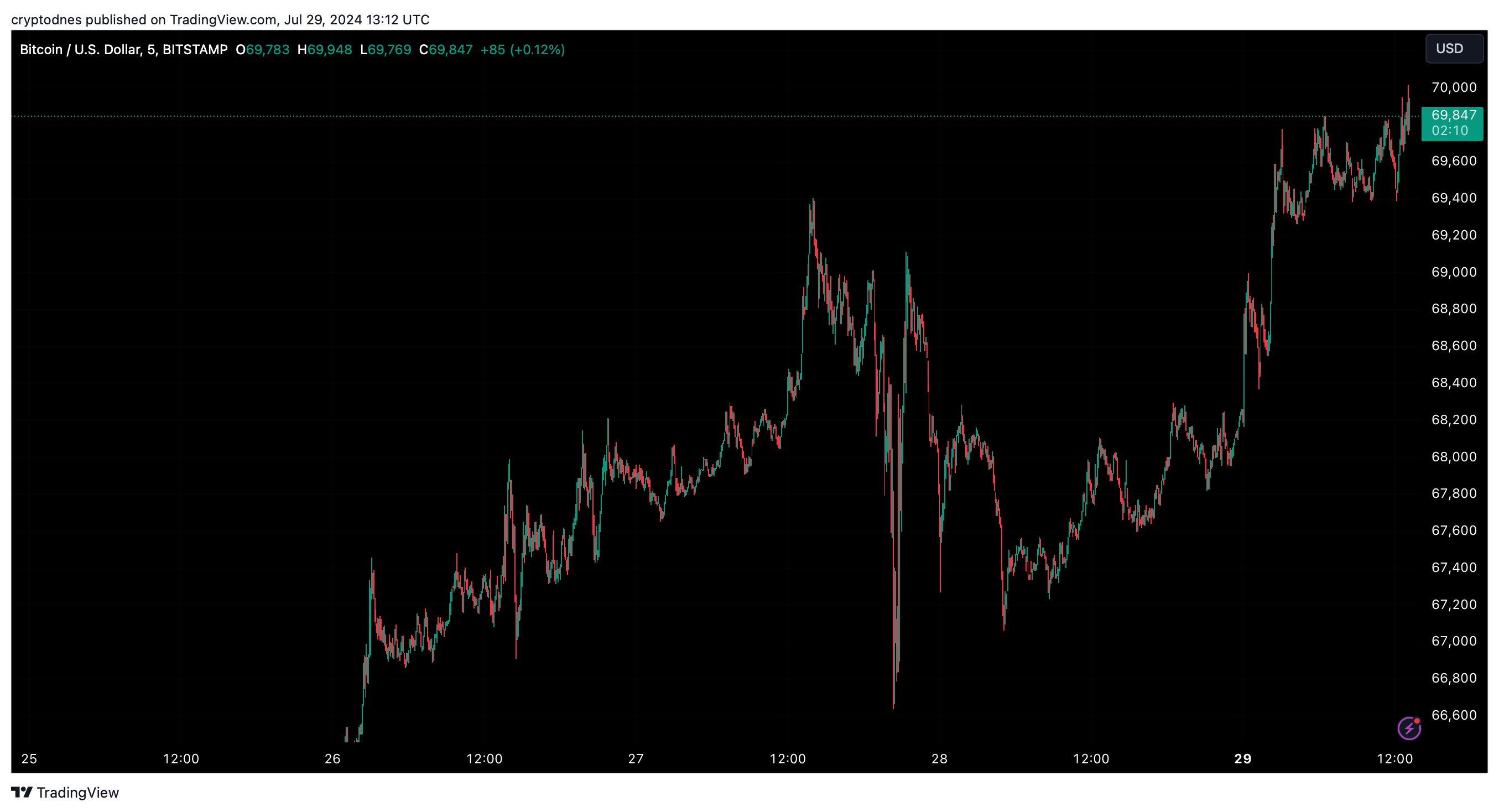

Bitcoin Breaks Above $70,000 Following Recent Trump Speech

29.07.2024 16:13 2 min. read Alexander Stefanov

Bitcoin managed to regain its bullish momentum after the recent correction to below $54,000.

This decline was due to macroeconomic factors, such as continued high interest rates due to inflation, as well as the liquidation of Bitcoin holdings by the German government and the repayment of Mt. Gox creditors.

At the time of writing, Bitcoin appears to have forgotten about these issues and is trading at just under $70,000 after a jump of almost 2.7% in the last 24 hours and has a volume of $25.7 billion.

The total market capitalization of the crypto market has reached $2.48 trillion after a 3.5% jump, and the leading cryptocurrency accounts for $1.374 trillion of the total.

According to CoinGlass, $77 million has been liquidated in the last 24 hours ($17.17 million in long positions and $59.8 million in short positions),

According to the majority of crypto enthusiasts, the positive development is largely due to positive comments from influencers during the Bitcoin Conference in Nashville. One of the more interesting comments was made by USA’s presidential candidate Donald Trump, who said that Bitcoin could overtake gold in the future and that it “will go to the moon.”

Furthermore, speaking at the conference, Trump said he would remove Gary Gensler and appoint a new SEC chairman on the first day of his inauguration.

-

1

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

2

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

3

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

4

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

European banking giant UniCredit is preparing to offer its professional clients a new investment product linked to BlackRock’s spot Bitcoin ETF (IBIT), according to a report by Bloomberg.

American State Bans Crypto Investments and Payments in Sweeping New Law

Connecticut has officially distanced itself from government adoption of digital assets like Bitcoin. On June 30, Governor Ned Lamont signed House Bill 7082 into law, placing sweeping restrictions on how the state and its agencies can engage with cryptocurrencies.

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

-

1

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

2

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

3

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

4

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read