Trump Implements Global Tariff Plan, Triggering Bitcoin Price Drop

03.04.2025 0:37 1 min. read Alexander Stefanov

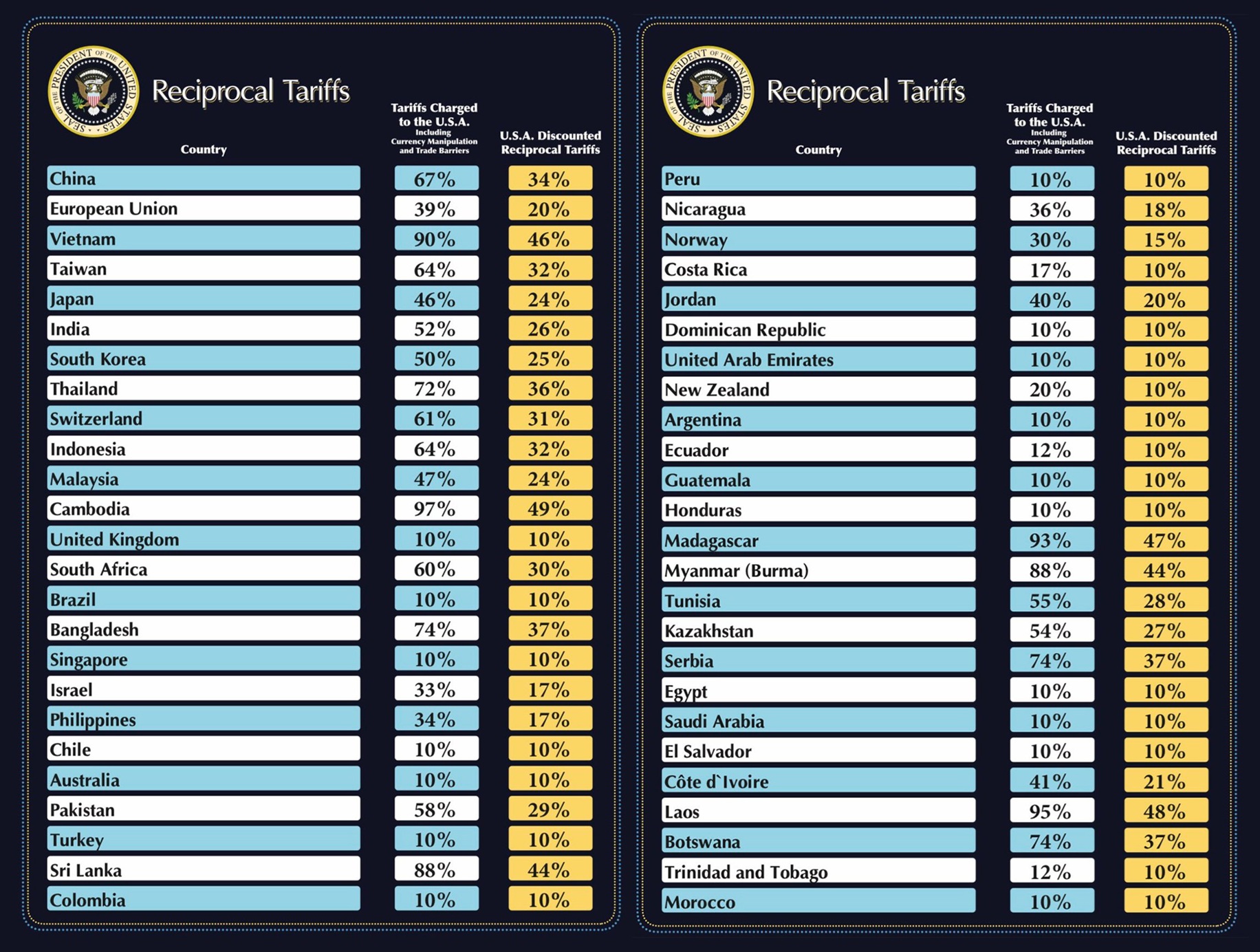

In a recent live address, U.S. President Donald Trump declared that a new base tariff of 10% would be applied universally to all countries.

However, he also outlined specific measures targeting certain nations, specifying different customs duties based on perceived trade practices.

Trump emphasized that he expects foreign leaders to halt tariffs imposed on the United States and begin purchasing American-made products.

For countries that fail to meet this standard, he plans to calculate the total impact, including non-monetary trade barriers, and enforce retaliatory measures at half the rate of their existing customs duties.

Among the targeted regions, the European Union will face a 20% tariff on goods from each member country, while imports from Japan will be hit with a 24% duty.

Initially, the proposed 10% tariff seemed relatively mild, but once the more detailed measures became clear, the market reaction was swift. Bitcoin’s value dropped abruptly, reflecting the uncertainty sparked by these aggressive trade policies.

Despite hitting a high above $87,000 earlier, Bitcoin’s price declined to $86,500 after Trump’s announcement.

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read