The Stock Market Lost $1 Trillion on its Worst Day Since 2022 – Who’s to Blame?

25.07.2024 13:00 1 min. read Kosta Gushterov

Investor enthusiasm for artificial intelligence (AI) weakened on Wednesday, sparking a $1 trillion drop in the Nasdaq 100 Index.

Nasdaq indexes fell more than 3%, marking the worst performance since October 2022. Semiconductor giants such as Nvidia, Broadcom and Arm Holdings led the decline.

The selloff followed Alphabet’s weak earnings report, which featured high capital spending and led to the company’s stock falling more than 5%.

Tesla also suffered, falling more than 12% after CEO Elon Musk provided limited details about its self-driving car initiative. Concerns have also emerged about the return on AI infrastructure spending, with it thought that while the investment is significant, the return will take time.

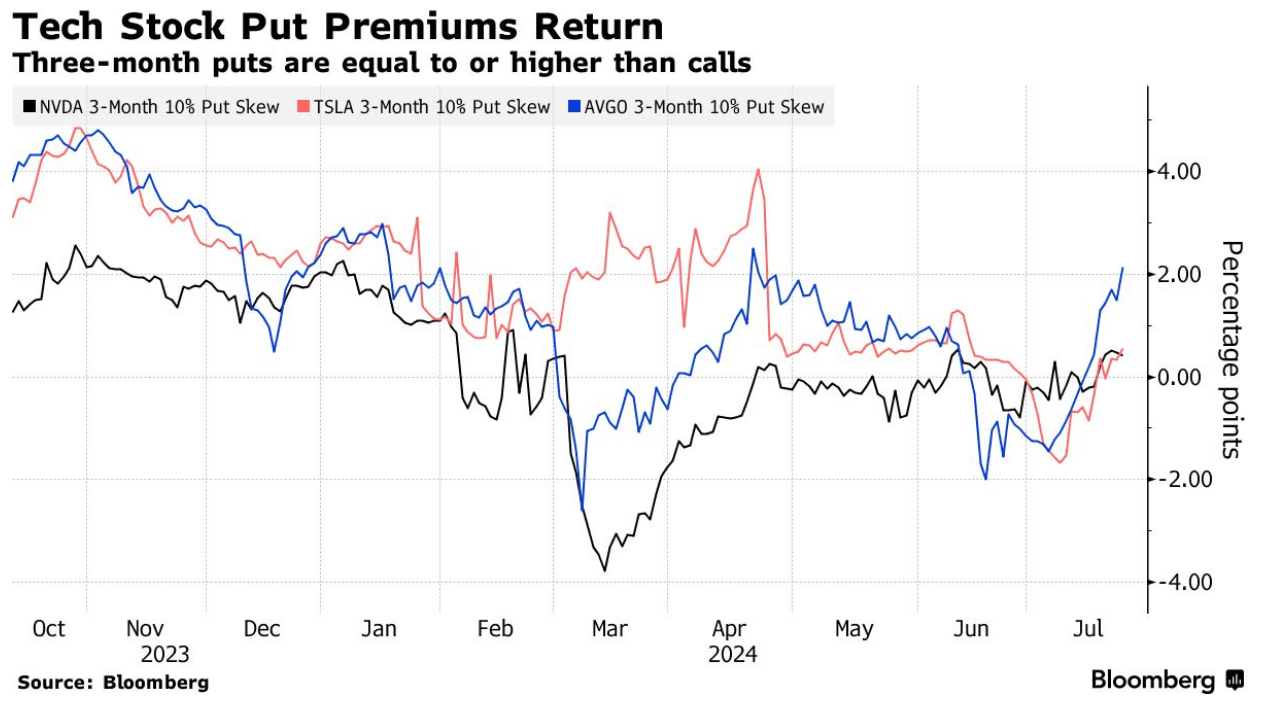

Nvidia’s options volatility rose to the highest level since March and Broadcom’s put options hit a three-month high. This stir follows the recent shift away from technology stocks to small-cap stocks triggered by expectations of a Federal Reserve interest rate cut.

Artificial intelligence computing hardware makers saw significant declines: Super Micro Computer fell 9.15%, Nvidia dropped 6.8% and Broadcom fell 7.6%. Large technology companies such as Meta Platforms, Microsoft and Apple also declined by 5.6%, 3.6% and 2.9% respectively.

Some analysts view the decline as a temporary correction rather than a fundamental change.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read