Why Can We Expect Bitcoin’s Price to Keep Rising?

19.10.2024 18:03 1 min. read Alexander Zdravkov

Bitcoin has experienced a roughly 10% rise over the past month, as optimism continues to grow in the market.

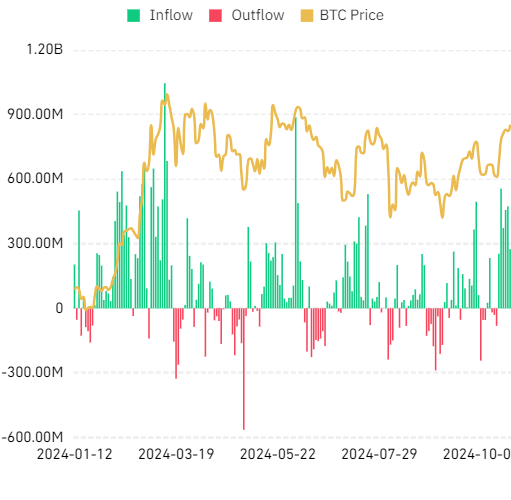

The cryptocurrency’s price has been climbing since October 11, coinciding with steady positive inflows in spot BTC ETFs, which have seen several consecutive days of gains.

After trading around $60,000 in early October and moving with little activity through the 10th, buying pressure began to pick up. This helped propel Bitcoin out of a consolidation period, driving the price upward to reach $68,149 as of mid-October, translating to a 12% increase for the month.

The market has shown resilience, particularly with spot BTC ETFs recording a continuous streak of net inflows, peaking at $555.90 million on October 14. Additionally, the uptick in active Bitcoin addresses suggests heightened interest, indicating stronger engagement from traders.

A technical indicator known as a “golden cross,” where a short-term moving average surpasses a long-term average, may soon emerge. As Bitcoin continues its upward trend, this signal, along with positive ETF flows and increased market activity, suggests the possibility of further growth ahead.

-

1

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

2

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

2

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read