U.S. Bitcoin ETFs Continue Outflows, Losing $211 Million

06.09.2024 13:30 1 min. read Alexander Stefanov

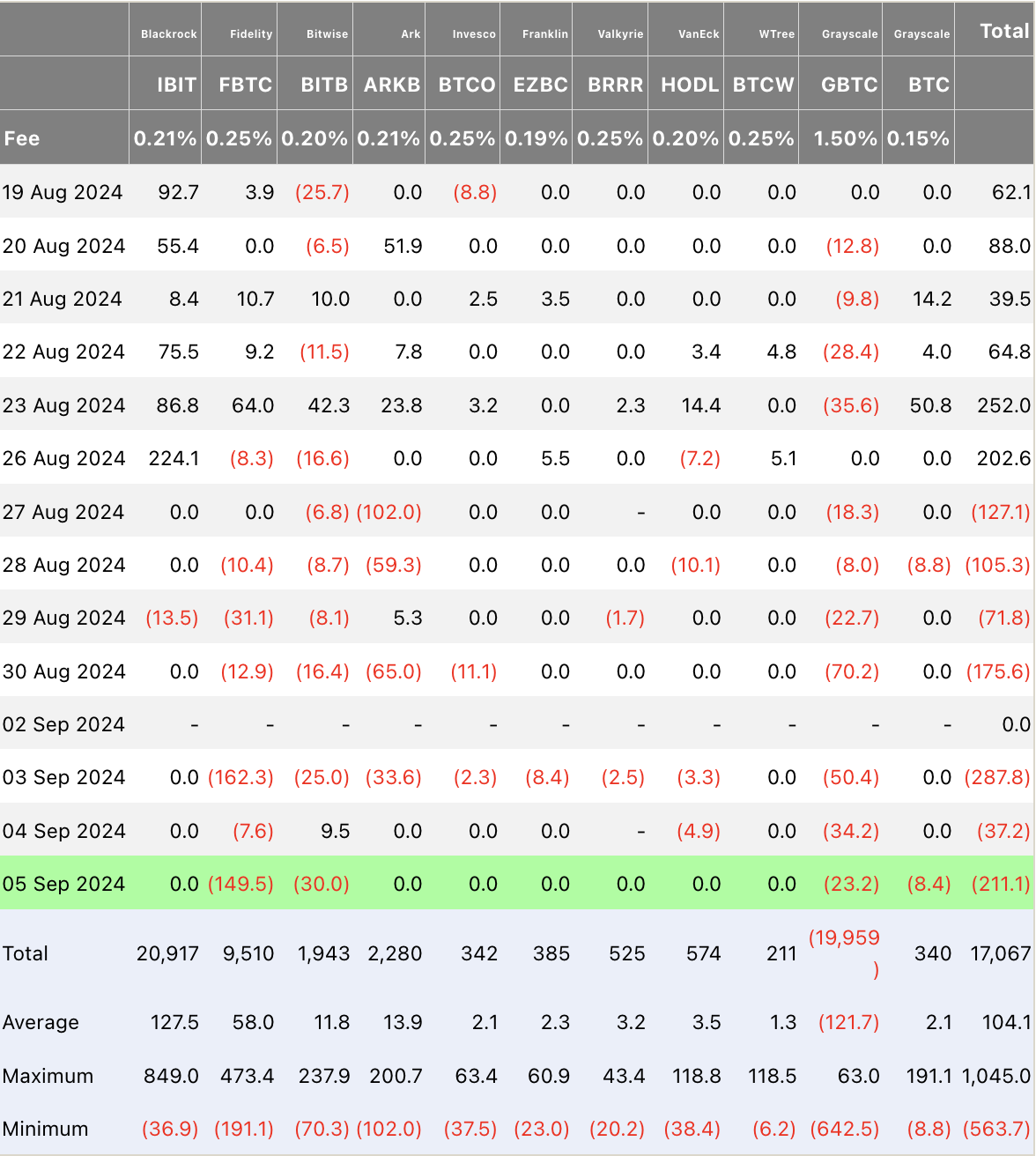

On Thursday, U.S. spot Bitcoin ETFs saw significant withdrawals, totaling $211.15 million, marking a week-long trend of outflows.

Fidelity’s FBTC led with $149.49 million in withdrawals, followed by Bitwise’s BITB, which lost $30 million. Grayscale’s GBTC and mini trust also saw declines of $23.22 million and $8.45 million, respectively.

No funds saw gains, while others, including BlackRock’s IBIT, recorded no activity. Trading volumes across 12 ETFs dropped to $1.35 billion, continuing the downward trend.

In the Ethereum ETF space, movements were minimal with $152,720 in outflows. Grayscale’s ETHE lost $7.39 million, but its Ethereum Mini Trust gained $7.24 million.

Other Ethereum ETFs showed no change, and trading volumes decreased to $108.59 million. Since launching, these Ethereum funds have experienced $562.31 million in outflows.

As markets await U.S. non-farm payroll data, experts suggest that a moderately weak report could ease concerns about economic growth and benefit both stocks and Bitcoin.

-

1

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

16.06.2025 12:00 1 min. read -

2

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

19.06.2025 21:00 2 min. read -

3

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

23.06.2025 22:00 1 min. read -

4

Corporate Bitcoin Buying Accelerates as Firms Raise Billions to Stack BTC

22.06.2025 15:00 2 min. read -

5

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

According to on-chain analyst Darkfost, Bitcoin is entering a new stage of on-chain behavior marked by two key developments: a rare third peak in the SOPR Trend Signal during a single bull cycle and a sustained outflow dominance in exchange flows.

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

In a stunning on-chain event that has reignited curiosity across the crypto community, more than $8.6 billion worth of Bitcoin linked to the network’s earliest years—commonly referred to as the “Satoshi era”—was quietly moved on Friday in what analysts believe is the largest single transfer of early-mined BTC ever recorded.

Esports Giant Moves Into Bitcoin Mining

The parent company behind the iconic esports brand Ninjas in Pyjamas (NIP) is taking a sharp turn into the world of Bitcoin mining, signaling a significant evolution from pure entertainment to digital infrastructure.

-

1

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

16.06.2025 12:00 1 min. read -

2

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

19.06.2025 21:00 2 min. read -

3

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

23.06.2025 22:00 1 min. read -

4

Corporate Bitcoin Buying Accelerates as Firms Raise Billions to Stack BTC

22.06.2025 15:00 2 min. read -

5

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read