Bitcoin Breaks Past $61,000, Boosting Investor Confidence

15.07.2024 0:39 1 min. read Alexander Stefanov

Bitcoin and the cryptocurrency market are showing signs of recovery from the recent price corrections, boosting investor confidence.

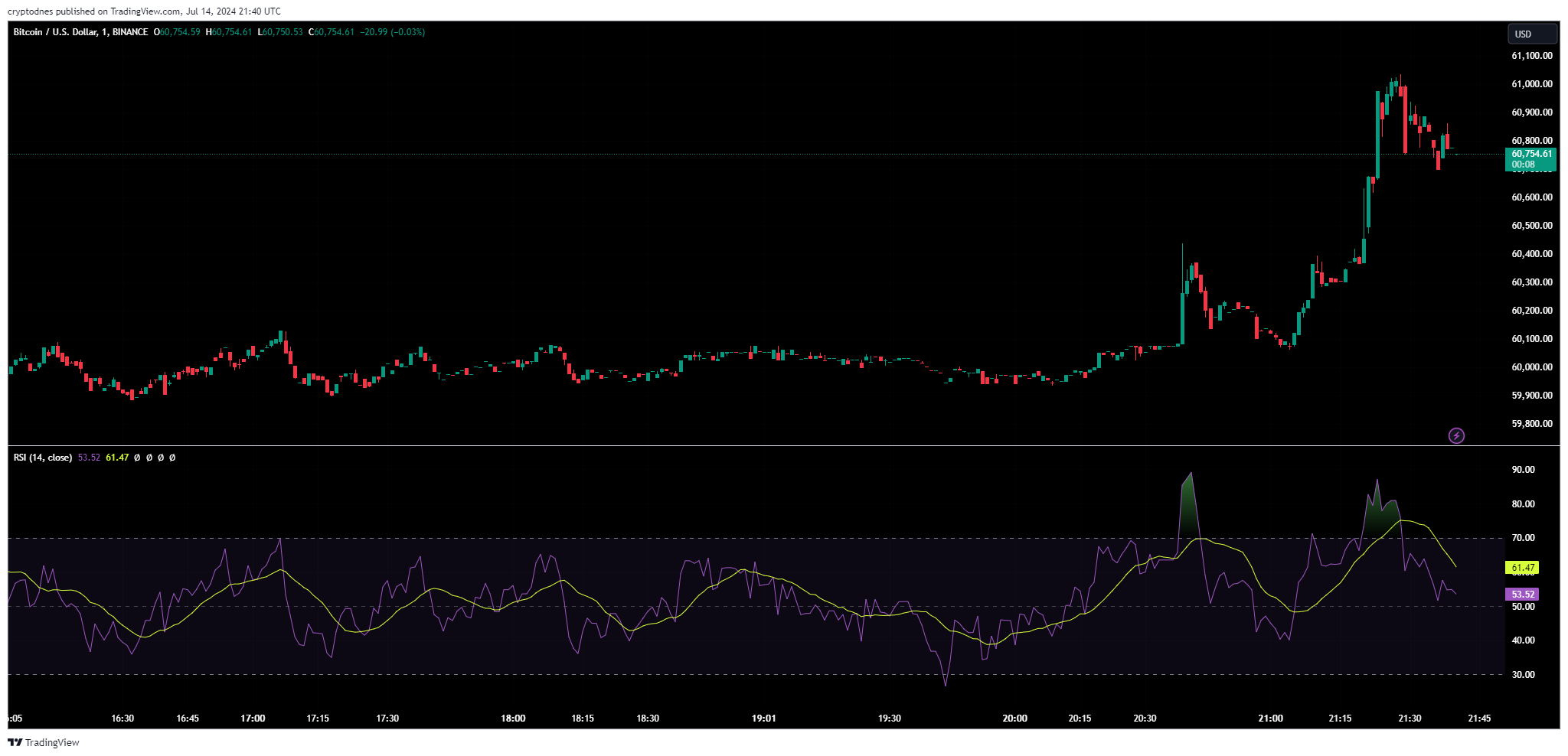

Earlier Bitcoin broke the $60,000 barrier after the news about an assassination attempt on Donald Trump and the resurgence seems to be gaining steam. Just moments ago BTC briefly reached the $61,000 price mark.

At the time of writing Bitcoin retraced to $60,775 after a 3.86% surge in the past 24 hours with a trading volume of around $22.6 billion. The flagship cryptocurrency is up 8.35% on the weekly chart.

During the past day $100.7 million were liquidated from the crypto market – $29.13 million in long positions and $71.57 million in short positions.

Proof for the bullish santiment can be found in the 1-day technical analysis from TradingView. The summary, moving averages and oscillators all point to “buy” with 10, 8 and 2 signals, respectively.

The recent selling preassure seems to have calmed down after the German government’s wallet (BKA) seems to have finished with its liquidation.

The biggest gainer in the past 24 hours is Mog Coin (MOG) after a 15.2% surge and a trading volume of $40.79 million. On the weekly chart the altcoin’s price jumped more than 46%.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read