Spot Bitcoin ETFs With Their Best Performance Since the Beginning of June

09.07.2024 12:00 1 min. read Alexander Stefanov

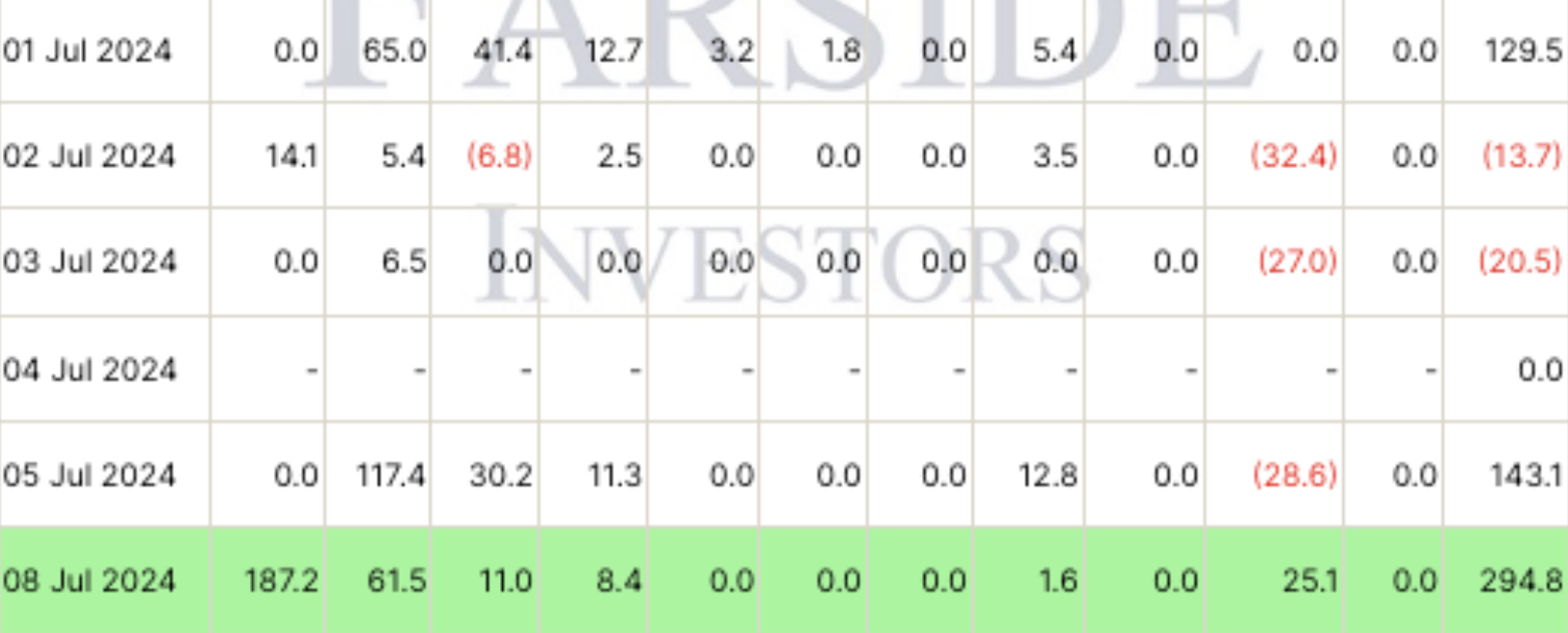

Against the backdrop of the crypto market, U.S.-based spot Bitcoin ETFs registered their strongest day of net inflows in more than a month.

This is the first time in three trading weeks that net inflows across all funds were positive, registering $295 million on July 8.

In addition, the inflows achieved marked the most significant inflow since June 5, when they reached more than $488 million.

BlackRock’s ETF, the iShares Bitcoin Trust, saw the largest inflows with a result of $187.2 million, while Fidelity’s Wise Origin Bitcoin Fund followed with $61.5 million.

The Grayscale Bitcoin Trust had a rare positive day, receiving inflows of $25.1 million.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read -

5

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bitcoin Pauses Below $110K as Analysts Eye Consolidation Phase

15.06.2025 20:00 1 min. read -

5

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read