Trump’s Chances in Presidential Race Dwindle, According to Prediction Platform

03.08.2024 10:00 1 min. read Alexander Stefanov

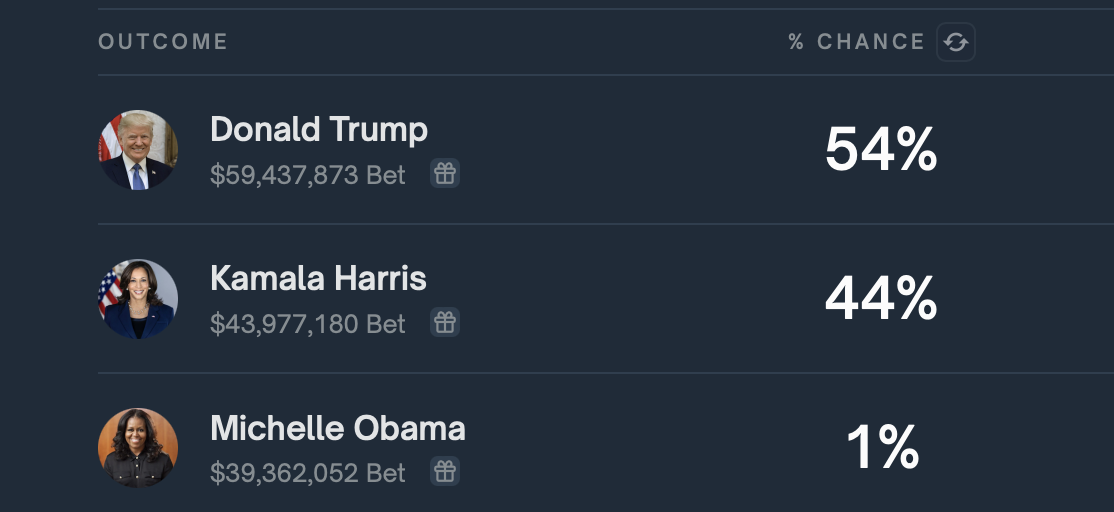

Donald Trump's chances of winning the U.S. presidential election have dropped to 54% in the Polymarket prediction platform from 72% in July.

This drop is due to the growing interest in Kamala Harris as a potential contender, with her chances increasing to 44%.

Harris’s chances have also improved in major polls, such as a Bloomberg survey that found she could win six of the seven swing states.

Despite the decline, Trump remains the preferred candidate in the crypto community due to his vocal support for the industry.

If re-elected, he has promised to fire Securities and Exchange Commission (SEC) Chairman Gary Gensler, end the regulatory war on crypto, ensure that all remaining BTC is mined in the US, and make Bitcoin the country’s reserve asset. However, some of these promises are considered unrealistic.

Harris’s position on cryptocurrencies remains unclear, though some stakeholders consider her unbiased.

Critics warn that her victory could harm the crypto industry, with the Securities and Exchange Commission likely to apply traditional financial regulations to the market under her stewardship.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

Robinhood Launches Ethereum and Solana Staking for U.S. Users

Robinhood has officially introduced Ethereum (ETH) and Solana (SOL) staking services for its U.S. customers, offering a new way for users to earn rewards on their crypto holdings.

Binance CEO Reveals What’s Fueling the Next Global Crypto Boom

Binance CEO Richard Teng shared an optimistic outlook on the future of cryptocurrencies during an appearance on Mornings with Maria, highlighting growing global acceptance, regulatory progress, and strategic reserve integration.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read