US Bitcoin ETFs Registered Their Best Performance in 6 Weeks

17.07.2024 14:00 1 min. read Alexander Stefanov

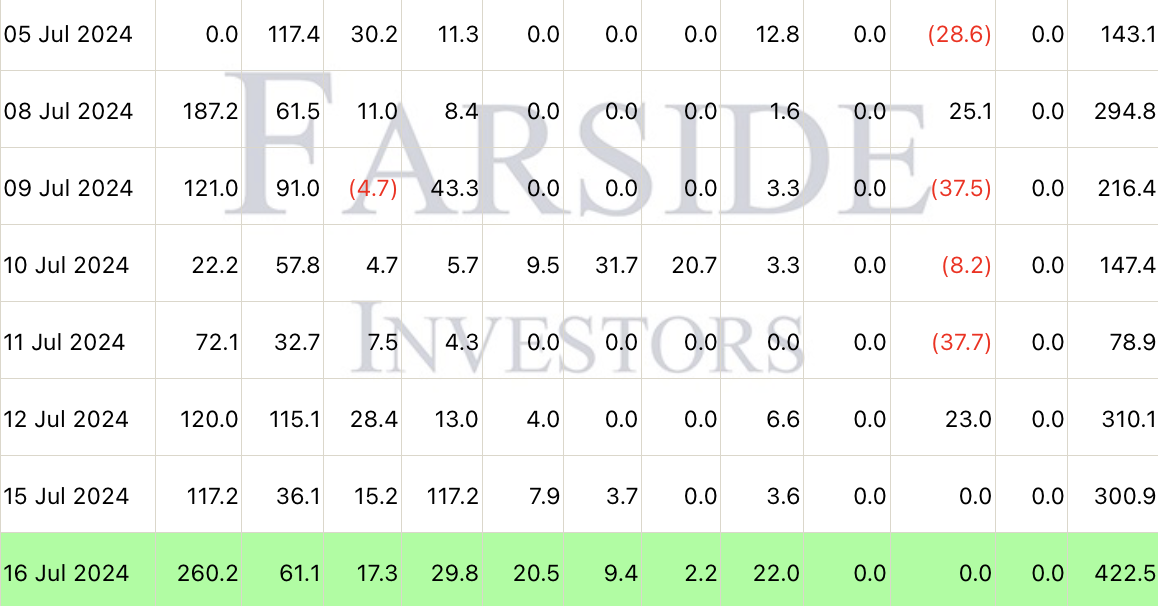

Momentum and investor faith appears to be sustained as US spot Bitcoin ETFs continued their winning streak for an 8th consecutive day on Tuesday.

After seeing a total of $300.9 billion in inflows on Monday (July 15), these ETFs performed even better on Tuesday, registering a total of $422.5 million in inflows.

For the day, BlackRock’s iShares Bitcoin Trust (IBIT) attracted $260 million and Fidelity’s fund (FBTC) registered the second-largest inflows with a result of $61.1 million.

ARK’s 21Shares ETF (ARKB) ranked third with inflows of $29.8 million followed by VanEck’s (HODL) at $22 million.

According to information provided by Farside, the total amount accumulated by all spot Bitcoin ETFs in the U.S. on July 16 signaled their best performance since June 5.

-

1

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

2

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

3

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

4

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

The Bitcoin market is entering a complex phase marked by rising realized profits, reduced whale balances, and historically prolonged sideways price movement.

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

European banking giant UniCredit is preparing to offer its professional clients a new investment product linked to BlackRock’s spot Bitcoin ETF (IBIT), according to a report by Bloomberg.

American State Bans Crypto Investments and Payments in Sweeping New Law

Connecticut has officially distanced itself from government adoption of digital assets like Bitcoin. On June 30, Governor Ned Lamont signed House Bill 7082 into law, placing sweeping restrictions on how the state and its agencies can engage with cryptocurrencies.

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

-

1

Arthur Hayes Sees Trouble Ahead for Bitcoin as Global Tensions Rise

12.06.2025 21:00 2 min. read -

2

Why Michael Saylor Bet on Bitcoin During the COVID Cash Crisis

12.06.2025 19:00 2 min. read -

3

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

13.06.2025 9:00 1 min. read -

4

Whale Leverages $30M on Bitcoin: Is a Parabolic Move Coming?

11.06.2025 21:00 1 min. read -

5

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read