Riot Platforms Buys Block Mining to Expand Bitcoin Mining Capacity

24.07.2024 19:00 1 min. read Alexander Stefanov

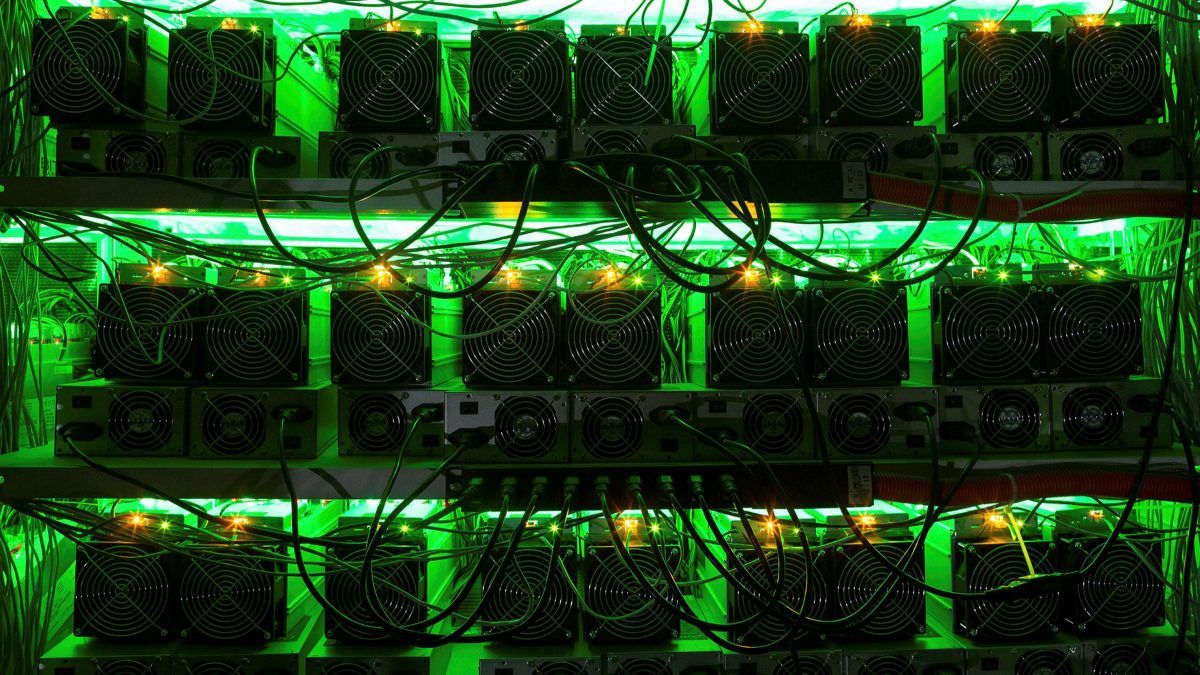

Riot Platforms, a major player in Bitcoin mining, has acquired Block Mining, a miner based in Kentucky, in a deal valued at $92.5 million.

This acquisition is set to enhance Riot’s mining capabilities significantly.

The company announced that the purchase will immediately add 60 megawatts (MW) to its operational capacity, with plans to expand Block Mining’s two facilities to a total of 110 MW by the end of 2024. This expansion would increase Riot’s overall potential capacity to 2 gigawatts.

Riot CEO Jason Les highlighted that the acquisition will diversify the company’s operations across the U.S. and accelerate growth in Kentucky. The deal includes $18.5 million in cash and $74 million in Riot common stock.

Despite the acquisition, Riot reported a decline in Bitcoin production, mining 255 BTC in June, a decrease from both May and June of the previous year. Riot’s stock fell by 5.31% on Tuesday and has decreased by nearly 25% year-to-date.

-

1

Real Estate Giant Plans $300M Bitcoin Purchase

22.06.2025 13:00 2 min. read -

2

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

25.06.2025 10:00 1 min. read -

3

Bitcoin Dominates Portfolios as Institutional Adoption Surges

25.06.2025 8:00 2 min. read -

4

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

5

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read

Robinhood Faces Scrutiny from European Bank Over Tokenized Stock Offerings

Lithuania’s central bank has reached out to Robinhood for further details regarding its newly launched stock token products, following a public distancing by OpenAI from the initiative.

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

As President Trump accelerates his tariff strategy ahead of the August 1 deadline, new White House letters reveal formal trade warnings sent to multiple nations, including Tunisia, Cambodia, Indonesia, and others.

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

-

1

Real Estate Giant Plans $300M Bitcoin Purchase

22.06.2025 13:00 2 min. read -

2

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

25.06.2025 10:00 1 min. read -

3

Bitcoin Dominates Portfolios as Institutional Adoption Surges

25.06.2025 8:00 2 min. read -

4

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

5

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read