Bitcoin’s Correlation With Gold Hits 11-Month Low

13.11.2024 19:30 1 min. read Alexander Zdravkov

Since the recent US presidential election, gold has fallen by around 5%, while Bitcoin has risen by over 20%, indicating a marked change in the relationship between these two assets.

Analysts believe that capital may move from traditional safe assets such as gold to BTC as investors reassess their strategies in uncertain economic times.

Analysts at QCP Capital say Bitcoin, often referred to as “digital gold“, is increasingly attracting capital that could traditionally flow into gold, signaling a structural shift toward digital assets as alternative safe havens.

With a market capitalization of about $1.73 trillion, Bitcoin recently surpassed the total value of silver, but still lags far behind gold, which has a market valuation of $17.5 trillion. However, QCP Capital analysts believe that a small change – such as shifting just 1% of gold’s capital to Bitcoin – could boost the cryptocurrency’s price to nearly $97,000.

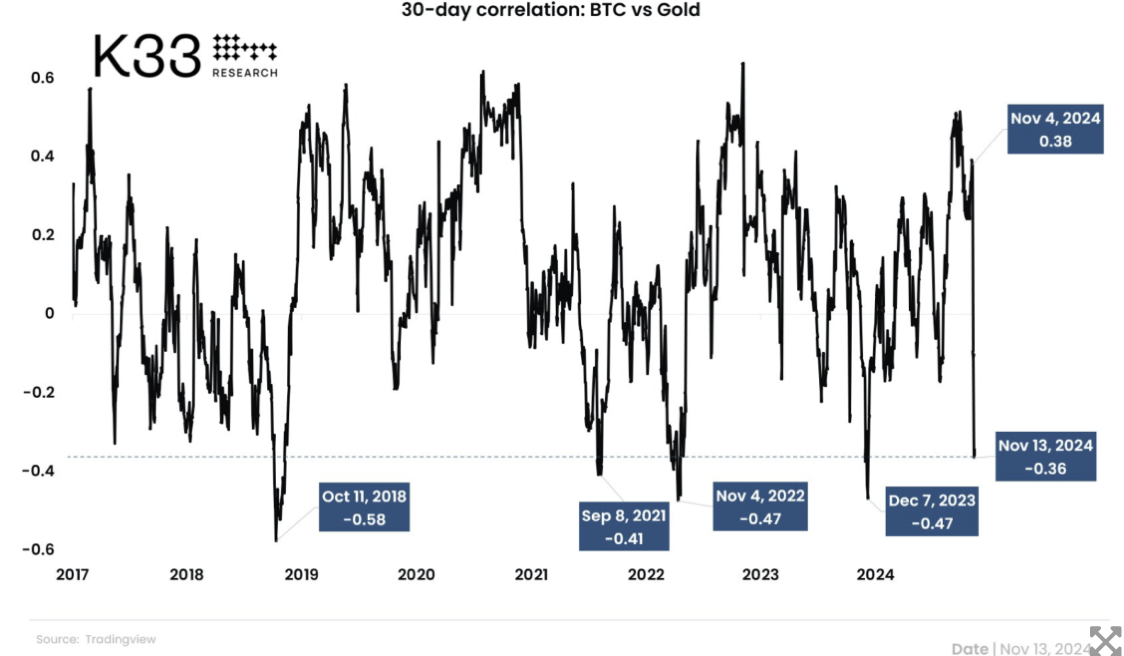

In parallel, head ofresearchat K33 Vetle Lunde pointed out that Bitcoin’s correlation with gold has fallen to an 11-month low, supporting the idea that BTC is establishing a standalone position in the market. The thirty-day correlation between the two assets has also reached a similar low, illustrating this divergence in performance.

-

1

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

2

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

3

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

4

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

5

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read

American State Bans Crypto Investments and Payments in Sweeping New Law

Connecticut has officially distanced itself from government adoption of digital assets like Bitcoin. On June 30, Governor Ned Lamont signed House Bill 7082 into law, placing sweeping restrictions on how the state and its agencies can engage with cryptocurrencies.

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

-

1

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

2

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

3

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

4

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

5

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read