Bitcoin Faces Selling Pressure as U.S. Institutions Unload Holdings

09.10.2024 13:00 1 min. read Alexander Zdravkov

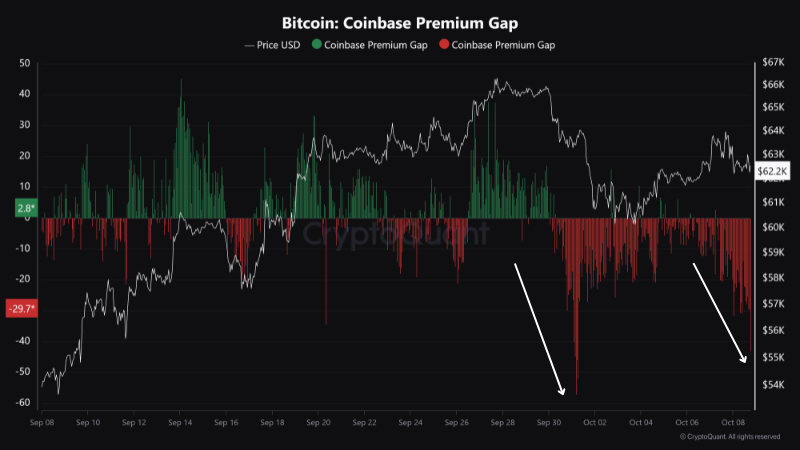

Bitcoin is facing selling pressure in the U.S., with its price hovering around $62,000.

Data from October shows institutional investors are offloading the cryptocurrency, weakening its momentum.

The Coinbase Premium Index, which compares Bitcoin prices on Coinbase and Binance, has stayed in the negative, signaling that U.S. investors are selling at lower prices than their global counterparts.

Analyst Maartunn pointed out that this index dropped to -$41, reflecting heightened selling activity.

In addition to this, U.S. Bitcoin ETFs have seen outflows, with over $408 million leaving these funds in early October, while inflows lag behind at $260 million. Even portfolios tied to BlackRock experienced significant outflows during this period.

Glassnode highlighted $62,600 as a key support level for Bitcoin. A fall below this could lead to a drop toward $52,000, while breaking through $64,000 could see a surge beyond $72,000. At the time of writing BTC is priced at $62,100.

The market remains on edge, with the potential for sharp reactions depending on Bitcoin’s next move.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

3

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

4

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

5

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read

Biggest Bitcoin Miner Will Raise $850M To Buy Bitcoin

MARA Holdings, Inc. (NASDAQ: MARA), a leading digital infrastructure and Bitcoin mining firm, announced plans to raise $850 million through a private offering of 0.00% convertible senior notes due 2032.

Crypto Market Slips on Senate Bill and Altcoin Leverage Risk

The crypto market dropped 1.82% over the last 24 hours, ending a multi-day streak of gains.

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

3

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

4

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

5

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read