XRP: What’s the Next Target After Bullish Breakout?

27.07.2025 11:30 1 min. read Kosta Gushterov

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

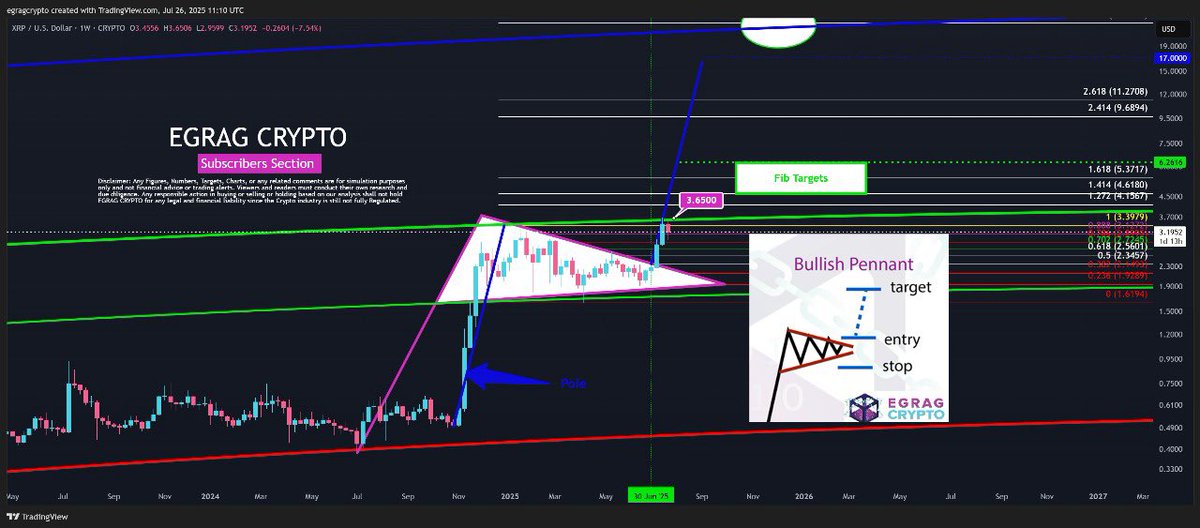

According to EGRAG CRYPTO’s recent chart update, $3.65 remains the key macro level to beat, based on a confirmed bullish pennant breakout on the weekly timeframe.

The pennant formation, a classic continuation pattern, follows a strong upward pole beginning in late 2023. The recent breakout in July 2025 validates the pattern, with XRP now hovering near $0.90 but showing signs of aiming significantly higher. Fibonacci extension targets suggest the next resistance levels lie at $1.91, $3.17, and $3.65, with long-term potential stretching even further to $4.68, $6.89, and $11.27, according to the chart.

Momentum indicators also support the bullish case, with volume rising and XRP outperforming many large-cap altcoins over the past two weeks. However, as EGRAG emphasizes, $3.65 is a macro target that may take time and multiple attempts to overcome, especially if Bitcoin begins to consolidate or retrace.

For now, XRP remains in breakout mode, and many analysts are watching the $1.91–$2.20 zone as the next short-term challenge. If bulls maintain pressure, the path toward $3.65 becomes increasingly realistic.

-

1

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

2

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

3

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

-

1

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

2

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

3

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read