The Stock Market Lost $1 Trillion on its Worst Day Since 2022 – Who’s to Blame?

25.07.2024 13:00 1 min. read Kosta Gushterov

Investor enthusiasm for artificial intelligence (AI) weakened on Wednesday, sparking a $1 trillion drop in the Nasdaq 100 Index.

Nasdaq indexes fell more than 3%, marking the worst performance since October 2022. Semiconductor giants such as Nvidia, Broadcom and Arm Holdings led the decline.

The selloff followed Alphabet’s weak earnings report, which featured high capital spending and led to the company’s stock falling more than 5%.

Tesla also suffered, falling more than 12% after CEO Elon Musk provided limited details about its self-driving car initiative. Concerns have also emerged about the return on AI infrastructure spending, with it thought that while the investment is significant, the return will take time.

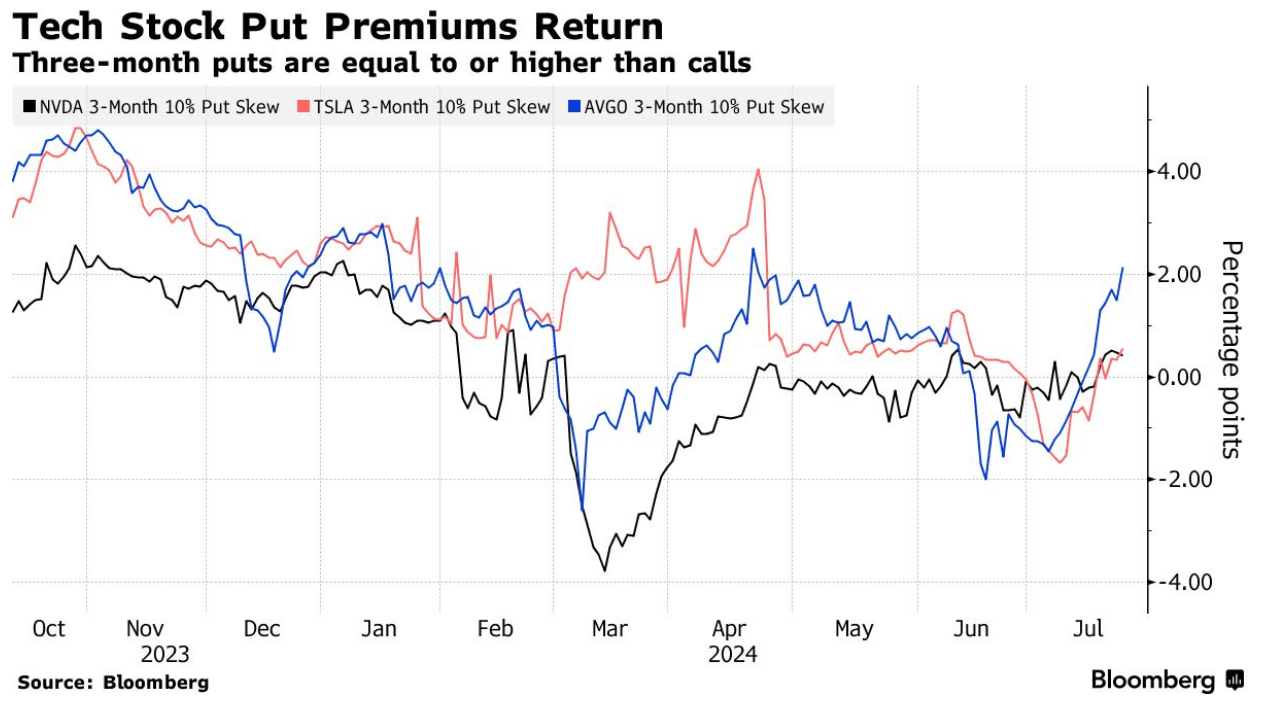

Nvidia’s options volatility rose to the highest level since March and Broadcom’s put options hit a three-month high. This stir follows the recent shift away from technology stocks to small-cap stocks triggered by expectations of a Federal Reserve interest rate cut.

Artificial intelligence computing hardware makers saw significant declines: Super Micro Computer fell 9.15%, Nvidia dropped 6.8% and Broadcom fell 7.6%. Large technology companies such as Meta Platforms, Microsoft and Apple also declined by 5.6%, 3.6% and 2.9% respectively.

Some analysts view the decline as a temporary correction rather than a fundamental change.

-

1

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

2

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

3

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

4

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

Fresh data on Personal Consumption Expenditures (PCE) — the Federal Reserve’s preferred inflation gauge — shows inflation ticked higher in May, potentially delaying the long-awaited Fed rate cut into September or later.

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

Federal Reserve Chair Jerome Powell is once again under fire, this time facing renewed criticism from Donald Trump over the Fed’s decision to hold interest rates steady in June.

U.S. National Debt Surge Could Trigger a Major Crisis, Says Ray Dalio

Billionaire investor Ray Dalio has sounded the alarm over America’s soaring national debt, warning of a looming economic crisis if no action is taken.

-

1

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

2

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

3

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

4

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read