Trump’s Chances in Presidential Race Dwindle, According to Prediction Platform

03.08.2024 10:00 1 min. read Alexander Stefanov

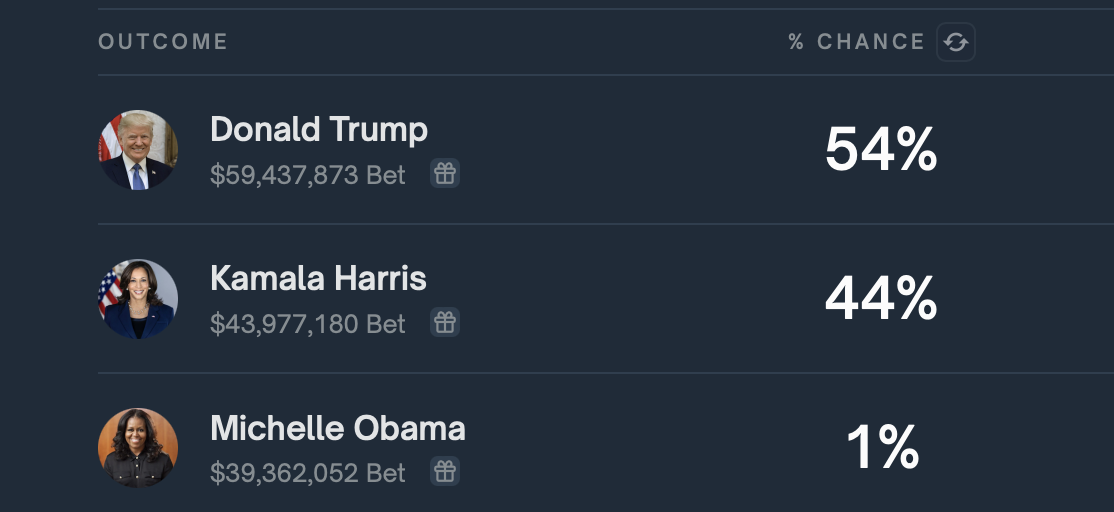

Donald Trump's chances of winning the U.S. presidential election have dropped to 54% in the Polymarket prediction platform from 72% in July.

This drop is due to the growing interest in Kamala Harris as a potential contender, with her chances increasing to 44%.

Harris’s chances have also improved in major polls, such as a Bloomberg survey that found she could win six of the seven swing states.

Despite the decline, Trump remains the preferred candidate in the crypto community due to his vocal support for the industry.

If re-elected, he has promised to fire Securities and Exchange Commission (SEC) Chairman Gary Gensler, end the regulatory war on crypto, ensure that all remaining BTC is mined in the US, and make Bitcoin the country’s reserve asset. However, some of these promises are considered unrealistic.

Harris’s position on cryptocurrencies remains unclear, though some stakeholders consider her unbiased.

Critics warn that her victory could harm the crypto industry, with the Securities and Exchange Commission likely to apply traditional financial regulations to the market under her stewardship.

-

1

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

2

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

3

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read -

4

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

5

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

Coinbase CEO Brian Armstrong has spotlighted a significant acceleration in institutional crypto adoption, driven largely by the surging popularity of exchange-traded funds and increased use of Coinbase Prime among major corporations.

What Will Happen With the Stock Market if Trump Reshapes the Fed?

Jefferies chief market strategist David Zervos believes an upcoming power shift at the Federal Reserve could benefit U.S. equity markets.

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

-

1

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

2

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

3

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read -

4

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

5

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read