U.S. Bitcoin Reserve Plan Could Reshape Global Finance, Says Deutsche Bank

13.03.2025 9:00 2 min. read Alexander Stefanov

The idea of a Strategic Bitcoin Reserve in the U.S. has caught the attention of Deutsche Bank, which sees it as a move with significant economic implications.

The German banking giant believes that by officially holding Bitcoin, the U.S. could strengthen its financial position while also shaping global regulatory trends.

According to Deutsche Bank, Bitcoin shares key characteristics with gold, particularly its scarcity due to a fixed supply. Unlike other digital assets, its decentralized nature and strong security make it a reliable store of value. Since it has never suffered a security breach, analysts view it as a “hard reserve asset” capable of offering financial stability.

One of Bitcoin’s advantages, the bank notes, is its minimal correlation with traditional investments, making it a useful tool for portfolio diversification. Additionally, holding Bitcoin over the long term could provide the U.S. with a hedge against inflation and potential weaknesses in the dollar.

Beyond direct financial benefits, the move could also position the U.S. as a leader in shaping global Bitcoin policies, similar to how it once influenced the gold standard. If Bitcoin continues to rise in value, some experts even suggest it could help ease national debt burdens.

Reports indicate that a major portion of the reserve will come from Bitcoin confiscated by law enforcement, reducing the need for taxpayer funding. The government is also exploring other budget-neutral strategies to expand its holdings without additional financial strain.

What Makes BTCBULL so Special?

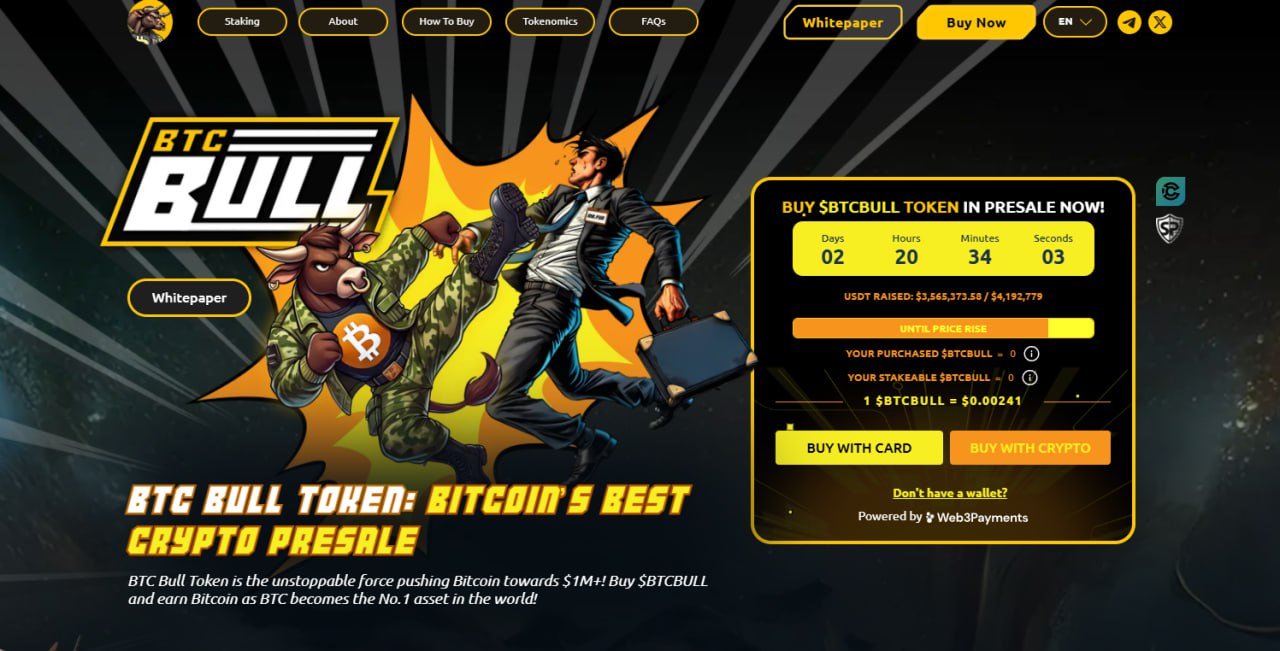

BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result. Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply. […]

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

Bitcoin treasury firm Strategy—formerly known as MicroStrategy—has expanded its already-massive BTC holdings with a fresh $472.5 million acquisition.

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

Famed author of Rich Dad Poor Dad, Robert Kiyosaki, has once again thrown his support behind Bitcoin following its recent surge above $120,000, calling it a win for those who already hold the asset—and a wake-up call for those who don’t.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read