Trump Implements Global Tariff Plan, Triggering Bitcoin Price Drop

03.04.2025 0:37 1 min. read Alexander Stefanov

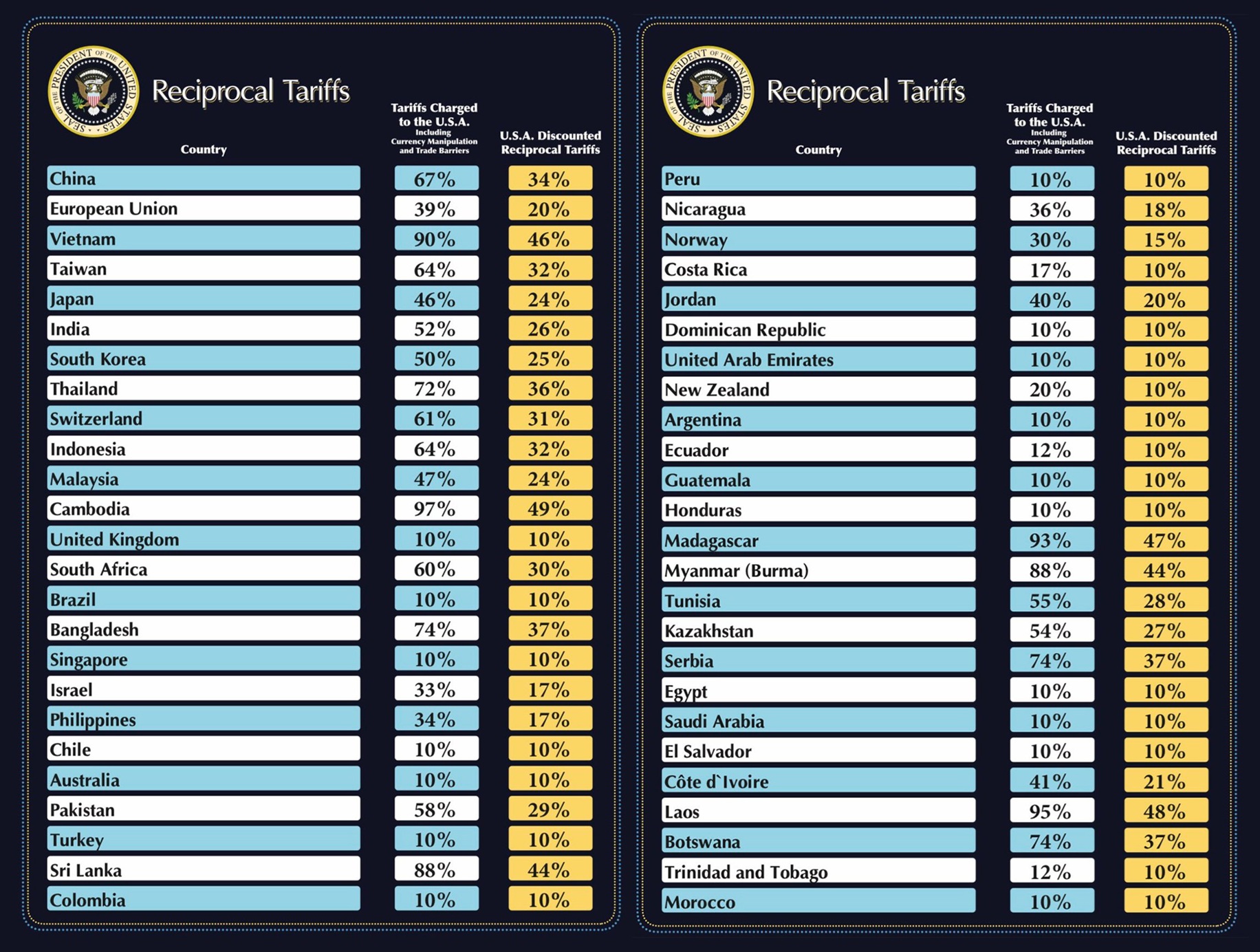

In a recent live address, U.S. President Donald Trump declared that a new base tariff of 10% would be applied universally to all countries.

However, he also outlined specific measures targeting certain nations, specifying different customs duties based on perceived trade practices.

Trump emphasized that he expects foreign leaders to halt tariffs imposed on the United States and begin purchasing American-made products.

For countries that fail to meet this standard, he plans to calculate the total impact, including non-monetary trade barriers, and enforce retaliatory measures at half the rate of their existing customs duties.

Among the targeted regions, the European Union will face a 20% tariff on goods from each member country, while imports from Japan will be hit with a 24% duty.

Initially, the proposed 10% tariff seemed relatively mild, but once the more detailed measures became clear, the market reaction was swift. Bitcoin’s value dropped abruptly, reflecting the uncertainty sparked by these aggressive trade policies.

Despite hitting a high above $87,000 earlier, Bitcoin’s price declined to $86,500 after Trump’s announcement.

-

1

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read -

2

Bitcoin at Crossroads as Geopolitical Tensions Weigh on Price

18.06.2025 20:00 1 min. read -

3

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

4

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

5

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

Robert Kiyosaki, author of Rich Dad Poor Dad, revealed on July 1 that he purchased another Bitcoin, reaffirming his long-term bullish stance—even if it comes with personal risk.

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

Bitcoin is poised for its strongest dollar rally in history during the second half of 2025, according to Standard Chartered’s latest market outlook.

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

Arizona Governor Katie Hobbs has officially vetoed House Bill 2324, a legislative proposal that aimed to create a state-managed reserve fund for holding seized cryptocurrency assets.

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

Public corporations have dramatically increased their Bitcoin (BTC) holdings in 2025, acquiring more than double the amount bought by exchange-traded funds (ETFs) during the first half of the year.

-

1

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read -

2

Bitcoin at Crossroads as Geopolitical Tensions Weigh on Price

18.06.2025 20:00 1 min. read -

3

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

4

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

5

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read