Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read Kosta Gushterov

Bitcoin could be on the verge of another major breakout as institutional inflows return to levels that historically trigger rapid price acceleration.

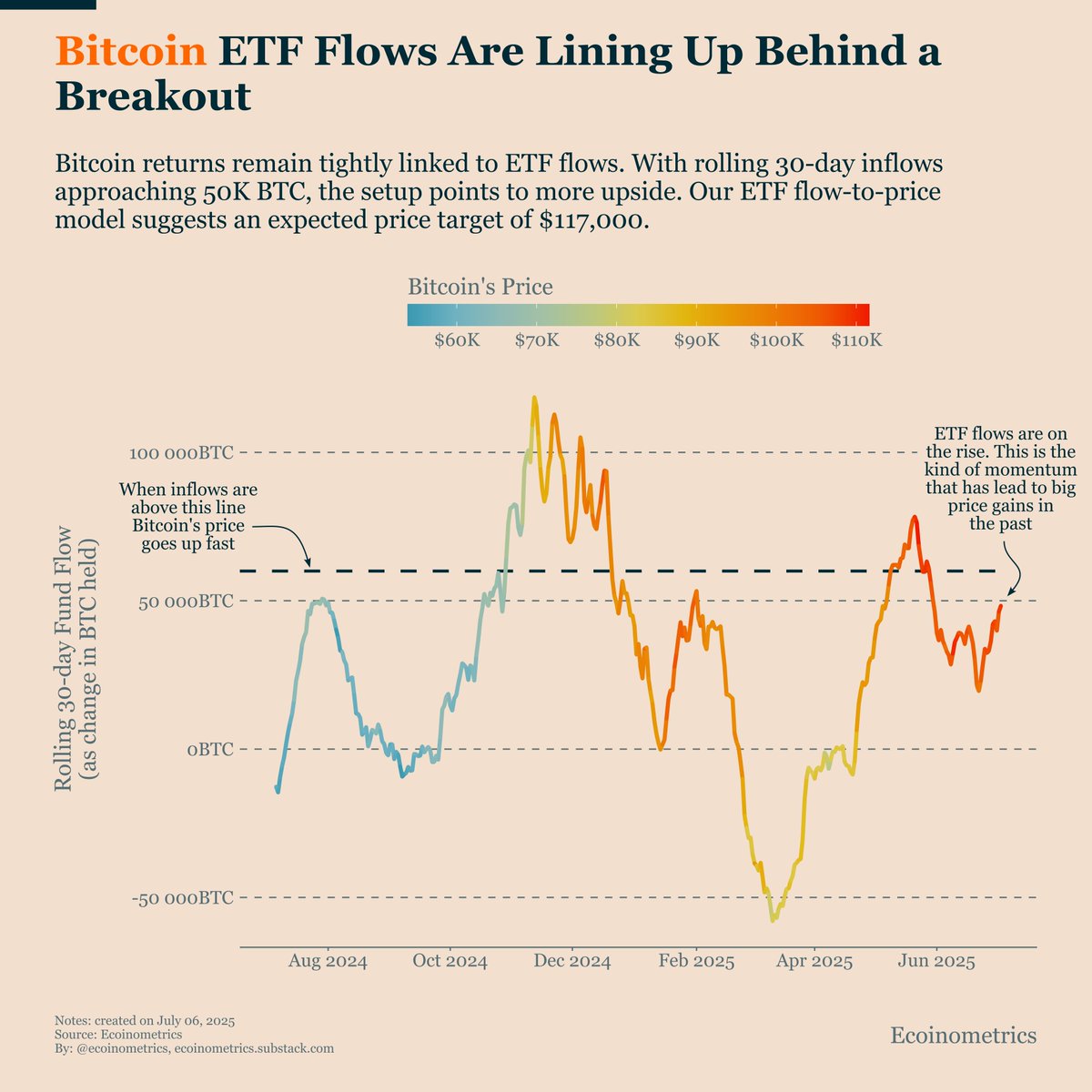

According to a new analysis by Ecoinometrics, 30-day rolling inflows into Bitcoin exchange-traded funds (ETFs) are nearing 50,000 BTC — a threshold that has previously signaled the start of powerful bull moves.

The report highlights a strong correlation between ETF fund flows and Bitcoin’s price direction. When rolling ETF inflows exceed the 50,000 BTC mark, past data shows Bitcoin’s price tends to surge significantly, as seen in Q4 2024 and early 2025. During those periods, BTC climbed rapidly toward new highs, driven largely by institutional demand reflected in spot ETF purchases.

Ecoinometrics’ ETF flow-to-price model now points to a potential target of $117,000, assuming inflows continue to rise. The model uses past inflow surges to estimate fair value, and current momentum suggests BTC may soon revisit the upper price bands that historically align with strong fund accumulation.

The accompanying chart shows color-coded bands corresponding to BTC’s price range ($60K–$110K) and compares them with the 30-day fund flow trajectory. During periods of high inflows — particularly above 50K BTC — the price has consistently trended higher, entering warmer-colored zones on the chart.

ETF inflows are once again rising in July, a sign that institutional confidence remains robust despite recent consolidation. This return of positive fund momentum reinforces the $117K projection and suggests that Bitcoin may soon enter its next breakout phase — as long as the inflow pattern continues.

With fund flows acting as a leading indicator of institutional demand, all eyes are now on whether the 50K BTC inflow level will be decisively breached. If so, Bitcoin’s path toward six-figure territory could become increasingly likely in the months ahead.

-

1

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

2

Corporate Bitcoin Buying Accelerates as Firms Raise Billions to Stack BTC

22.06.2025 15:00 2 min. read -

3

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

21.06.2025 19:00 1 min. read -

4

Here is What Robert Kiyosaki Expects From Bitcoin Until 2030

20.06.2025 20:00 1 min. read -

5

Strategy Scoops Up Another 10,100 Bitcoin, Treasury Nears 600K BTC

16.06.2025 16:15 1 min. read

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

According to on-chain analyst Darkfost, Bitcoin is entering a new stage of on-chain behavior marked by two key developments: a rare third peak in the SOPR Trend Signal during a single bull cycle and a sustained outflow dominance in exchange flows.

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

In a stunning on-chain event that has reignited curiosity across the crypto community, more than $8.6 billion worth of Bitcoin linked to the network’s earliest years—commonly referred to as the “Satoshi era”—was quietly moved on Friday in what analysts believe is the largest single transfer of early-mined BTC ever recorded.

Esports Giant Moves Into Bitcoin Mining

The parent company behind the iconic esports brand Ninjas in Pyjamas (NIP) is taking a sharp turn into the world of Bitcoin mining, signaling a significant evolution from pure entertainment to digital infrastructure.

-

1

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

2

Corporate Bitcoin Buying Accelerates as Firms Raise Billions to Stack BTC

22.06.2025 15:00 2 min. read -

3

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

21.06.2025 19:00 1 min. read -

4

Here is What Robert Kiyosaki Expects From Bitcoin Until 2030

20.06.2025 20:00 1 min. read -

5

Strategy Scoops Up Another 10,100 Bitcoin, Treasury Nears 600K BTC

16.06.2025 16:15 1 min. read