Spot Bitcoin ETFs With Their Best Performance Since the Beginning of June

09.07.2024 12:00 1 min. read Alexander Stefanov

Against the backdrop of the crypto market, U.S.-based spot Bitcoin ETFs registered their strongest day of net inflows in more than a month.

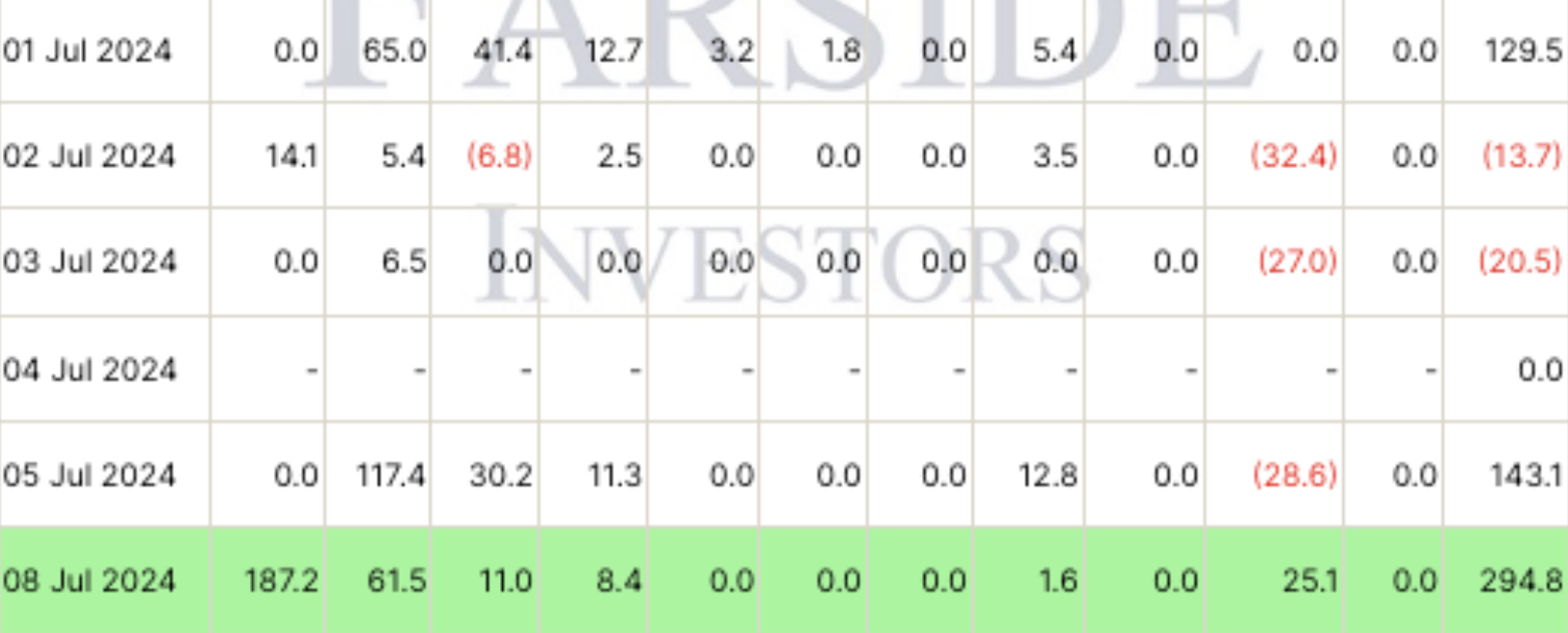

This is the first time in three trading weeks that net inflows across all funds were positive, registering $295 million on July 8.

In addition, the inflows achieved marked the most significant inflow since June 5, when they reached more than $488 million.

BlackRock’s ETF, the iShares Bitcoin Trust, saw the largest inflows with a result of $187.2 million, while Fidelity’s Wise Origin Bitcoin Fund followed with $61.5 million.

The Grayscale Bitcoin Trust had a rare positive day, receiving inflows of $25.1 million.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read

Bitcoin: Is the Cycle Top In and How to Spot It?

Bitcoin may not have reached its peak in the current market cycle, according to a recent analysis by crypto analytics firm Alphractal.

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

Bitcoin: Historical Trends Point to Likely Upside Movement

Bitcoin may be gearing up for a significant move as its volatility continues to tighten, according to on-chain insights from crypto analyst Axel Adler.

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read